Yen rebounded broadly today as market participants interpreted comments from BoJ Governor Kazuo Ueda as a potential signal for a rate hike in December. Ueda noted that there is still a month before the next policy meeting and that the central bank will have a substantial amount of data to consider by then. While he did not commit to any policy changes or express a clear intention to adjust interest rates, this “openness” was well-received by Yen bulls. The mere possibility of BoJ adopting a more hawkish stance provided enough impetus for Yen to strengthen against its peers.

In contrast, Euro declined broadly, breaking to the downside against both Aussie and Loonie, although it remained range-bound against Dollar. ECB attempted to downplay the significance of the previous day’s stronger-than-expected wage growth data, which is a clear indication that they are prepared to deliver another rate cut in December. Notably, one of the known dovish members of ECB Governing Council suggested the idea of continuous rate cuts until the deposit rate reaches neutral level of 2%. While it may be premature to project policy that far ahead, it appears that some officials are already setting the stage to manage market expectations for the coming year.

Overall, for the week so far, Euro is the worst-performing major currency. Despite today’s rebound, Yen remains the second weakest, followed by Dollar. Aussie is currently the strongest performer, followed by Loonie and Swiss Franc. Sterling and Kiwi continue to occupy middle positions in the performance rankings.

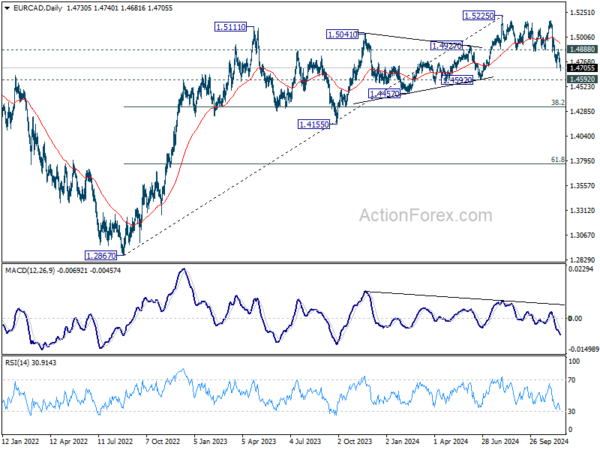

Technically, EUR/CAD’s fall from 1.5225 resumed by breaking through 1.4710 temporary low. Near term outlook will now stay bearish as long as 1.4888 resistance holds, and deeper fall would be seen to 1.4592 support. Firm break there would argue that the decline from 1.5225 is at least correcting the whole uptrend from 1.2867 (2022 low). Deeper fall should then be seen to 38.2% retracement of 1.2867 to 1.5225 at 1.4324.

In Europe, at the time of writing, FTSE is up 0.32%. DAX is up 0.23%. CAC is down -0.29%. UK 10-year yield is down -0.0357 at 4.438. Germany 10-year yield is down -0.035 at 2.318. Earlier in Asia, Nikkei fell -0.85%. Hong Kong HSI fell -0.53%. China Shanghai SSE rose 0.07%. Singapore Strait Times fell -0.12%. Japan 10-year yield rose 0.0269 to 1.096.

US initial jobless claims falls to 213k, vs exp 220k

US initial jobless claims fell -6k to 213k in the week ending November 16, below expectation of 220k. Four-week moving average of initial claims fell -4k to 218k.

Continuing claims rose 36k to 1908k in the week ending November 9, highest since November 13, 2021. Four-week moving average of continuing claims rose 5k to 1879k, highest since November 27, 2021.

Fed’s Barkin avoids prejudging December decision, cites vulnerability to cost shocks

Richmond Fed President Tom Barkin told the Financial Times he would not “prejudge” the rate decision at the December meeting. He acknowledged the dual challenges of elevated inflation and labor market strains.

“If you’ve got inflation staying above our target, that makes the case to be careful about reducing rates,” he said. “If you’ve got unemployment accelerating, that makes the case to be more forward-leaning.”

Barkin emphasized growing vulnerability to cost shocks which he said was higher than it might have been five years ago. He also pointed to business concerns over potential inflationary pressures stemming from President-elect Donald Trump’s proposed tariffs and deportation policies

However, he added that Trump’s plans to boost domestic energy production could have a counteracting “disinflationary” effect.

While businesses are apprehensive about economic policy changes under the new administration, Barkin underscored that the Fed would not preemptively adjust its policy.

“We shouldn’t try to solve it before it happens,” he remarked.

ECB’s Stournaras supports continuous rate cuts until neutral level reached

Greek ECB Governing Council member Yannis Stournaras expressed strong support for further monetary easing, suggesting a rate cut at every meeting moving forward until the policy rate reaches the “neutral rate,” estimated at around 2%.

Speaking with Bloomberg TV, Stournaras described the proposed quarter-point reduction in December, which would bring the deposit rate to 3%, as the “right response” to current economic and inflation conditions.

He refrained from ruling out a larger 50 basis-point cut, and emphasized that external factors, including market reactions and the Fed’s actions, remain uncertain.

Stournaras also downplayed concerns over the sharp third-quarter rise in negotiated wages, the highest since the euro’s inception in 1999, stating, “We expect that to fall in the months to come. We thought it’s one blip but not a permanent increase.”

ECB’s Villeroy: Wage data backward-looking, advocates agile pragmatism

French ECB Governing Council member François Villeroy de Galhau, speaking at a conference today, emphasized a cautious and pragmatic stance on monetary policy, downplaying the significance of recent stronger-than-expected wage data.

He described the Q3 surge in negotiated wages as a “backward-looking” indicator, primarily reflecting the “lagged effects” of earlier negotiations in Germany, which were already factored into the ECB’s September projections.

Villeroy highlighted a shift in risks, stating that the balance for both growth and inflation now tilts to the downside. He also noted that potential US tariffs are “not expected to alter significantly the inflation outlook in Europe”.

Against this backdrop, Villeroy reaffirmed the ECB’s commitment to “continue to reduce the degree of monetary policy restriction,” while underscoring that the pace must be guided by “agile pragmatism” and “full optionality” in future decisions.

BoJ’s Ueda: FX impact on economy and prices taken ‘seriously’ in policy decisions

At a forum today, BoJ Governor Kazuo Ueda admitted that the central bank takes exchange rate movements “seriously” when forming its economic and inflation outlook. He also stressed the importance of understanding the factors driving current exchange rate changes and their broader implications.

On monetary policy, Ueda reiterated that decisions would be made “meeting by meeting,” based on the most up-to-date information. With a month remaining until December meeting, Ueda noted that additional data would provide greater clarity for the central bank’s deliberations.

Commenting on potential impacts from the policies of US President-elect Donald Trump, Ueda admitted that it was too hard to predict. He affirmed that “as soon as the new administration announces new set of policies, we would like to incorporate into our economic outlook.”

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 154.68; (P) 155.28; (R1) 156.04; More…

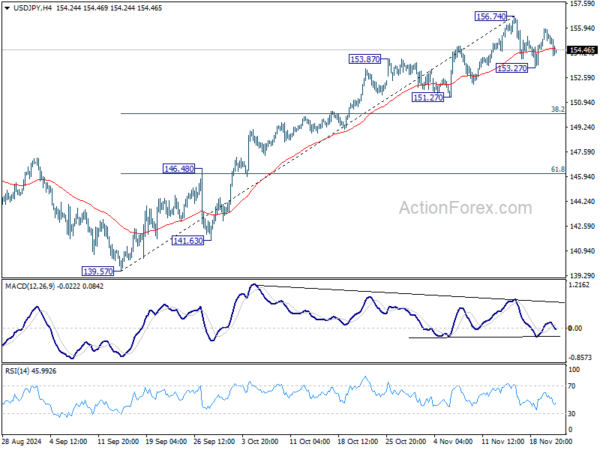

USD/JPY dips notably today but stays in range of 153.27/156.74. Intraday bias remains neutral at this point. On the upside, break of 156.74 will resume the whole rally from 139.57 towards 161.94 high. On the downside, though, break of 153.27 will resume the correction towards 38.2% retracement of 139.57 to 156.74 at 150.18.

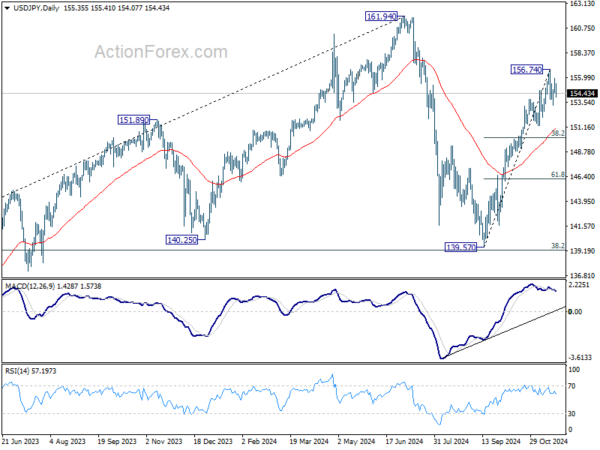

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low). The range of medium term consolidation should be set between 38.2% retracement of 102.58 to 161.94 at 139.26 and 161.94. Nevertheless, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.