Mostly modest changes in the major indices

The major European indices are closing the day mixed to start the trading week. The end of day changes are mostly modest.

The provisional closes are shown

- German DAX, -0.1%

- France’s CAC -0.2%

- UK’s FTSE 100, -0.1%

- Spain’s Ibex, +0.1%

- Italy’s FTSE MIB, +0.4%

In other markets as London/European traders look to exit:

- Spot gold is trading at $1865.27, up $21 or 1.16%. The price traded at its highest level since early February 1 today with the high price reaching $1865.99 (and is also above its 200 day moving average at $1846.12).

- Spot silver is up $0.66 or 2.44% at $28.09

- WTI crude oil futures are trading up $0.77 or 1.18% at $66.14

- Bitcoin has moved back into negative territory and trades down $-430 or -0.98% at $43,626. The high price reached $46,646.15. The low price extended to $42,141.

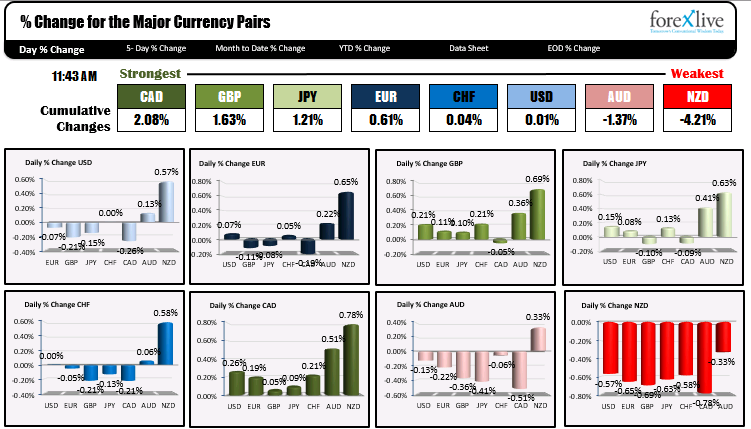

In the forex market, the CAD is now the strongest of the majors (the USDCAD is trading in its session lows as I type). The NZD remains the weakest. The USD is mixed with most of the gains first the NZD. It is down verse the CAD, GBP, JPY and EUR.

In the US debt market, yields are higher with a marginally higher yield curve as well.

In the European debt market, the benchmark 10 year yields are also trading higher the German 10 yield reach day high yield the -0.102%. The high yield last week reached -0.096%

In the US stock market, major indices are all pointing to the downside led by the NASDAQ index which is down -0.79%. Below are the changes in ranges for the North American European indices today.

This article was originally published by Forexlive.com. Read the original article here.