European majors are broadly under pressure today, with Swiss Franc leading losses. SNB’s unexpected 50bps rate cut caught markets off guard, and its significantly downgraded inflation projections suggest more easing is on the table for 2025. Meanwhile, Euro managed to hold steady after ECB’s widely anticipated 25bps cut. ECB demonstrated clear confidence in its inflation trajectory. Despite its professed “data-dependent” stance, the path toward a neutral rate now seems well-defined.

In contrast, Australian Dollar is shining as the strongest performer, driven by robust domestic job data that dashed hopes for a February rate cut by RBA The Yen follows closely ahead of BoJ’s closely watched Tankan survey. Kiwi also shows strength, while Dollar and Canadian Dollar trade mixed for the session.

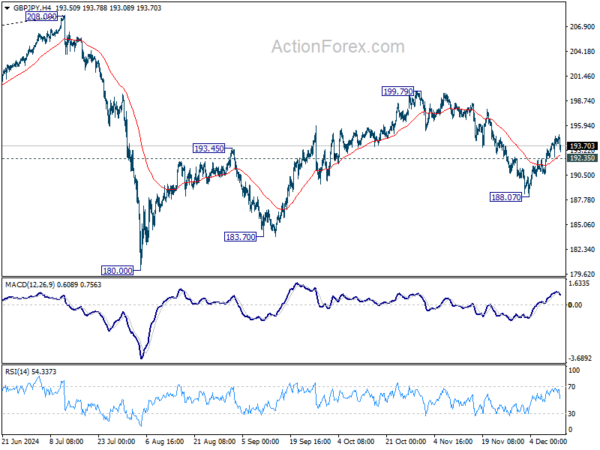

Looking ahead, Yen will likely stay in focus during the Asian session with the Tankan survey results, while UK GDP data tomorrow could impact Sterling’s direction. GBP/JPY stands at an inflection point.

Technically, near term in GBP/JPY outlook was mixed up with the stronger than expected rebound from 188.07. However, break of 192.35 minor support argues that fall from 199.79 is in progress. More importantly, that would also revive the case that while corrective rise from 180.00 has completed at 199.79. Deeper fall should then be seen to 180.00/183.70 support zone.

In Europe, at the time of writing, FTSE is up 0.07%. DAX is up 0.14%. CAC is up 0.17%. UK 10-year yield is up 0.0281 at 4.349. Germany 10-year yield is up 0.024 at 2.156. Earlier in Asia, Nikkei rose 1.21%. Hong Kong HSI rose 1.20%. China Shanghai SSE rose 085%. Singapore Strait Times rose 0.43%. Japan 10-year JGB yield fell -0.0212 to 1.051.

US PPI up 0.4% mom, 3.0% yoy, highest annual rise since Feb 2023

US PPI for final demand rose 0.4% mom in November, above expectation of 0.3% mom. Nearly 60% of the broad-based rise in final demand prices can be attributed to a 0.7% mom increase in goods. Prices for final services moved up 0.2% mom. PPI less foods, energy, and trade services inched up 0.1% mom.

On an unadjusted basis, PPI advanced 3.0% yoy for the 12 months period, well above expectation of 2.5% yoy. It’s also the largest rise since moving up 4.7% yoy in February 2023. PPI less foods, energy, and trade services advanced 3.5% yoy.

US initial jobless claims rise to 242k, above exp 221k

US initial jobless claims rose 17k to 242k in the week ending December 7, above expectation of 221k. Four-week moving average of initial claims rose 6k to 224k.

Continuing claims rose 15k to 1886k in the week ending November 30. Four-week moving average of continuing claims rose 3.5k to 188k, highest sine November 27, 2021.

ECB cuts to 3.00%, projects inflation steady around target through 2027

ECB cut its deposit rate by 25bps to 3.00%, aligning with market expectations. The overall decisions and economic projections reflect confidence in the ongoing disinflation process. Yet, he Governing Council reiterated its “data-dependent and meeting-by-meeting approach,” refraining from pre-committing to any specific rate path.

In its statement, the ECB highlighted that the “disinflation process is well on track.” The bank’s updated projections show headline inflation averaging 2.4% in 2024, moderating further to 2.1% in 2025 and 1.9% in 2026.

Inflation excluding energy and food is expected to average 2.9% in 2024, easing to 2.3% in 2025 and stabilizing at 1.9% by 2026 and 2027.

ECB added that inflation is projected to settle around its 2% target “on a sustained basis.”

However, growth expectations were revised downward, reflecting continued economic challenges. ECB now forecasts the Eurozone economy to expand by just 0.7% in 2024, improving modestly to 1.1% in 2025 and 1.4% in 2026.

Growth is expected to rest primarily on rising real incomes, which should bolster household consumption, alongside gradual increases in business investment. Additionally, ECB noted that the fading effects of restrictive monetary policy should support a recovery in domestic demand over time.

Ifo flags structural risks as German economy faces subdued 0.4% growth next year

Germany’s economy is forecast to contract by -0.1% in 2024, according to the Ifo Institute. The economy has been “treading water for five years”, with growth stalled amid structural challenges.

The institute presents two possible trajectories for 2025: sluggish growth of just 0.4% if structural issues persist, or a recovery to 1.1% if economic policy reforms support industrial revival.

Timo Wollmershäuser, Head of Forecasts at Ifo, stated, “It is not yet clear whether the current phase of stagnation is a temporary weakness or one that is permanent and hence a painful change in the economy.”

He noted that Germany’s export sector, once a key driver of growth, has become “increasingly decoupled from global economic development,” with competitiveness eroding, particularly in industrial goods outside Europe.

In a pessimistic scenario, this weakness could lead to “creeping deindustrialization,” while an optimistic outcome would depend on supportive policies enabling manufacturing to expand production capacities. Such measures could, in turn, boost private consumption and reduce the high savings rate, providing further stimulus to the economy.

SNB cuts by 50bps, projects weaker inflation and modest growth in 2025

SNB took a decisive step by lowering its policy rate by 50 basis points to 0.50%. In its accompanying statement, the central bank highlighted that underlying inflationary pressures have “decreased again” this quarter, warranting the larger-than-expected rate cut. SNB reiterated its commitment to “monitor the situation closely” and stated that it would “adjust its monetary policy if necessary.”

The latest conditional inflation forecasts reflect a significantly subdued outlook, even with interest rate down from 1.00% to 0.50%.

For 2025, inflation is now projected at just 0.3%, a notable downgrade from the 0.6% forecast in September. However, the 2026 outlook saw a slight upward revision to 0.8%, from 0.7% previously.

Looking at some details, inflation is expected to decline sharply from 0.7% in Q4 2024 to a low of 0.2% in Q2 2025, before gradually recovering to 0.8% in 2026 and 0.7% in 2027. These figures underscore the SNB’s view of persistent deflationary risks, necessitating its proactive policy stance.

In terms of economic growth, SNB estimates GDP growth for 2024 to come in at around 1%, with a modest pickup to 1-1.5% expected in 2025. Despite this improvement, challenges remain, including slightly rising unemployment and declining utilization of production capacity.

Australia’s employment data beats expectations, unemployment drops below to 3.9%

Australia’s labor market showed surprising resilience in November as employment grew by 35.6k, surpassing expectations of a 29.6k increase. The standout figure was the 52.6k gain in full-time jobs, offsetting a decline of -17k in part-time positions.

Unemployment rate fell significantly, dropping from 4.1% to 3.9%, well below the anticipated 4.2%. However, a slight dip in the participation rate, from a record high of 67.1% to 67.0%, tempered the optimism.

Employment-to-population ratio nudged up to 64.4%, matching levels from a year ago and maintaining its position 2.2% above pre-pandemic levels. Monthly hours worked showed no growth, indicating stability in workforce activity despite the overall gains in employment.

David Taylor, Head of Labour Statistics at the ABS, noted that an unusually high number of unemployed individuals transitioned into employment during November. This dynamic contributed to both the rise in job creation and the sharp fall in unemployment. Taylor also highlighted the role of population growth, which has bolstered labor supply and helped maintain the balance between employment growth and demographic expansion.

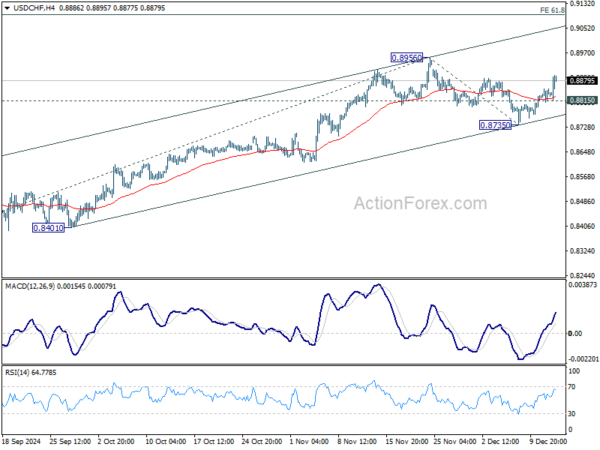

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.8817; (P) 0.8836; (R1) 0.8860; More…

Intraday bias in USD/CHF remains on the upside for the moment. Corrective fall from 0.8956 should have completed at 0.8735 after hitting 55 D EMA. Further rally should be seen to retest 0.8956 high first. Firm break there will resume the whole rise from 0.8374. Next target is 61.8% projection of 0.8374 to 0.8956 from 0.8735 at 0.9095. On the downside, below 0.8815 minor support will turn intraday bias neutral first. But risk will stay on the upside as long as 0.8735 support holds, in case of retreat.

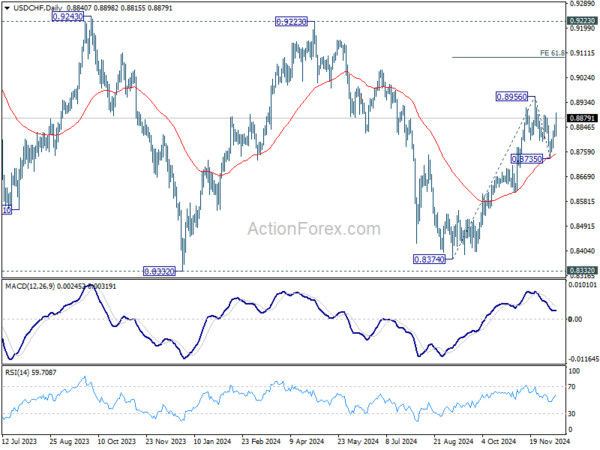

In the bigger picture, price actions from 0.8332 (2023 low) are currently seen as a medium term corrective pattern, with rise from 0.8374 as the third leg. Overall outlook will continue to stay bearish as long as 0.9223 resistance holds. Break of 0.8332 low is in favor at a later stage when the consolidation completes.