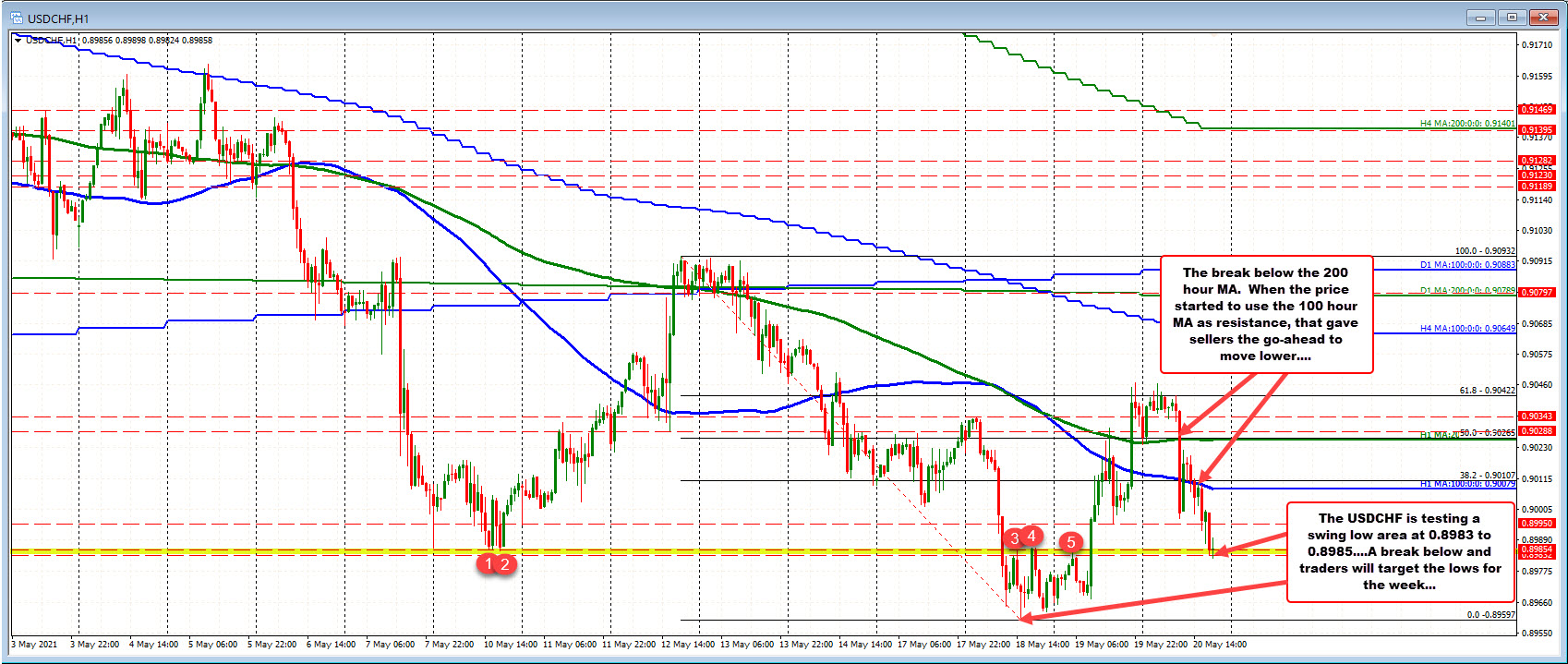

Swing area between 0.8983 and 0.895 four

The USDCHF opened above its 200 hour moving average earlier today, but when that moving average gave way in the European session, the sellers piled in and pushed the pair lower. After consolidating above and below the 100 hour MA (blue line), traders started to lean against the 100 hour moving average. That was the clue needed for the sellers to give the pair a shove to the downside.

The price is now testing a key swing area between 0.8983 and 0.8985. That level was support going back to May 10, but was subsequently broken (to the downside) on May 18th and acted as resistance see red numbered circles 3, 4 and 5) until breaking back higher on May 19.

Now with the swing area being tested again, will the buyers hold and push the price back higher?

Key bias defining level for both the buyers and sellers. Stay above and there could be a bounce back toward the 100 hour MA. Move below, and the low extreme for the week at 0.85597 would be targeted.