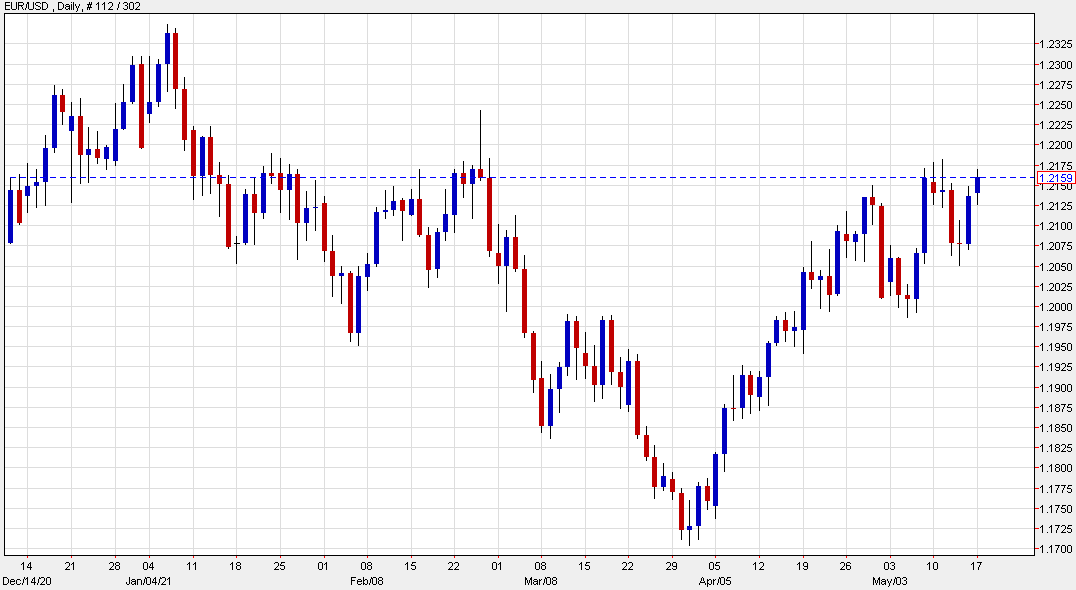

Credit Agricole on the euro

Credit Agricole CIB Research discusses the latest readings from its FX positioning indicator.

“According to our FX positioning gauge, the EUR was bought for most of the past week with real money investors driving most of the latest development.

This makes sense, especially when considering that equity-related

inflows may be among the main drivers of currency strength.

Speculative-oriented investors such as hedge funds, however, have been fading currency upside,” CACIB notes.

“Those flows were sufficient for preventing the single currency from entering strongly overbought territory. From that angle, further short-term upside cannot be ruled out, at least as long as EUR-denominated risk assets continue to perform,” CACIB adds.

For bank trade ideas, check out eFX Plus.