Dallas-area manufacturing data

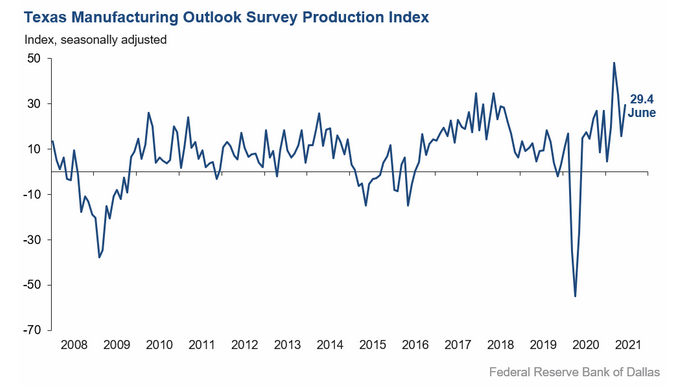

- Prior was 34.9

- Production 29.4 vs 15.7 prior

- New orders 26.7 vs 20.8 prior

- Wages and benefits index hits record 48.1 vs 39.0 prior (prior had also been a record)

The main index has been bouncing around in the past few months but inflationary indications continue to rise. The raw materials and finished goods indexes both hit records as well. Even with that, the measures of future business are very strong.

The special questions in the report were also revealing. 61% of respondents said they were experiencing supply-chain disruptions compared to 35.5% in February with about 60% of those experiencing problems saying they’d worsened in the past month. About 45% of those experiencing disruptions don’t anticipate that they will return to normal for at least 7 months.

In terms of hiring, asked about impediments to hiring 42.5% of companies said workers are looking for more pay than offered. That compares to 33.8% in April.

This article was originally published by Forexlive.com. Read the original article here.