UPCOMING

EVENTS:

- Monday: China PMIs, German IFO.

- Tuesday: US Durable Goods Orders, US Consumer Confidence.

- Wednesday: Australia Q4 CPI, BoC Policy Decision, FOMC

Policy Decision. - Thursday: Eurozone GDP and Unemployment Rate, ECB Policy

Decision, US Q4 GDP, US Jobless Claims. - Friday: Tokyo CPI, Japan Unemployment Rate, Japan

Industrial Production and Retail Sales, Swiss Retail Sales, France CPI,

German CPI, Canada GDP, US Core PCE, US Q4 ECI.

Tuesday

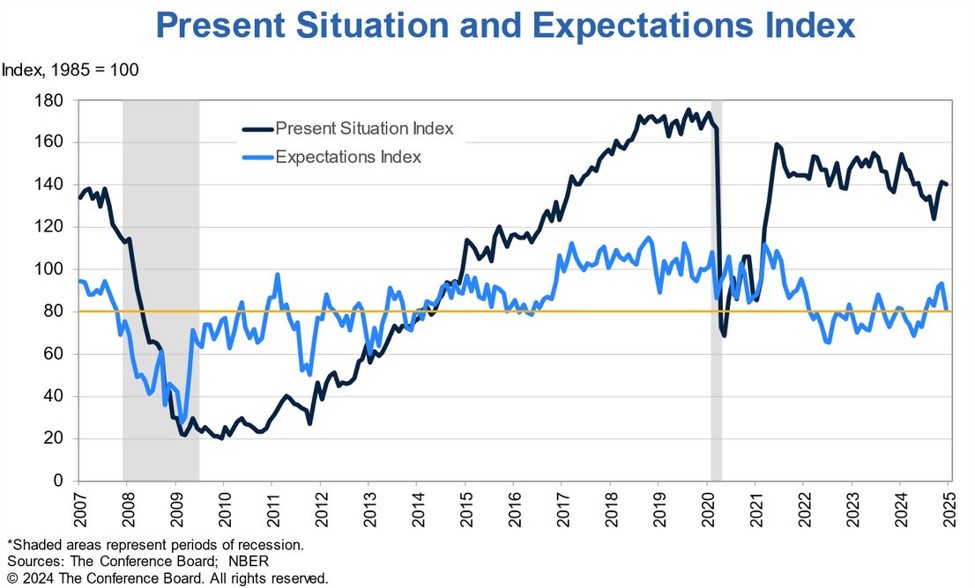

The US Consumer

Confidence is expected at 106.0 vs. 104.7 prior. Last month, consumer confidence dropped to 104.7 vs. 112.8 in

November.

Dana M. Peterson,

Chief Economist at The Conference Board said: “The recent rebound in consumer

confidence was not sustained in December as the Index dropped back to the middle

of the range that has prevailed over the past two years”.

“While weaker

consumer assessments of the present situation and expectations contributed to

the decline, the expectations component saw the sharpest drop. Consumer

views of current labour market conditions continued to improve,

consistent with recent jobs and unemployment data, but their assessment of

business conditions weakened.”

This might have

been just an outlier among lots of upbeat economic data. Overall, we are

still in the range that has prevailed over the past two years, and we

haven’t got any strong catalyst that could suggest a sudden weakening in the

economy.

US Consumer Confidence

Wednesday

The Australian Q4

CPI Y/Y is expected at 2.5% vs. 2.8% prior, while the Q/Q measure is seen at

0.3% vs. 0.2% prior. The RBA is focused on the underlying inflation figures

with the Trimmed Mean CPI Y/Y expected at 3.3% vs. 3.5% prior, while the Q/Q

reading is seen at 0.6% vs. 0.8% prior.

As a reminder, the

RBA softened further its stance at the last policy decision as it nears

the first rate cut. The market is seeing a 54% chance of a 25 bps cut in

February although the first fully priced cut is seen in April.

The latest Australian Employment report came in a touch softer than expected but

didn’t change much in terms of market pricing which was influenced more by the

recent Australian Monthly

CPI that showed core

inflation easing with the Trimmed Mean CPI Y/Y coming in at 3.2%.

A soft Q4 CPI

report will likely see the market sealing a rate cut in February already, while higher than expected figures might

keep it on the edge with the probabilities favouring an April action.

Australia Trimmed Mean CPI YoY

The BoC is expected

to cut interest rates by 25 bps and bringing the policy rate to 3.00%. As a

reminder, the BoC cut interest rates by 50 bps at the last policy meeting but dropped the line saying “if the economy evolves broadly in line with

our latest forecast, we expect to reduce the policy rate further”, which

suggests that we reached the peak in “dovishness” and the

central bank will now switch to 25 bps cuts and will slow the pace of easing.

The recent Canadian Employment report was much stronger than expected, while the CPI report came mostly in line with forecasts showing once again

that the central bank got inflation back under control.

The CAD

hasn’t responded much to economic data recently as the focus switched to

Trump’s tariffs threats and

the negative economic impact they could have on Canada. Trump said that he

intends to impose 25% tariffs on imports from Canada as soon as February 1st.

Despite the

general US Dollar weakness on tariffs optimism triggered by soft Trump’s

comments on China, the Canadian Dollar underperformed significantly its peers

with the USD/CAD rate remaining stuck in a roughly 150 pips range.

Bank of Canada

The Fed is

expected to keep interest rates unchanged at 4.25-4.50%. As a reminder,

the central bank cut interest rates by 25 bps at the last meeting in December

raising growth and inflation projections and lowering the expected rate cuts in

2025 from 100 bps to 50 bps (in line with market’s pricing at that time).

The central

bank will likely stress the need to wait a bit more for the next rate cut to

get more economic data and more clarity on Trump’s policies. As Fed’s Waller recently mentioned, the pace of rate cuts will

depend on inflation progress. He didn’t even rule out completely a March cut which was taken as a dovish surprise by the market.

The recent US

inflation data came in softer than expected and marked the peak in the

inflation hysteria and the repricing in rate cuts expectations. Before the

data, the market was even pricing in the chances on no rate cuts in 2025.

That was the

signal that the pricing was getting too much aggressive and in fact we just

needed a couple of benign inflation reports to get it back to price in almost

two rate cuts by the end of the year (which would be in line with the latest

Fed’s projections).

Overall, this

decision is unlikely to influence markets expectations too much as the data in

Q1 is what really matters. Despite the expected cautiousness, a bit more

positive talk on inflation could see the US Dollar weakening further (as

long as Trump doesn’t spoil the party).

Federal Reserve

Thursday

The ECB is

expected to cut interest rates by 25 bps and bring the policy rate to 2.75%.

The recent Eurozone CPI report showed core inflation remaining pretty

sticky, especially on the services side.

Moreover, despite

all the doom and gloom, the latest Flash PMIs showed a notable rebound in economic activity which might even get stronger if the Russia-Ukraine

war gets settled.

Also, news on EU to push AI, advanced research and clean tech in bid

to compete with the US and China got louder with pressures to reduce and

simplify regulations and increase investment. The prospects of a great 2025 for

the Euro and European equities strengthen by the day.

European Central Bank

The US Jobless

Claims continue to be one of the most important releases to follow every week

as it’s a timelier indicator on the state of the labour market.

Initial

Claims remain inside the 200K-260K range created since 2022, while Continuing Claims continue to hover around

cycle highs although we’ve seen some easing recently.

This week Initial

Claims are expected at 220K vs. 223K prior, while there’s no consensus for Continuing

Claims at the time of writing although the prior release showed an increase to

1899K vs. 1853K prior.

US Jobless Claims

Friday

The Tokyo Core CPI

Y/Y is expected at 2.5% vs. 2.4% prior. The BoJ hiked interest rates by 25 bps

the last week but didn’t offer anything in terms of forward guidance with Governor

Ueda saying that they have any preconceived idea and that they will make a

decision at each policy meeting by examining economic and price developments as

well as risks. The market doesn’t expect another rate hike any time soon

with the next one seen in October at the earliest.

Tokyo Core CPI YoY

The US PCE Y/Y is

expected at 2.6% vs. 2.4% prior, while the M/M measure is seen at 0.3% vs. 0.1%

prior. The Core PCE Y/Y is expected at 2.8% vs. 2.8% prior, while the M/M

figure is seen at 0.2% vs. 0.1% prior.

Forecasters

can reliably estimate the PCE once the CPI and PPI are out, so the market

already knows what to expect. Therefore, unless we see a deviation from the expected numbers, it

shouldn’t affect the current market’s pricing.

US Core PCE YoY

The US Q4

Employment Cost Index (ECI) is expected at 0.9% vs. 0.8% prior. This is the most

comprehensive measure of labour costs, but unfortunately, it’s not as

timely as the Average Hourly Earnings data. The Fed though watches this

indicator closely.

US Employment Cost Index