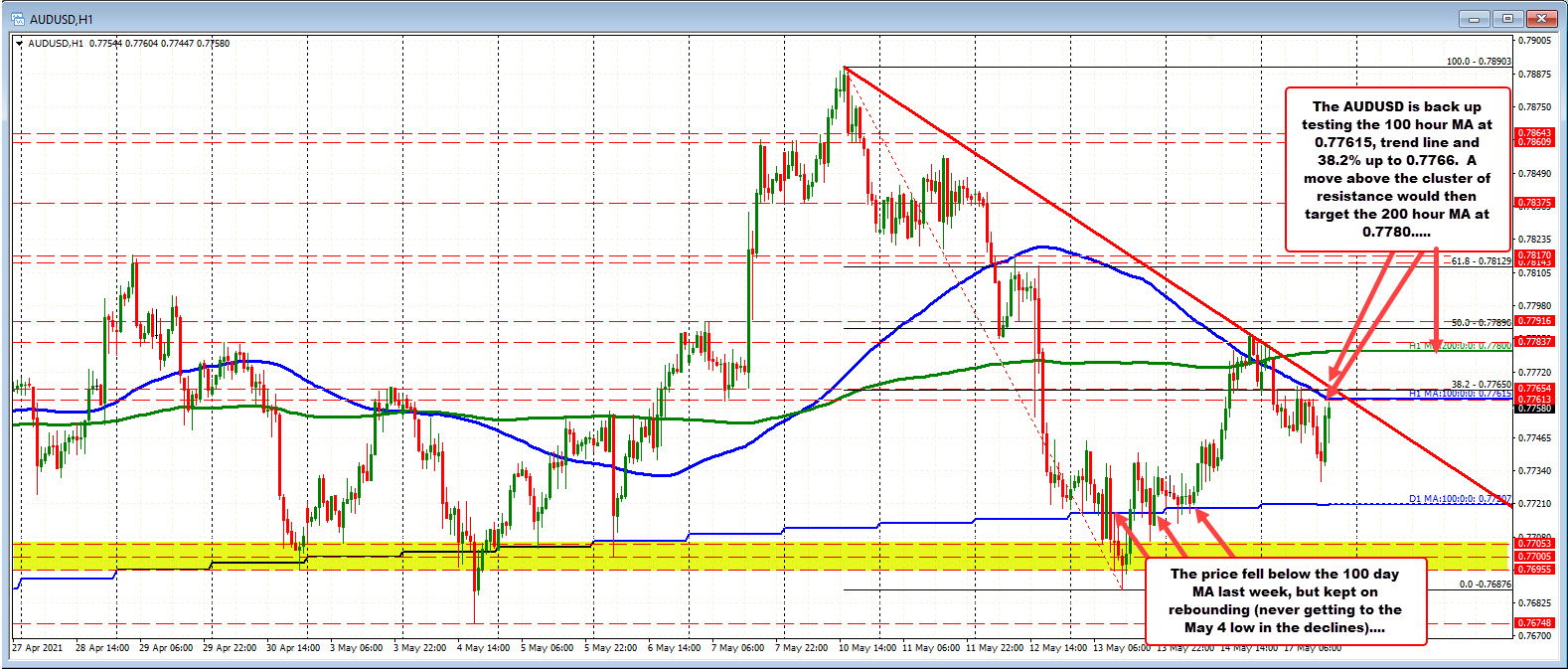

Overhead resistance targets lining up

The AUDUSD trended lower, and started the NY session near the lows for the day. The low bottomed at 0.7730. There was nothing special technically about the level, but it was ahead of the 100 day MA at 0.77207. Last week, the price traded above and below that MA level, but could not reach the May low at 0.76748. I can’t say that the moving average has been particularly influential from a traders standpoint. Nevertheless staying above it is a tilt more in the bullish direction.

On the topside, the pair is approaching a cluster of resistance starting with the 100 hour moving average at 0.77615. The 38.2% retracement of the move down from last week’s high comes in at 0.77650. Finally a Topside trendline cuts across at 0.7766. That cluster of resistance needs to be broken in order to give more of a bullish bias for the pair. Getting back above the 200 hour moving average at 0.7780 would be a nether key target to get to and through (and stay above) if the buyers are to take more control.

For now however, expect sellers to lean against the cluster area with stops a break above. The sellers have been in more control today. The correction higher last week stalled against the 50% retracement level and failed on the brakes of the moving averages. That gives me more of a bearish tilt technically.