Is Google Stock a Buy or Sell?

Hello, this is Itai Levitan at ForexLive.com. Today, I’m analyzing whether Google stock (Alphabet Inc.) is a buy or sell, and my take may surprise you. Unlike many who are looking to buy now, I’m approaching this with a lot more patience. In this update, I’ll walk you through my expert strategy based on precise technical analysis, which targets an entry at specific lower prices. Let’s dive in.

The Patient Approach: Wait for the Right Moment

Imagine you’re buying real estate: you wouldn’t rush to buy if prices were high; instead, you’d wait for a 20-25% correction before diving in. That’s precisely the mindset I’m applying to Google stock. While the market currently has Alphabet trading around $181 in the pre-market, my plan focuses on buying during a deeper dip if specific conditions align.

For those currently holding Alphabet shares, I’d be cautious. If the price reaches between $186 and $188.5, I would consider diluting my position or even selling a significant portion. The reward-to-risk ratio in this range may not justify holding. But my main focus here is not on where to sell but on where to buy.

Anchored View of Key Earnings Levels

I’ve anchored my technical analysis to three key earnings dates: October 24, 2022, January 30, 2023, and April 24, 2023. Each of these dates marked points where Google stock consolidated before a strong upward move. These are essential reference points because they show where major buyers entered, likely including institutions and insiders who had a solid long-term outlook. The anchored VWAPs from these dates provide an orientation for where support may lie, but they are not definitive buy triggers. I’m clearing these lines from the chart to avoid confusion.

The Dip Buying Plan

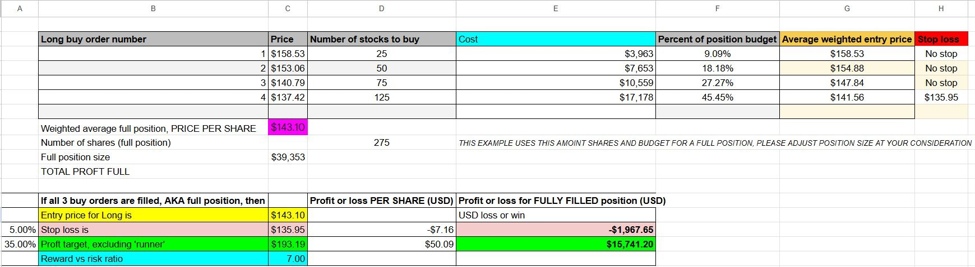

I’ve set up a structured dip-buying plan with four pre-prepared limit orders at specific technical levels. Here’s the breakdown:

- First Buy Order at $158.53 – Initial X amount of shares purchased.

- Second Buy Order at $153.06 – Doubling the initial share quantity (2X).

- Third Buy Order at $140.79 – Tripling the initial amount (3X).

- Fourth Buy Order at $137.42 – Quintuple the original quantity (5X).

By following a Fibonacci-inspired scaling, each buy increases in size, creating a weighted average entry price of $143.10 if all orders are filled. This disciplined approach allows for capturing a better entry price while managing risk effectively.

How to buy Alphabet stock with the Levitan method

Risk Management: Stop Loss and Profit Target

Once the final buy order at $137.42 is filled, I’ll set a 5% stop loss at $135.95. The goal is not just to protect capital but to control potential downside if the market moves against me.

On the profit side, my target is a 35% increase from the average entry price, aiming for $193.10 per share. This setup offers a 7:1 reward-to-risk ratio—an attractive profile for a patient, disciplined trader. If only some of the buy orders are filled, the average entry price will be slightly higher, but this can still yield a strong return.

Flexibility with Profit Taking

Although my final target is $193, flexibility is essential. For instance, if three of the four buy orders are filled and the price begins to rise, I may opt to take partial profits along the way, mitigating risk and locking in gains. This adaptability allows for adjustments based on market conditions and evolving technical signals.

GOOG stock weekly chart and showing where to buy the stock

Why Patience Pays Off

This isn’t about reacting to the latest market move or speculation. It’s about waiting for the right setup and not feeling pressured to jump in too early. I’m not concerned with immediate market trends, potential new all-time highs, or the impact of macro events like the “Trump effect” or other news. This plan is grounded in sound technical analysis, targeting precise entry points and disciplined risk management.

Key Takeaway: If Google stock dips to my target prices, I’m ready to buy. However, if the price doesn’t reach these levels, I may miss out—but that’s part of my strategy. I’d rather miss an opportunity than enter at the wrong price, compromising the risk-reward balance.

Closing Thoughts

Is Google stock a buy or sell? For me, it’s a buy, but only if it meets my conditions. I know targeting an entry at $143.10 may seem extreme, but often, patience and discipline deliver the best results. This method allows for a 5% risk with a potential 35% gain, translating into a high reward-to-risk ratio. Remember to set your orders in advance; you don’t want to chase the market when it hits these levels, as high-frequency algorithms can drive the price up quickly, making it difficult to achieve your planned entry.

Buy or sell Google stock at your own risk. Visit ForexLive.com for more expert insights, and thank you for following along.