AUD/USD analysis

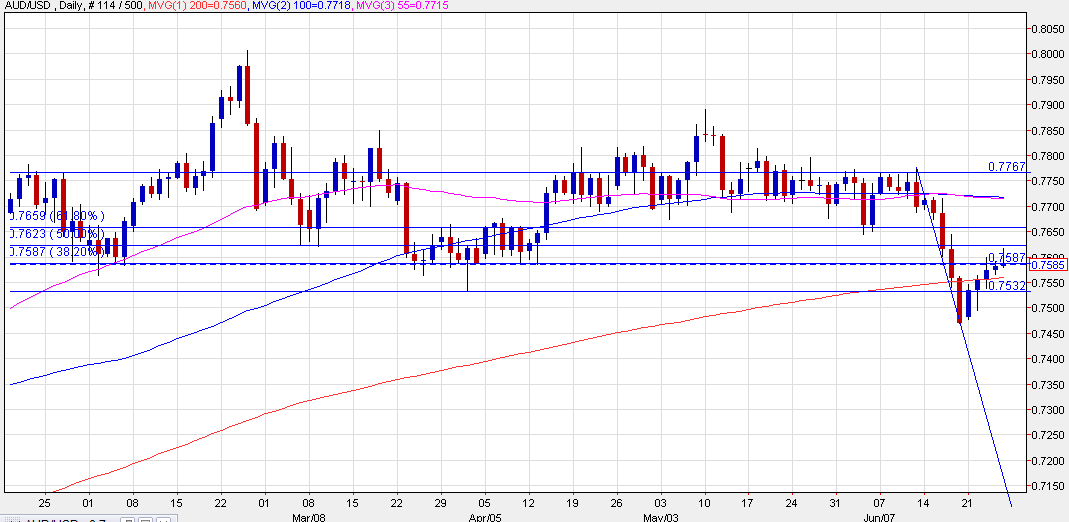

The Australian dollar perked up earlier today, hitting 0.7617 but it’s given it all back on USD strength due to rising yields. It’s now trading flat on the day at 0.7585.

For me, this is the most-interesting chart at the moment because it captures the uncertainty in the US dollar, risk appetite and commodities. It also looked to be in the midst of a big breakdown last week but showed this week it could be a false break.

The downside risk is 0.7000 on the break of the March 31 now but we’re back above that and the 200-day moving average now.

There’s also the fibonacci retracement of the drop from June 10-17. It tagged the 50% level today before slipping.

I would like to see a rise to 0.7656 before getting on board with the ‘false breakdown’ technical narrative. That said, I can’t see a great fundamental case for a drop with Fed risk now minimized and the delta variant well scrutinized. Base metals prices have also bounced back this week.

All told, I think we might have to get through quarter end before there’s a better signal.