Euro stole the limelight last week with a steep selloff triggered by poor activity data. This downturn has intensified the pressing need for the ECB to ease monetary policy swiftly back to neutral levels. While Euro’s decline was pronounced, Sterling and the Swiss Franc are not far behind, each facing their own set of challenges. Although these European majors are clearly bearish against most other major currencies, their relative outlook is less clear due to their intertwined relationship.

Conversely, Canadian Dollar and Australian Dollar emerged as the strongest performers, partly supported by renewed risk-on sentiment in the US markets. This positive mood has bolstered commodity-linked currencies as investors seek higher-yielding assets. Dollar holds the position of the third strongest currency; however, its upward momentum is somewhat capped by risk-on sentiment and sluggishness in treasury yields. Nevertheless, the greenback could merely be consolidating against commodity currencies and Yen, with buyers ready to come in again any time.

European Majors Falter on Intertwined Economic and Political Challenges

European major currencies posted significant declines last week, with Euro leading the way as market participants increased bets on more aggressive monetary easing by ECB. The catalyst for the sell-off was disappointing Eurozone PMI data, which revealed contractions in both the services and manufacturing sectors. The manufacturing sector’s prolonged recession is deepening, and the services sector has now joined in contraction. The deteriorating conditions in the Eurozone’s largest economies, Germany and France, have intensified concerns about the region’s economic prospects.

Adding to the economic woes are mounting political challenges. France’s government remains unstable following this year’s snap election, and Germany is preparing for early elections, contributing to domestic uncertainty. Externally, the recent escalation in the conflict between Ukraine and Russia is casting a long shadow over the region. Furthermore, the risks of renewed trade tensions with the US looming, as a new administration under Donald Trump is set to take office next year. These factors are collectively dampening business optimism across Europe.

Economists are increasingly highlighting the urgent need for lower interest rates to support the faltering economies. The markets are currently pricing in a 50% probability of a 50 bps rate cut by ECB in December, a significant shift from previous expectations. More importantly, there is growing speculation that ECB would need to expedite the reduction of rates from the current 3.25% to the estimated neutral rate of 2%. Some ECB policymakers, particularly the more dovish members, are even discussing the possibility that rates may need to fall below the neutral level in this cycle to stimulate the economy effectively and prevent inflation undershooting.

The situation in the UK is somewhat more complex. On one side, recent data showed an unexpected contraction in retail sales and the first contraction in the private sector in 13 months, as indicated by PMI readings, with the services sector stagnating. On the other side, inflation figures surprised to the upside, with the CPI rising more than expected to 2.3%, and services inflation ticking up to 5%. These inflationary pressures, combined with uncertainty surrounding the impact of the Labour government’s budget, complicate BoE’s ability to accelerate monetary easing.

Moreover, according to S&P Global, business optimism in the UK has been in a sharp and persistent decline since the general elections in July. Companies are expressing a clear “thumbs down” to the recent budget policies, suggesting that sentiment may deteriorate further before reaching a bottom. This negative trend in business confidence could pressure the BoE to act more swiftly in the early part of next year to support the economy.

Swiss Franc is also facing its own set of challenges. Deflationary pressures are mounting, with Swiss CPI falling consistently from 1.4% in mid-year to just 0.6% in October. With geopolitical risks sustaining demand for the safe-haven Franc, its appreciation exacerbates further deflationary trends. Also, aggressive easing by ECB could further strengthen the Franc, potentially forcing SNB to intervene more forcefully to prevent excessive appreciation. With the policy rate already low at 1.00%, SNB has limited ammunitions before considering a return to negative interest rates.

Lack of Conviction in European Crosses, While Commodity Currencies Show Strength

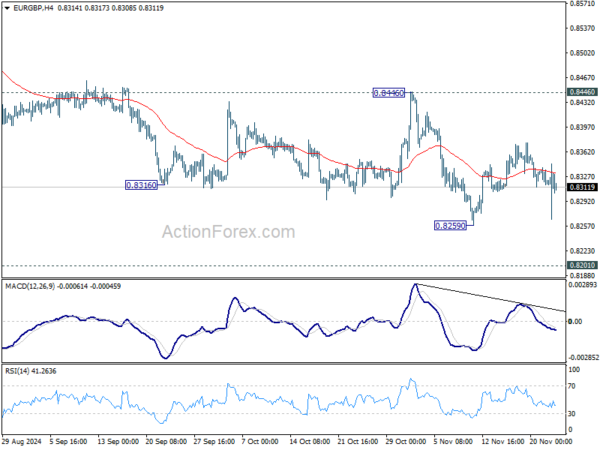

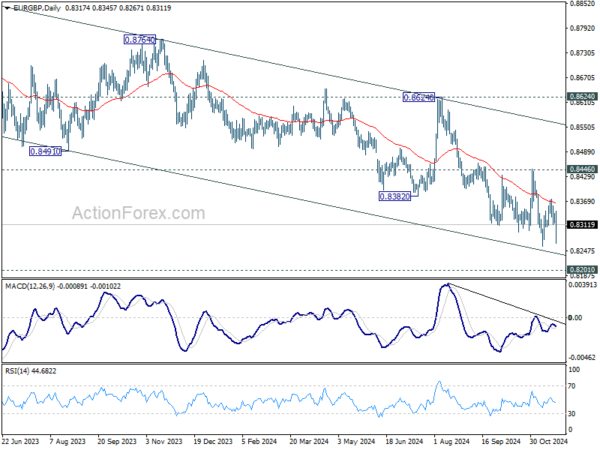

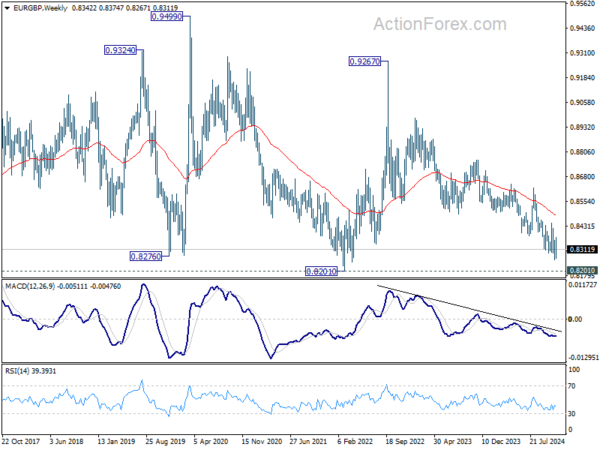

Technically, while Euro displayed weakness against both the Sterling and Swiss Franc, the selling pressure lacked clear conviction, leaving the movements in EUR/CHF, EUR/GBP, and to a lesser extent GBP/CHF indecisive. This lack of clarity suggests that market participants are still hesitant to fully commit to a clear trend for these pairs.

In contrast, the outlook for European crosses with commodity currencies appears more defined. This is likely driven by renewed sense of risk appetite, particularly stemming from the strength seen in US markets.

EUR/GBP spiked lower on Friday but quickly recovered ahead of 0.8259 support, without a breakout. On the one hand, near term outlook stays bearish with 0.8446 resistance intact, and further decline is in favor. On the other hand, EUR/GBP would be facing an important level at 0.8201 (2022 low) on next fall, which could provide strong support for a sustainable rebound. It might still take some more time for the outlook to clear out itself.

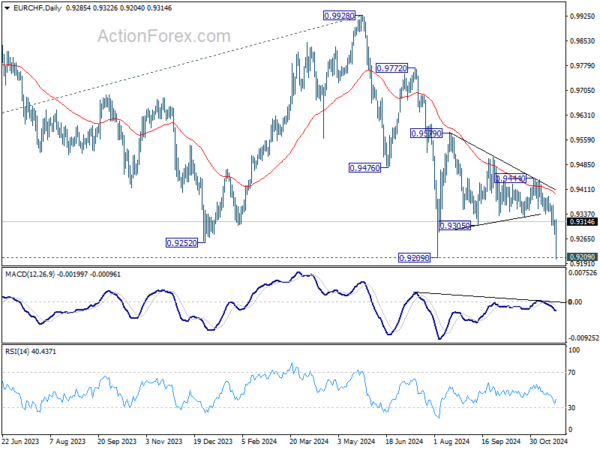

EUR/CHF dived even more sharply to 0.9204 on Friday, but rebounded equally strongly after a brief breach of 0.9209 low. The long term down trend remains intact, but EUR/CHF would likely have more consolidations above 0.9204/9 first before making a more decisive down move.

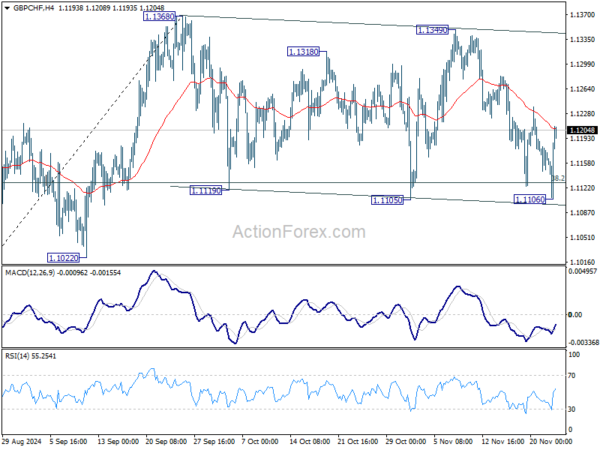

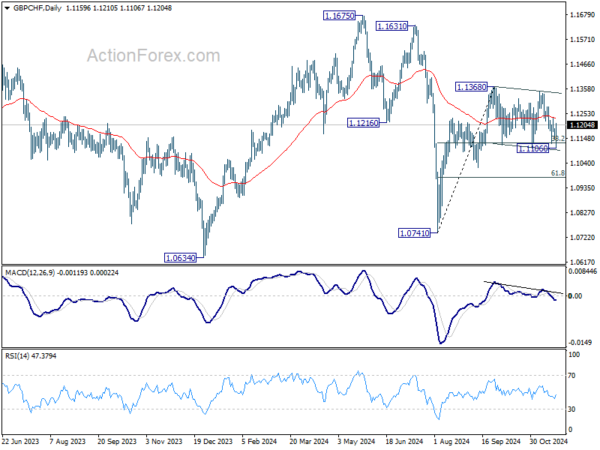

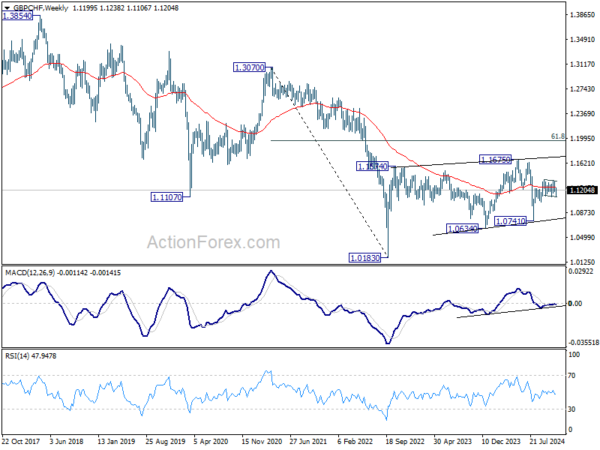

GBP/CHF drew notable support again from 38.2% retracement of 1.0741 to 1.1368 at 1.1128 again last week. The development keeps price action from 1.1368 as a sideway consolidation pattern. That means, rise from 1.0741 is still in favor to resume at a later stage. Yet, firstly, the bullish outlook is not totally cleared with GBP/CHF still struggling around flat 55 W EMA. Secondly, it’s unsure how long the consolidation will extend further.

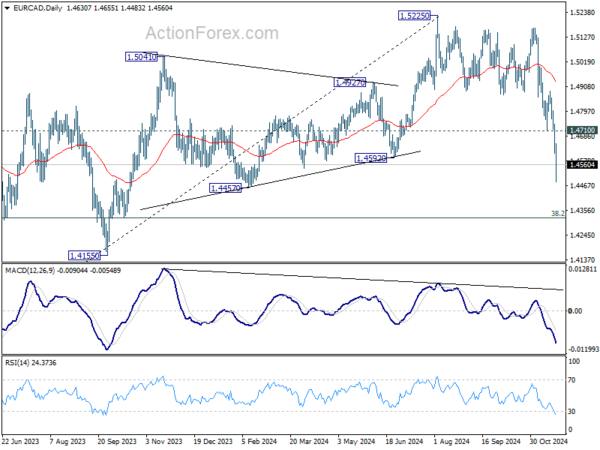

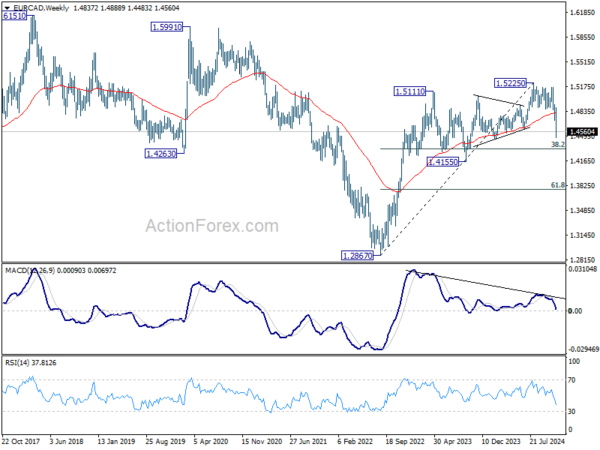

EUR/CAD‘s fall from 1.5225 accelerated lower last week and broke through 1.4592 support decisively. Considering bearish divergence condition in W MACD, 1.5225 is at least a medium term top. Further decline is expected as long as 1.4710 support turned resistance holds. Next target is 38.2% retracement of 1.2867 (2022 low) to 1.5225 at 1.4324. Sustained break there will indicate medium term bearish reversal and target 61.8% retracement at 1.3768 next.

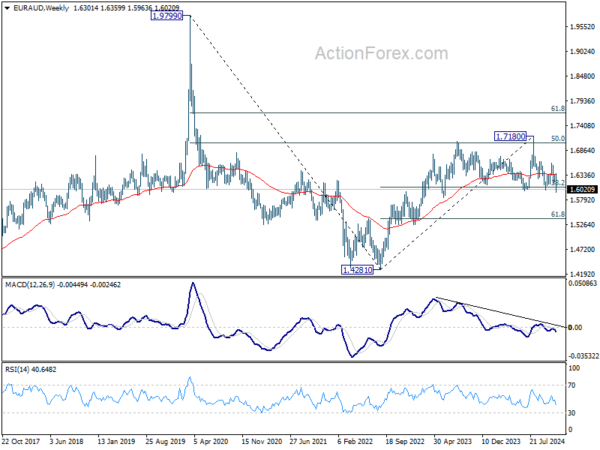

EUR/AUD‘s decline from 1.7180 tried to resume through 1.5996/6002 support zone last week. Further fall is expected as long as 1.6161 support turned resistance holds. Considering bearish divergence condition in W MACD, sustained break of 1.5996 will argue that the trend from 1.4281 (2022 low) is reversal. Deeper fall would be seen to 61.8% retracement of 1.4281 to 1.7180 at 1.5388 next.

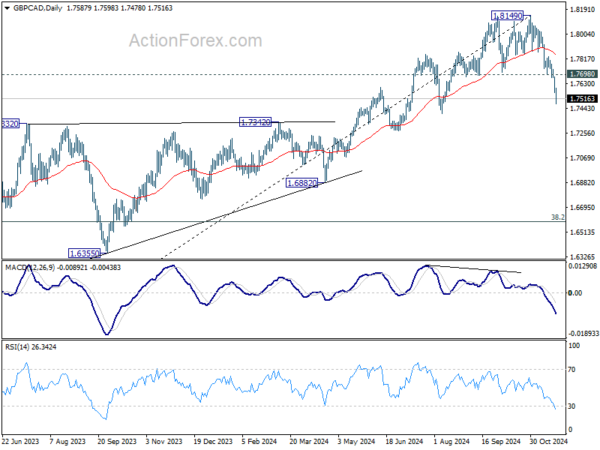

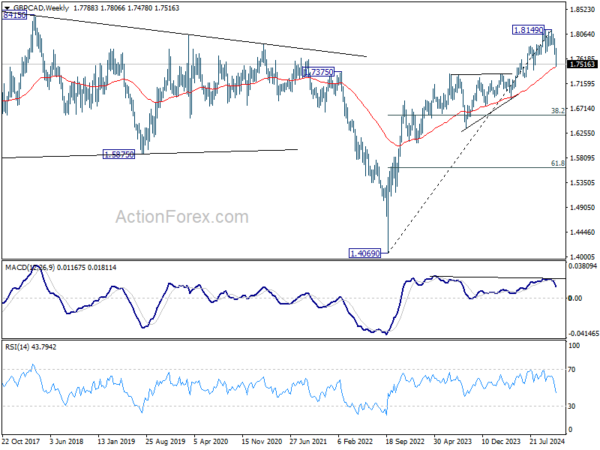

A medium term top should be in place at 1.8149 in GBP/CAD considering bearish divergence condition in D MACD. But it’s still early to conclude if the up trend from 1.4069 (2022 low) is reversing. Nonetheless, further decline is expected as long as 1.7698 support turned resistance holds. Sustained trading below 55 W EMA (now at 1.7454) will pave the way to 38.2% retracement of 1.4069 to 1.8149 at 1.6590.

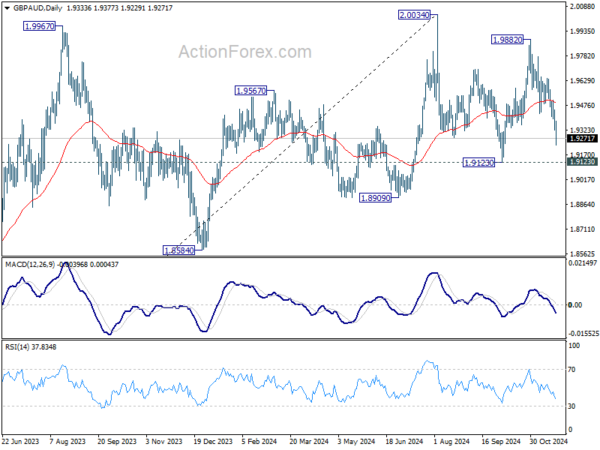

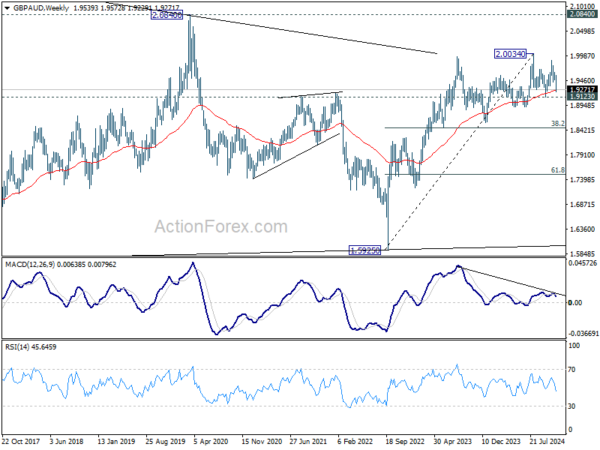

GBP/AUD‘s outlook is less clear. Bearish divergence in W MACD suggests medium term topping at 2.0045. But firm break below 1.9123 support is needed to confirm. In this case, deeper fall would be seen to 38.2% retracement of 1.5925 to 2.0034 at 1.8464 as a correction. Nevertheless, strong rebound from 1.9123 will keep outlook bullish for another rise through 2.0034 at a later stage.

Resilient US Economy Propels Equities, Dollar Index Surges on Weak Euro

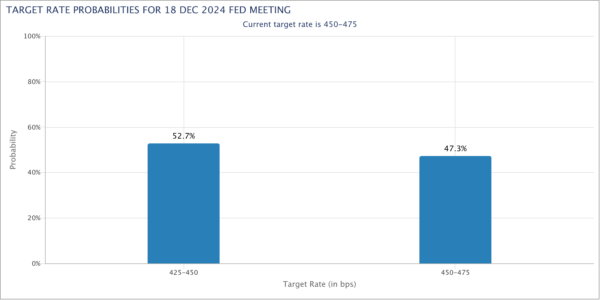

In the US markets, investors displayed renewed optimism as they cheered robust economic indicators, particularly the encouraging PMI data with services sector stood out with a significant performance boost. Market participants seemed unfazed with diminishing likelihood of aggressive Fed rate cuts. Fed funds futures now indicate only a 52.7% probability of a rate cut in December, suggesting that traders believe Fed might even consider pausing rate adjustments. The upcoming US employment data, set to be released in two weeks, will be crucial.

Technically, DOW’s strong rebound last week suggests that pull back from 44486.70 has completed at 42938.70 already. Break of 44486.70 will resume larger up trend to 100% projection of 32327.20 to 39889.05 from 38000.96 at 45562.81 next.

10 year yield continued to struggle around 4.45 mark, facing strong resistance from medium term falling trend line, as well as 61.8% retracement of 4.997 to 3.603 at 4.464. However, there is no clear sign of a reversal for now. Further rise is in favor as long as 4.264 support holds. Sustained break of 4.464 will strengthen the bullish case that whole correction from 4.997 has completed with three waves down to 3.603. Further rally should then be seen to 4.737 and then 4.997.

Dollar Index surged further to 108.07 last week and breached 100% projection of 99.57 to 107.34 from 100.15 at 107.92 before closing slightly lower at 107.55. Surprisingly, that was neither driven by risk-off sentiment nor rally in US yields, but the deep selloff in Euro.

Immediate focus in now on whether Dollar Index could sustain above 107.92 with conviction. In this case, that would strengthen the case that pullback from 114.77 (2022 high) as completed after getting strong support from 55 M EMA. Further rally should then be seen to 161.8% projection at 112.72 next.

Nevertheless, rejection by 107.92, followed by break of 106.11 support, will keep medium term outlook neutral first.

EUR/USD Weekly Outlook

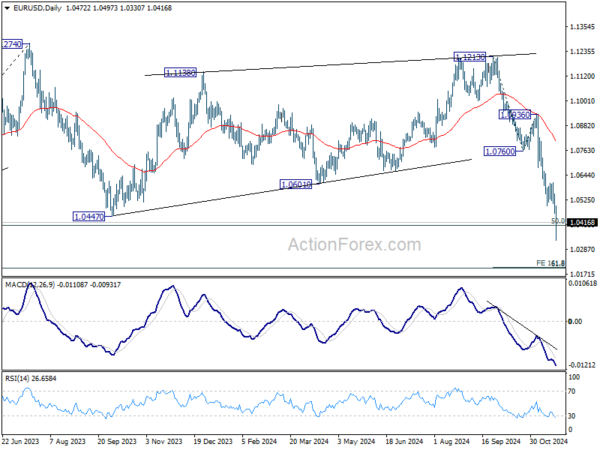

EUR/USD’s decline from 1.1213 continued last week and accelerated to as low as 1.0330. There is no sign of bottoming yet and initial bias stays on the downside this week. Sustained trading below 1.0404 key fibonacci level will carry larger bearish implication and target next level at 161.8% projection of 1.1213 to 1.0760 from 1.0936 at 1.0203. Nevertheless, strong rebound from current level, followed by break of 1.0609 resistance, will indicate short term bottoming.

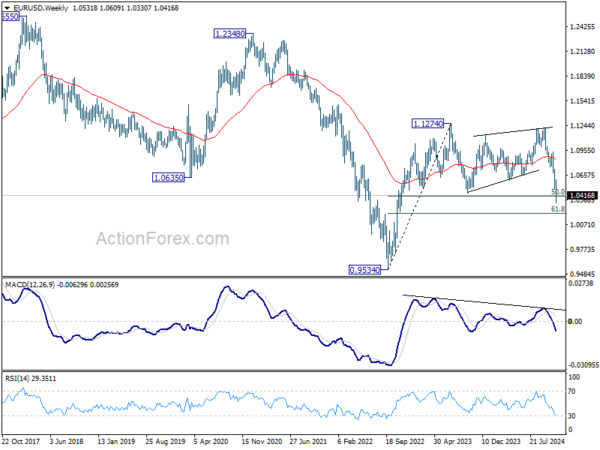

In the bigger picture, immediate focus is now on 50% retracement of 0.9534 (2022 low) to 1.1274 at 1.0404. Strong rebound from this level will keep price actions from 1.1273 (2023 high) as a medium term consolidation pattern only. However, sustained break of 1.0404 will raise the chance that whole up trend from 0.9534 has reversed. That would pave the way to 61.8% retracement at 1.0199 first. Firm break there will target 0.9534 low again.

In the long term picture, down trend from 1.6039 remains in force with EUR/USD staying well inside falling channel, and upside of rebound capped by 55 M EMA (now at 1.0991). Consolidation from 0.9534 could extend further and another rising leg might be seem. But as long as 1.1274 resistance holds. downside breakout would be mildly in favor.