Sounds like a cure for insomnia

What to do if the Fed keep reassuring markets rates won’t rise

There is a narrative I recently read that the Federal Reserve is stuck. Their mandate has slipped from controlling inflation and maintaining employment to simply preventing interest rates from rising so a Democrat Government can keep spending.

The sentiment sounds unduly harsh in my view. However, there are very real pressures on the Fed not to raise interest rates. Here are some of those compelling pressures that Crescat capital bring to attention in their latest newsletter.

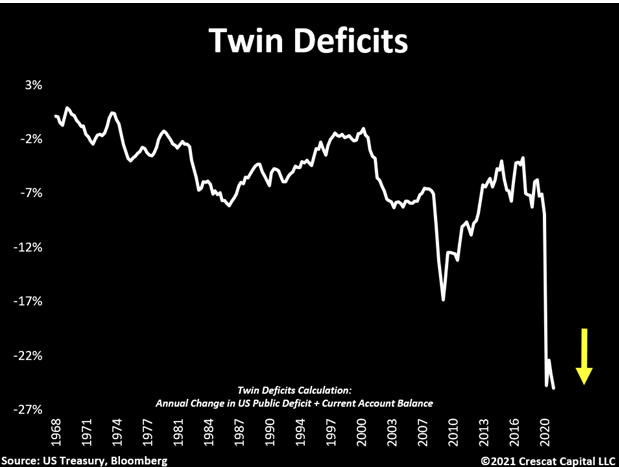

- The US economy is running a twin deficit of 25% of nominal GDP. (Twin deficits occur when a country has both a current account deficit and a government budget deficit at the same time).

- There are very high US corporate debt to GDP ratios. Meaning? Thereis a very strong need for the US to keep monetary conditions loose.

- The Fed is ignoring inflation with their ‘it’s transitory’ mantra. This means that despite commodity prices soaring, and consumer prices and PPI metrics the Fed see inflation actually falling according to their CPI metrics.

- The S&P500 real earnings yield (take away inflation) means that a price reset in equities is due at some point. This is widely expected, but look at the two other places this took place with the tech bubble and the housing bubble.

5. Nominal real bond yields are falling. Nominal rates are well below levels of inflation.

The takeaway

If these things are true – rates have to remain low, but inflation is set to rise. That will mean the following:

- Real rates will fall further

- Gold & silver will lift higher

The argument against this is if the Fed say right, enough is enough, we have to raise rates. If they do this, gold and silver fall.