Trades near highs.

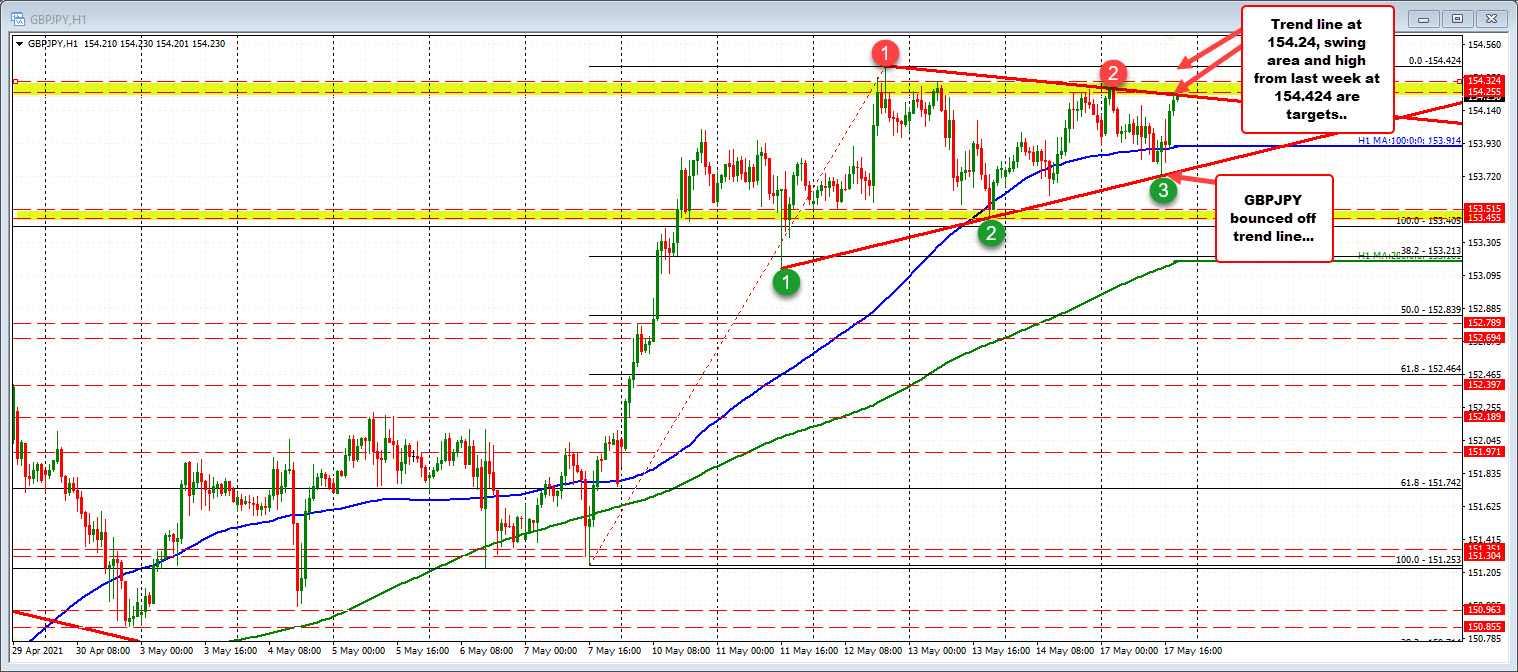

The GBPJPY is higher and tests a topside trendline from a consolidation range. Earlier in the session, the price tested the lower trendline of what is a bull pennant formation.

A break above the trendline currently at 154.24, would still have to get through the highs seen over the last week at 154.275 (from Friday), 154.324 (from Thursday) and 154.424 (from Wednesday).

Helping the bullish bias is that the price on the weekly chart has been trading above a swing area between 152.854 and 153.668. The low price today stalled at 153.727 - just above the high of that swing area.

Buyers are making a play off the lower trend line on the hourly and the swing high off the weekly chart, but they have to get to the open road ahead above the highs from last week.

This article was originally published by Forexlive.com. Read the original article here.