Australian Dollar faced broad declines in Asian trading following Q3 GDP data that fell short of expectations, marking a continued slowdown in the economy. Despite the weakness, the data isn’t severe enough to prompt an immediate policy response from RBA, either this month or in February. The central bank’s decision-making remains anchored on progress in services disinflation, easing labor market pressures, and broader signs of domestic economic adjustment. Nonetheless, this GDP reading is still a step forward, albeit tiny. .

Asian markets, meanwhile, remained largely steady despite political chaos in South Korea. President Yoon Suk Yeol’s surprise declaration of martial law to counter alleged “anti-state forces” among his political opponents was met with unanimous rejection by lawmakers, forcing him to rescind the order swiftly. The political backlash now leaves Yoon facing the possibility of impeachment. Despite the drama, KOSPI fell only -1.3%, and market reactions elsewhere, such as an initial spike in Yen and a drop in US Treasury yields, quickly reversed.

So far this week, Aussie and Kiwi have taken over from European majors as the weakest performers, followed by Swiss Franc. Dollar and Yen remain in a tight race for the strongest currency, with Sterling trailing as a distant third. Euro and Canadian Dollar occupy middle positions in the currency rankings.

On the technical front, attention is still centered on whether the US 10-year Treasury yield can defend key cluster support around the critical 4.1% to 4.2% range. This represents 55 D EMA (now at 4.223) and 38.2% retracement of 3.603 to 4.505 at 4.160. Strong bounce from current level will keep the rally from 3.603 alive, and limit USD/JPY’s decline. Today’s US ADP employment report and ISM Services data could provide the trigger for the next move in yields, or traders might hold their bets until Friday’s NFP.

In Asia, Nikkei closed up 0.10%. Hong Kong HSI is down -0.17%. China Shanghai SSE is down -0.65%. Singapore Strait Times is up 0.62%. Japan 10-year JGB yield is down -0.0236 at 1.057. Overnight, DOW fell -0.17%. S&P 500 rose 0.05%. NASDAQ rose 0.40%. 10-year yield rose 0.027 to 4.223.

Fed officials signal neutral policy path but keep December decision open

Several Federal Reserve officials shared their views overnight but avoided giving specific guidance on what to expect at the December 18 FOMC rate decision. The tone of their remarks highlighted confidence in recent economic progress while maintaining a cautious stance on future rate adjustments.

Fed Governor Adriana Kugler characterized the US economy as being in a “good position” following significant strides toward maximum employment and price stability. She acknowledged that the labor market remains solid and inflation is steadily moving toward 2% target, albeit with “some bumps along the way.”

Kugler emphasized that Fed is moving policy toward a “more neutral setting” while remaining vigilant for risks or supply shocks that could reverse progress.

San Francisco Fed President Mary Daly reiterated the importance of recalibrating policy but left the timing of adjustments undecided. “Whether it will be in December or sometime later, that’s a question we’ll have a chance to debate and discuss in our next meeting,” she said.

Chicago Fed President Austan Goolsbee shared a more forward-looking perspective, suggesting that “over the next year it feels to me like rates come down a fair amount” from current levels. However, he acknowledged the importance of meeting regularly to reassess economic conditions as they evolve.

ECB’s Holzmann: Modest rate cut possible next week, not more

Austrian ECB Governing Council member Robert Holzmann indicated in an interview with Austria’s Oberösterreichische Nachrichten newspaper that a rate cut at next week’s meeting is possible, but ruled out a significant reduction.

He stated that while the likelihood of a reduction “isn’t zero,” the cut would be “moderate, not very strong,” as current data do not strongly support such a move.

Holzmann mentioned that a 25bps cut is “conceivable,” but emphasized “not more” than that. Though, no decision has been made and it will depend on the “final data we receive.”

He acknowledged that inflation developments have been moving in the “right direction,” but recent “deviations to the upside” have emerged.

Additionally, he expressed concern over a “row of challenges” facing the economy, highlighting that the geopolitical environment suggests price increases are “more likely than unlikely.” Contributing factors include rising oil and energy prices and potential impacts from policies under President-elect Donald Trump.

Australia’s Q3 GDP expands 0.3% qoq, marking continued economic slowdown

Australia’s GDP grew by 0.3% qoq in Q3, falling short of expectations for a 0.5% qoq expansion, while annual growth reached 0.8% yoy. However, GDP per capita declined by -0.3% qoq, marking the seventh consecutive quarter of contraction.

Katherine Keenan, head of national accounts at the Australian Bureau of Statistics, remarked that “the Australian economy grew for the twelfth quarter in a row, but has continued to slow since September 2023.”

Public sector spending was the key driver of growth during the quarter, with government consumption and public investment making significant contributions.

Japan’s PMI services shows renewed growth, composite activity marginally improves

Japan’s services sector returned to growth in November, with PMI Services index finalized at 50.5, up from 49.7 in October. Composite PMI, which combines manufacturing and services activity, edged up to 50.1 from 49.6, signaling a modest overall improvement in private-sector activity.

Usamah Bhatti, Economist at S&P Global Market Intelligence, noted that the services sector experienced a “renewed upswing” as improved demand and stronger client confidence supported output and sustained new business growth. The sector’s near-term outlook appears favorable, with growth in outstanding business reaching its highest level in eight months, and optimism about the 12-month outlook remaining robust.

While the services sector drove the overall stabilization, the manufacturing sector continued to lag, with a slight contraction in production. Input cost pressures persisted across industries, contributing to higher prices for goods and services. However, businesses expressed optimism that inflationary and global uncertainties would subside, paving the way for a stronger rebound in Japan’s private sector.

China’s Caixin PMI services falls to 51.5, manufacturing boosts composite index to 52.3

China’s Caixin PMI Services dropped to 51.5 in November from 52.0, missing market expectations of 52.5, reflecting a slowdown in the sector’s expansion. However, PMI Composite rose to 52.3 from 51.9, supported by improvements in manufacturing.

Wang Zhe, Senior Economist at Caixin Insight Group, highlighted the challenges facing the economy. He noted that while the downturn appears to be “bottoming out,” the recovery requires “further consolidation.” Persistent contraction in employment underscores that the impact of economic stimulus has yet to translate into labor market gains, with businesses hesitant to expand their workforce.

Wang also stressed the importance of monitoring the “consistency and effectiveness” of additional stimulus measures. The economy continues to face “structural and cyclical pressures,” compounded by the risk of “continued accumulation of external uncertainties,” necessitating “sufficient policy buffers.”

Looking ahead

Eurozone PMI services final, PPI, and UK PMI services final will be released in European session. But the focuses will be on US ADP employment, and US ISM services featured later in the day. Fed will also publish Beige Book economic report.

EUR/AUD Daily Outlook

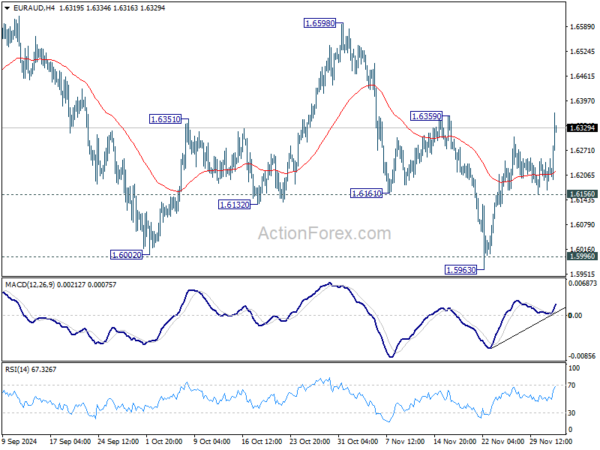

Daily Pivots: (S1) 1.6164; (P) 1.6208; (R1) 1.6247; More…

Immediate focus is now on 1.6359 resistance in EUR/AUD as rebound from 1.5963 resumes today. Firm break there will be the first sign of bullish trend reversal, after successfully defending 1.5996 key support level. Further rally should then be seen to 1.6598 resistance for confirmation. Nevertheless, break of 1.6156 support will turn bias back to the downside for 1.5996 again.

In the bigger picture, immediate focus is now on 1.5996 key support level. Sustained break there will argue that whole up trend from 1.4281 (2022 low) is already reversing. Deeper decline would be seen to 61.8% retracement of 1.4281 to 1.7180 at 1.5388, even as a correction. Nevertheless, strong rebound from current level, followed by break of 1.6359 resistance, will keep medium term outlook neutral at worst.