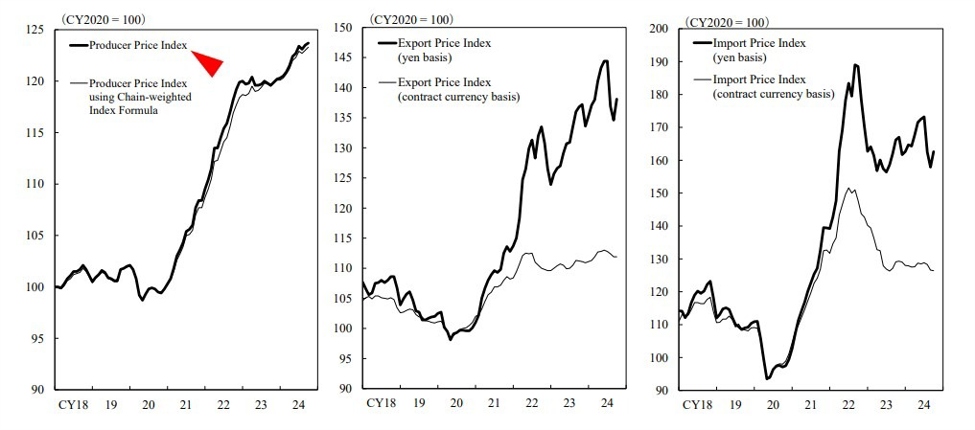

Japanese wholesale prices, the PPI or CGPI:

+0.2% m/m

- expected 0.0%, prior 0.0%

+3.4% y/y

- expected +3.0%, prior +2.8%

The higher results will be a bit of a tailwind for the yen, at the margin. Not too much though, there is the huge monetary policy divergence that is weighing on the hapless yen to contend with.

Of note is that renewed yen falls pushed up import costs for some goods

The Bank of Japan is wary of yen weakness pushing up prices, the Bank wants inflation but not like that. The Bank wants inflation coming from wage growth pushing up demand. The Bank has said it’ll consider raising rates to help slow or stop the yen decline. But political pressure is on the Bank not to hike until wages are seen rising at the next round of wage negotiations in (Japan’s) spring.

—

The Producer Price Index (PPI) in Japan is also known as the Corporate Goods Price Index (CGPI)

- its a measure of the average change over time in the selling prices received by domestic producers for their output

- is calculated by the Bank of Japan

Unlike the Consumer Price Index (CPI), which measures the price change that consumers see for a basket of goods and services, the CGPI focuses on the change in the prices of goods sold by companies.

The PPI reflects some of cost pressures faced by producers

- its based on a basket of goods that represents the range of products produced within the Japanese economy, including items such as:

- raw materials like metals and chemicals

- semi-finished goods

- and finished products

- different weights are assigned to each category within the index based on its contribution to the overall economy.

- it does not account for the quality improvements in goods and services over time, which might lead to overestimation of inflation

- additionally, it reflects only the prices of domestically produced goods, leaving out the impact of imported goods

The PPI can be used as a guide to inflationary pressures in the economy:

- If producers are facing higher costs, they may pass these on to consumers, leading to higher consumer prices.