Dollar’s strong rally paused in early US trading after PCE inflation data came in below expectations, easing concerns that Fed might maintain higher rates for an extended period. Markets are also digesting remarks from Fed officials following the hawkish rate cut earlier in the week.

Most notably, Cleveland Fed President Beth Hammack, the sole dissenter in the rate cut decision, noted that monetary policy is “not far from a neutral stance.” She expressed the preference for holding rates steady until there is clearer evidence that inflation is resuming its downward path toward 2%.

Meanwhile, San Francisco Fed President Mary Daly called the rate cut a “close call” and suggested that the policy recalibration phase is “behind us.” She’s also “very comfortable” with Fed’s median projections for just two rate cuts next year, with a possibility of even fewer.

New York Fed President John Williams struck a balanced tone, stating that the “baseline trajectory is moving down towards neutral rates,” but emphasized the importance of being data-dependent. Williams highlighted that Fed has time to assess incoming data and risks, adding, “I think we’re in a great place, well positioned” to meet its objectives.

For the week, Dollar remains the strongest performer by a significant margin, followed by the Swiss Franc and British Pound. On the weaker side, New Zealand Dollar is the worst performer, followed by Australian Dollar, while Yen has climbed slightly, now the third weakest. Euro and Canadian Dollar are mixed in the middle.

In Europe, at the time of writing, FTSE is down -0.81%. DAX is down -0.98%. CAC is down -0.94%. UK 10-year yield is down -0.038 at 4.545. Germany 10-year yield is down -0.017 at 2.289. Earlier in Asia, Nikkei fell -0.29%. Hong Kong HSI fell -0.16%. China Shanghai SSE fell -006%. Singapore Strait Times fell -1.14%. Japan 10-year JGB yield fell -0.0311 to 1.055.

US PCE inflation ticks up to 2.4% yoy, core unchanged at 2.8% yoy

US headline PCE price index rose 0.1% mom in November, below expectation of 0.2% mom. Core PCE price index (excluding food and energy) also rose 0.1% mom, below expectation of 0.2% mom. Prices for goods increased less than 0.1% mom and prices for services increased 0.2% mom. Food prices increased 0.2% mom and energy prices also increased 0.2% mom.

From the same month one year ago, headline PCE index ticked up from 2.3% yoy to 2.4% yoy, below expectation of 2.5% yoy. Core PCE was unchanged at 2.8% yoy, below expectation of 2.9% yoy. Prices for goods decreased -0.4% yoy and prices for services increased 3.8% yoy. Food prices increased 1.4% yoy and energy prices decreased -4.0% yoy.

Personal income rose 0.3% mom or USD 71.1B, below expectation of 0.4% mom. Personal spending rose 0.4% mom or USD 81.3B. below expectation of 0.5% mom.

Canada’s retail sales rises 0.6% mom in Oct, unchanged in Nov

Canada’s retail sales rose 0.6% mom to CAD 67.6B in October, above expectation of 0.4% mom. Sales were up in five of nine subsectors and were led by increases at motor vehicle and parts dealers.

Core retail sales—which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers—were up 0.2% mom.

In volume terms, retail sales were unchanged.

Advance information suggests that sales were relatively unchanged in November.

UK retail sales edge up 0.2% mom, below 0.4% mom expectations

UK retail sales volumes rose by 0.2% mom in November, falling short of expectations for a 0.4% increase. This modest gain partly recovered the -0.7% mom decline recorded in October. Growth in supermarkets and non-food stores provided support, but this was partially offset by weaker performance from clothing retailers.

On an annual basis, sales volumes increased by 0.5% over the year to November. However, volumes remain -1.6% below their pre-pandemic levels from February 2020.

Looking at the broader trend, retail sales volumes rose by 0.3% in the three months to November compared with the prior three-month period. Compared to the same period last year, volumes were up by 1.9%, suggesting some resilience despite ongoing economic uncertainties.

Japan’s core CPI reaccelerates to 2.7%, driven by energy and rice

Japan’s core CPI (excluding food) rose to 2.7% yoy in November, marking the first reacceleration in three months and exceeding market expectations of 2.6% yoy. Core inflation has remained above the BoJ’s 2% target since April 2022, highlighting persistent price pressures. This increase was attributed to reduced government subsidies for utility bills and a sharp rise in rice prices.

Energy prices surged 6.0% yoy, up from October’s 2.3% yoy gain. Within this category, electricity prices jumped 9.9% yoy, and city gas costs climbed 6.4% yoy. Meanwhile, rice prices soared by a staggering 63.6% yoy, the steepest increase since 1971, driven by last year’s unusually hot summer that disrupted production.

Core-core CPI (excluding food and energy) ticked up from 2.3% yoy to 2.4% yoy, while headline CPI rose to 2.9% from October’s 2.3%. Service prices, a key indicator for BOJ as they often reflect wage dynamics, increased 1.5% yoy, unchanged from the prior month.

NZ’s exports rises 9.1% yoy in Nov, imports up 3.9% yoy

New Zealand’s trade data for November showed a significant improvement, with goods exports rising 9.1% yoy to NZD 6.5B, while goods imports increased by a more modest 3.9% yoy to NZD 6.9B. The resulting trade deficit of NZD -437m was much smaller than the expected NZD -1951m.

Exports saw notable gains across key markets. Shipments to China increased 6.3% yoy, adding NZD 106m, while exports to Australia climbed 8.4% yoy (NZD 62m) and to the US by 12% yoy (NZD 85m). Exports to the EU surged the most, rising 27% yoy (NZD 74m), with shipments to Japan also showing strength at 7.2% yoy (NZD 19m).

On the import side, data was more mixed. Imports from China edged down -1.7% yoy (NZD -29m) and from the EU fell sharply by -16% yoy (NZD -163m). Similarly, imports from South Korea dropped -12% yoy (NZD -61m ). However, imports from Australia rose 14% yoy (NZD 101m) and from the US increased 7.2% yoy (NZD 41 m).

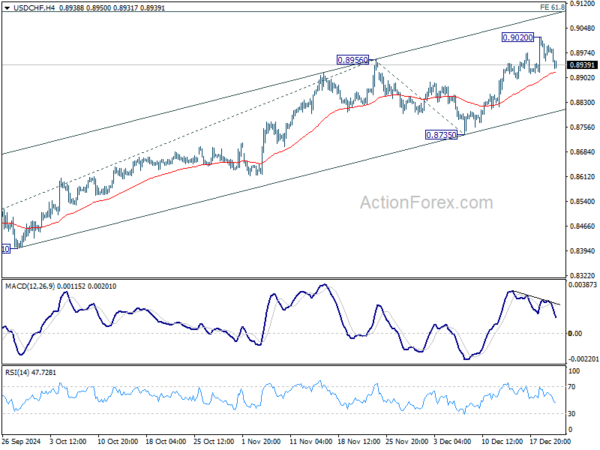

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8951; (P) 0.8990; (R1) 0.9027; More…

Intraday bias in USD/CHF remains neutral for consolidations below 0.9020 temporary top Some more consolidations could be seen but further rally is expected as long as 0.8735 support holds. On the upside, break of 0.9020 will resume the rally from 0.8374. Next target will be 61.8% projection of 0.8374 to 0.8956 from 0.8735 at 0.9095.

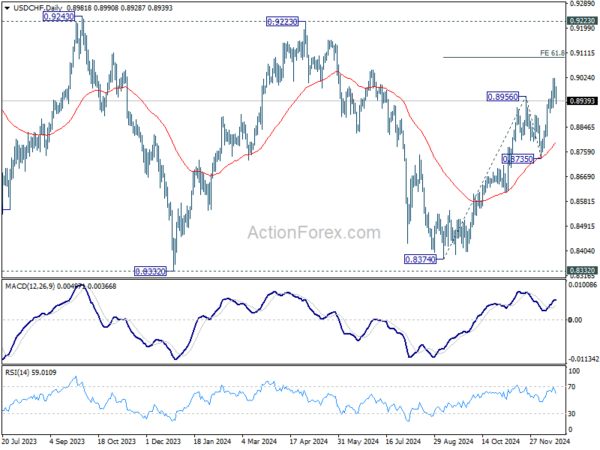

In the bigger picture, price actions from 0.8332 (2023 low) are currently seen as a medium term corrective pattern, with rise from 0.8374 as the third leg. Overall outlook will continue to stay bearish as long as 0.9223 resistance holds. Break of 0.8332 low is in favor at a later stage when the consolidation completes.