The forex markets are largely consolidating today, with no major developments to drive decisive moves. Euro is showing some recovery, but the uptick appears more like a corrective bounce than a reversal. Sterling and Swiss Franc are following similar patterns, with modest strength lacking the momentum needed for sustained gains. This cautious tone is evident in the tight trading ranges of EUR/USD, GBP/USD, and USD/CHF, as traders await key events, including Wednesday’s UK CPI release, and Eurozone and UK PMI data on Friday.

Yen, however, is under mounting pressure as the European session progresses. Rising treasury yields in the US are acting as a headwind, with US 10-year yield once again eyeing the 4.5% mark. Compounding Yen’s challenges is the absence of clear signals from BoJ regarding its next policy move. With no explicit guidance on a December rate hike, market participants are increasingly skeptical of imminent monetary tightening. Despite this, Yen remains sensitive to risk sentiment, meaning it could stage a rebound if US equity markets face renewed sell-offs.

Focus will soon turn to RBA meeting minutes, set for release during the upcoming Asian session. Earlier this month, RBA left its cash rate unchanged at 4.35% but caught markets off guard by maintaining a strongly vigilant stance on upside inflation risks. NAB, one of Australia’s largest banks, has already revised its forecast for the first rate cut, pushing the timeline from February to May 2025. The minutes will be closely analyzed to gauge whether February remains a realistic window for RBA’s initial easing move or if the central bank is preparing for a longer wait.

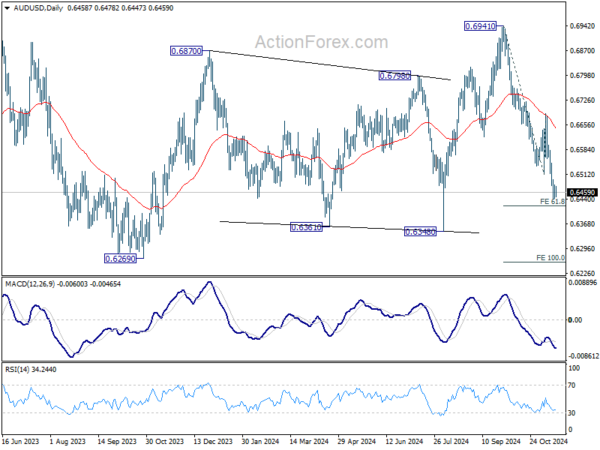

Technically, AUD/USD’s fall from 0.6941 paused last week just ahead of 61.8% projection of 0.6941 to 0.6511 from 0.6687 at 0.6421. But there is no sign of bottoming yet, not to mention even reversal. Firm break of 0.6421 would probably trigger another round of accelerated selloff, and pushes AUD/USD towards 100% projection at 0.6257, which is slightly below 0.6269 (2023 low).

In Europe, at the time of writing, FTSE is down -0.04%. DAX is down -0.56%. CAC is down -0.45%. UK 10-year yield is up 0.0382 at 4.509. Germany 10-year yield is up 0.043 at 2.398. Earlier in Asia, Nikkei fell -1.09%. Hong Kong HSI rose 0.77%. China Shanghai SSE fell -0.21%. Singapore Strait Times fell -0.32%. Japan 10-year JGB yield rose 0.0012 to 1.076.

ECB’s Makhlouf: Pretty overwhelming evidence needed for 50bps cut in Dec

Irish ECB Governing Council member Gabriel Makhlouf signaled caution today, emphasizing that an interest rate cut at the December 12 meeting is not guaranteed.

“It would be going a bit far to say an ECB interest rate cut next month is ‘in the bag,’” he stated, adding that the evidence s would need to be “pretty overwhelming” for a more aggressive 50bps reduction.

Makhlouf also addressed the uncertainty surrounding the impact of US President-elect Donald Trump’s administration on inflation dynamics. He stressed that it would be “premature” to base monetary policy decisions on assumptions about Trump’s fiscal and trade policies, stating, “I do think it would be premature to come to conclusions as to exactly what it is that the new US administration is going to do.”

Eurozone goods exports rises 0.6% yoy in Sep, imports falls -0.6% yoy

Eurozone goods exports rose 0.6% yoy to EUR 237.8B in September. Goods imports fell -0.6% yoy to EUR 225.3B. Trade balance reported a EUR 12.5b surplus. Intra-Eurozone trade fell -1.0% yoy to EUR 215.5B.

In seasonally adjusted term, goods exports rose 0.4% mom to EUR 237.6B. Goods imports fell -0.8% mom to EUR 224.1B. Trade balanced reported EUR 13.6B surplus, larger than expectation of EUR 7.9B. Intra-Eurozone trade fell -0.9% mom to EUR 212.9B.

BoJ’s Ueda highlights wages as key inflation driver, reaffirms tightening path

BoJ Governor Kazuo Ueda reiterated in a speech today that the central bank remains committed to its gradual policy tightening path, conditional on the realization of its economic and price outlook. However, the timing of adjustments will depend on evolving “economic activity and prices” as well as “financial conditions.”

Ueda stated that monetary policy decisions would hinge on assessments at each Monetary Policy Meeting, taking into account the latest data and projections. Key considerations include underlying inflation trends and financial conditions, with a focus on balancing risks to economic activity.

On inflation, Ueda highlighted that the effects of previous cost pass-throughs from higher import prices are waning. However, he noted that “inflationary pressure stemming from wage increases is projected to strengthen” as economic activity and wage growth remain robust.

While underlying inflation currently lags the 2% target, it is expected to rise moderately and align with the price stability target in the second half of the projection period through fiscal 2026.

NZ BNZ services rises to 46, still extremely challenging conditions

New Zealand’s BusinessNZ Performance of Services Index rose slightly from 45.7 to 46.0 in October. Despite the marginal improvement, the index stayed well below the 50 threshold, indicating ongoing contraction in the sector for a fourth consecutive month. The result also falls significantly short of the long-term average of 53.1.

The proportion of respondents reporting negative sentiment increased from 58.5% to 59.1%. Concerns about the cost of living and broader economic challenges continued to dominate.

BNZ Senior Economist Doug Steel emphasized the sector’s struggles, stating that “although it is contracting at a much slower pace than it was in June (when the PSI was 41.1), the PSI has been hovering between 45 and 46 over the last four months.” He noted that while some business surveys indicate an improving outlook, current conditions remain “extremely challenging”.

USD/JPY Mid-Day Outlook

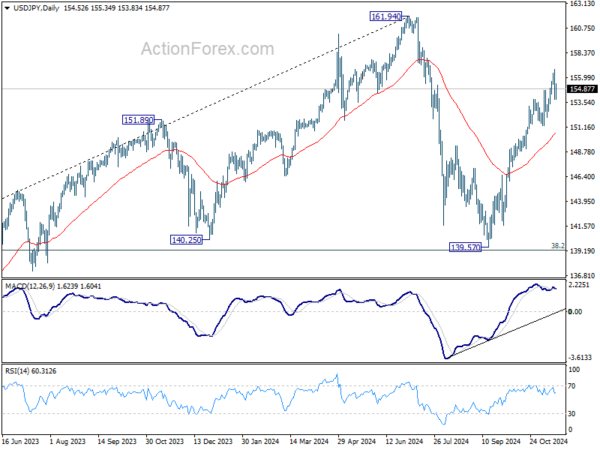

Daily Pivots: (S1) 153.18; (P) 154.97; (R1) 156.07; More…

Intraday bias in USD/JPY remains neutral for the moment. Another rise is in favor as long as 153.87 resistance turned support holds. Break of 156.74 will resume the rally from 139.57 towards 161.91 high. However, firm break of 153.87 and the near term rising channel would confirm short term topping. In this case, intraday bias will turn back to the downside for 151.27 support, or even further to 38.2% retracement of 139.57 to 156.74 at 150.18.

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low). The range of medium term consolidation should be set between 38.2% retracement of 102.58 to 161.94 at 139.26 and 161.94. Nevertheless, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.