Yen jumps broadly in Asian trading today, boosted by heightened government warnings against the recent selloff on the currency. Japanese Finance Minister Katsunobu Kato issued a strong statement addressing the “one-sided and drastic moves” in Yen, confirming that the government is monitoring the situation with the “utmost sense of urgency.” He emphasized Japan’s commitment to take “appropriate actions” to counter what it considers excessive volatility.

Supporting this stance, Japanese Ministry of Finance released quarterly data revealing substantial interventions earlier last quarter. On July 11, Japan spent JPY 3.168T on dollar-selling intervention, followed by an additional JPY 2.367T on July 12. These efforts successfully lifted the Yen from a low of 161.76 to 157.30 within two days, effectively defending the critical 160 psychological level.

Adding a broader regional perspective, South Korea’s Finance Minister, Choi Sang-mok, also announced an expanded 24-hour monitoring framework that will now include financial markets and foreign exchange alongside ongoing concerns related to the Middle East. Minister Choi assured markets that South Korean authorities are prepared to act swiftly if volatility spikes in the currency or financial markets.

The coordinated messages from both Japan and South Korea suggest the possibility of regional intervention should depreciation pressures on Yen and South Korean Won intensify, highlighting a collective commitment to maintaining currency stability in the face of global economic uncertainties.

Overall in the currency markets, Aussie is currently as the strongest performer of the week, followed by Kiwi and Loonie. Aussie is bolstered by robust risk-on sentiment emanating from the US, RBA’s vigilance on inflation, and the notable rebound in copper prices. Conversely, Euro is currently the weakest, followed by Swiss Franc and Dollar. Sterling and Yen are positioned in the middle of the performance spectrum.

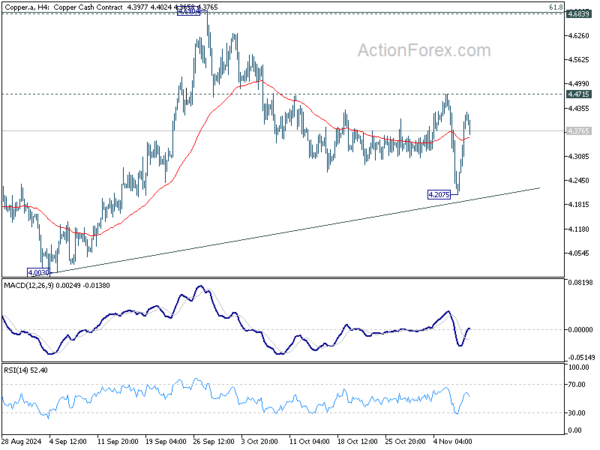

Technically, focus is now back on 4.4715 resistance in Copper after the strong rebound from 4.2075. Firm break there will argue that corrective fall from 4.6904 has completed as a three-wave corrective move. In this case, stronger rise would be seen back to 4.6904. If realized, this would provide extra lift to AUD/USD towards 0.6941 high.

In Asia, at the time of writing, Nikkei is up 0.22%. Hong Kong HSI is down -0.58%. China Shanghai SSE is down -0.33%. Singapore Strait Times is up 1.55%. Japan 10-year JGB yield is down -0.0056 at 1.001. Overnight, DOW fell -0.00%. S&P 500 rose 0.74%. NASDAQ rose 1.51%. 10-year yield fell -0.085 to 4.341.

US 10-yr yield retreats after Fed holds rates steady; Powell highlights fiscal risks

US 10-year Treasury yield eased back notably overnight following Fed’s decision to keep interest rates steady. Chair Jerome Powell’s balanced commentary offered a calm counterpoint to the election-fueled rally in yields seen earlier this week.

During the press conference, Powell downplayed the immediate impact of the election on monetary policy, stating that it “will have no effect on our policy decisions” in the near term. He emphasized that Fed’s current policy stance is “well positioned” to manage risks and uncertainties, and that the central bank can adjust its policy restraints “more slowly” or “more quickly” depending on how economic developments unfold.

Addressing recent inflation data, Powell noted that it “wasn’t terrible,” but was “a little higher than expected.” He highlighted that by December, the FOMC will have additional data to consider, including one more employment report and two more inflation reports. “We’ll make a decision as we get to December,” Powell said.

However, he issued a stark warning about the US fiscal situation, asserting that fiscal policy is “on an unsustainable path.” Powell elaborated: “The federal government’s fiscal path, fiscal policy, is on an unsustainable path. The level of our debt relative to the economy is not unsustainable, the path is unsustainable.” He added, “We see that in a very large deficit, you’re at full employment that’s expected to continue, so it’s important that be dealt with. It is ultimately a threat to the economy.”

More on FOMC:

Technically, 10-year yield has encountered notable resistance from medium term falling trend line and 61.8% retracement of 4.997 to 3.603 at 4.464. Some consolidations would be seen first, but such consolidations should be relatively brief as long as 4.223 support holds. Rise from 3.603 is expected to resume sooner rather than later. Sustained trading above 4.464 will pave the way to retest 4.997 high. Nevertheless, break of 4.223 will argue that deeper correction is underway back to 55 D EMA (now at 4.075).

Looking ahead

France trade balance, Swiss SECO consumer climate will be featured in European session. Later in the day, Canada employment and US U of Michigan consumer sentiment will be released.

EUR/JPY Daily Outlook

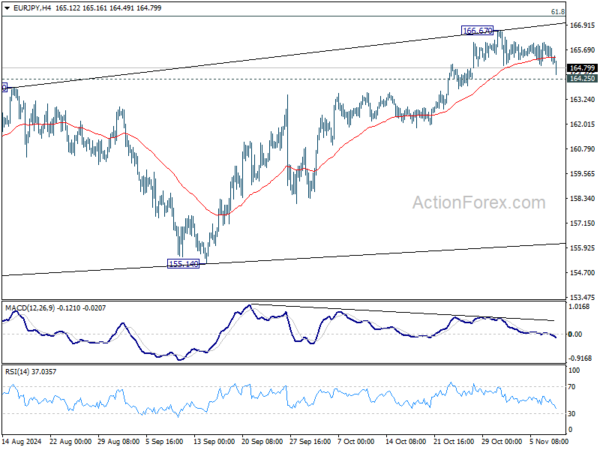

Daily Pivots: (S1) 164.80; (P) 165.39; (R1) 165.79; More….

EUR/JPY’s retreat from 166.67 extends lower today but stays above 164.25 minor support. Intraday bias remains neutral for the moment, and further rally is in favor. On the upside, Sustained break of 61.8% retracement of 175.41 to 154.40 at 167.38 will pave the way to retest 175.41 high. However, considering bearish divergence condition in 4H MACD, firm break of 164.25 will indicate short term topping, and turn bias to the downside for 55 D EMA (now at 163.36).

In the bigger picture, price actions from 175.41 are seen as correction to rally from 114.42 (2020 low). The range of consolidation should have been set between 38.2% retracement of 114.42 to 175.41 at 152.11 and 175.41 high. However, decisive break of 152.11 would argue that deeper correction is underway.