Dollar traded broadly lower in Asian session as markets reacted to President-elect Donald Trump’s appointment of Scott Bessent, a seasoned fund manager, as Treasury Secretary. Bessent’s stance aligns with Trump’s policies on tariffs, though his pragmatic approach has been perceived as a stabilizing factor. He advocates for tariffs to be introduced “gradually” and supports tax reforms, deregulation, and economic growth as pathways to address the US’s significant debt burden. These positions have led some to describe him as a “safe hand” for the role, offering reassurance to bond markets too.

However, Bessent’s favor for a strong Dollar and his endorsement of tariffs continue to generate debate. While his appointment may have triggered a temporary pullback in the greenback, analysts caution that his economic philosophies could ultimately reinforce Dollar strength, particularly if supported by broader economic fundamentals.

Despite the session’s softness, the Dollar remains the best-performing currency in November, bolstered by resilient U.S. economic data and expectations of a slower Fed easing path. Canadian Dollar ranks as the second strongest, followed by Australian Dollar. Conversely, Euro, British Pound, and Swiss Franc are the weakest performers. Japanese Yen and New Zealand Dollar are holding a middle-ground position.

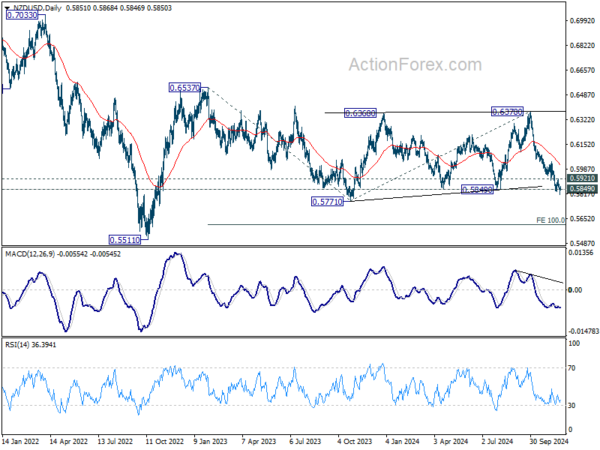

NZD/USD pair is drawing significant attention this week as RBNZ rate cut awaited. A key focus is whether RBNZ signals deeper monetary easing in its projections for 2025. Technically, NZD/USD is still struggling to break through 0.5849 decisively for now. But outlook will remain bearish as long as 0.5921 resistance zone. Firm break of 0.5771/5849 support zone will resume whole fall from 0.6537 to 100% projection of 0.6537 to 0.5771 from 0.6378 at 0.5612.

In Asia, at the time of writing, Nikkei is up 1.46%. Hong Kong HSI is down -0.44%. China Shanghai SSE is down 0.80%. Singapore Strait Times is up 0.13%. Japan 10-year JGB yield is flat at 1.080.

New Zealand’s Q3 retail sales down -0.1% qoq, ex-auto sales slumps -0.8% qoq

New Zealand’s retail sales volume for Q3 showed a marginal decline of -0.1% qoq, a better outcome than the expected -0.5% qoq contraction. However, the data revealed underlying weakness, as retail sales excluding autos fell by a sharper-than-expected -0.8% qoq, missing the forecast of -0.3% qoq.

A breakdown of the data shows that 10 out of 15 retail industries experienced lower sales volumes during the quarter.

Meanwhile sales value dropped significantly by -0.7% qoq. Regionally, 15 of the 16 regions reported lower seasonally adjusted sales values, underscoring the broad-based nature of the decline.

As Michael Heslop, an economic indicators spokesperson, noted, “Retail activity was flat in the September 2024 quarter, with a decrease in spending in most retail industries being offset by an increase in motor vehicles and electrical and electronic goods.”

New Zealand’s goods exports rises 7.5% yoy in Oct, goods imports up 3.0% yoy

New Zealand’s goods exports increased by 7.5% yoy in October, reaching NZD 5.8B, while total goods imports rose by 3.0% yoy to NZD 7.3B. This resulted in a trade deficit of NZD -1.54B, which, although significant, was better than the expected deficit of NZD -1.76B.

Key export markets demonstrated robust growth, with exports to China rising by NZD 113m (8.4% yoy), Australia up by NZD 60m (8.3% yoy), the US surging NZD 90m (15% yoy), the EU increasing NZD 48m (18% yoy), and Japan gaining NZD 19m (6.7% yoy).

On the import side, trends were more mixed. Imports from China and the EU declined, falling NZD 42m (-2.7% yoy) and NZD 35m (-3.2% yoy) respectively. However, imports from the US surged by NZD 459m (79% yoy), while South Korea and Australia saw notable increases of NZD 148m (32% yoy) and NZD 58m (7.5% yoy) respectively.

RBNZ to cut 50bps, Fed minutes and inflation data watched

RBNZ is widely anticipated to lower the Official Cash Rate by additional 50bps to 4.25% this week. A key focus will be the new economic projections in the Monetary Policy Statement, which are expected to indicate further rate reductions in 2025.

Current market expectations suggest that RBNZ’s OCR could decline to 3.50% by the end of next year, with a terminal rate projected between 3.00% and 3.50% in the following year. However, there is potential for more significant downside surprises in this outlook.

Also, Fed is set to release the minutes of November’s FOMC meeting. Unlike the September meeting, which was marked by intense debate over a 50 bps rate cut, the atmosphere in November is expected to reflect greater consensus.

Two pressing questions face the Fed: first, whether it will implement another interest rate cut in December, with market odds currently split at approximately 50/50. It is unlikely that the minutes will provide substantial clues, as the decision will heavily depend on forthcoming employment data.

The second question concerns Fed’s rate path for next year. Given the uncertainty surrounding Donald Trump’s policies as he prepares to take office again next year, Fed officials are unlikely to have a definitive plan at this stage.

Inflation data will be a major focal point this week too, with key releases including the Eurozone’s CPI flash estimate, US PCE index, and Australia’s monthly CPI.

Eurozone’s CPI is of particular importance; headline CPI is expected to rise back to 2.3%, while core CPI is anticipated to tick up to 2.8%. Markets are already betting on a December 50bps cut by ECB following last week’s disappointing Eurozone PMI data. Any downside surprises in the inflation figures will reinforce this dovish outlook.

Additional data to monitor include GDP figures from Switzerland and Canada, as well as Germany’s Ifo Business Climate Index.

Here are some highlights for the week:

- Monday: New Zealand retail sales, trade balance, Germany Ifo business climate.

- Tuesday: Japan SPPI; US house price index, consumer confidence, new home sales.

- Wednesday: Australia monthly CPI; RBNZ rate decision; Germany Gfk consumer sentiment; US GDP revision, jobless claims, durable goods orders, goods trade balance, Chicago PI, personal income and spending, PCE inflation, FOMC minutes.

- Thursday: New Zealand ANZ business confidence; Germany CPI flash; Eurozone M3 money supply.

- Friday: Japan Tokyo CPI, unemployment rate, industrial production, retail sales, consumer confidence, housing starts; Germany import prices, retail sales, unemployment rate; Swiss GDP; Eurozone CPI flash; Canada GDP.

USD/CHF Daily Outlook

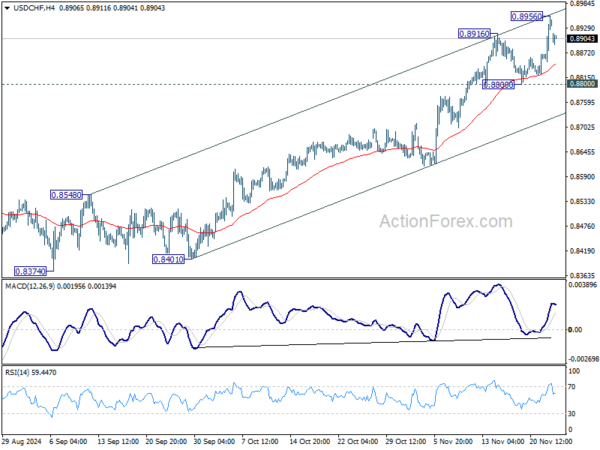

Daily Pivots: (S1) 0.8877; (P) 0.8918; (R1) 0.8983; More…

Intraday bias in USD/CHF is turned neutral first with current dip and some consolidations could be seen first. But outlook will will stay bullish as long as 0.8800 support holds, in case of retreat. Break of 0.8956 will resume the rally from 0.8374, and target 0.9223 key resistance next.

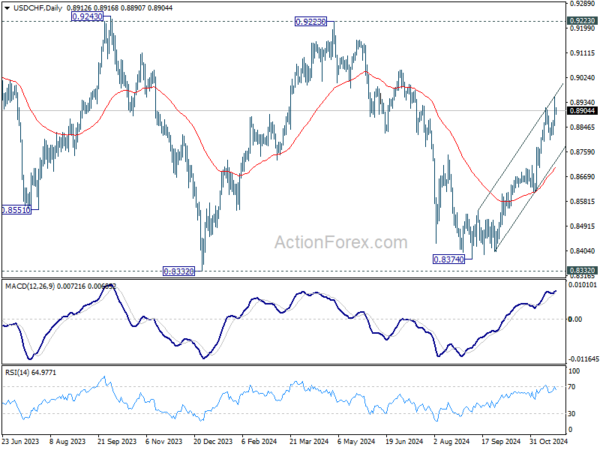

In the bigger picture, price actions from 0.8332 (2023 low) are currently seen as a medium term corrective pattern. Rise from 0.8374 is seen as the third leg. Overall outlook will continue to stay bearish as long as 0.9223 resistance holds. Break of 0.8332 low is in favor at a later stage when the consolidation completes.