Dollar continued to weaken in early US session, erasing the strong gains it enjoyed following Donald Trump’s election victory. The greenback has turned negative for the week against several major currencies, suggesting that the initial post-election optimism has waned. Investors are now shifting their attention to Fed’s upcoming rate decision for guidance on Dollar’s next move. However, the pressing issue of Fed’s monetary policy path for next year—beyond today’s expected 25bps cut and another anticipated in December—is unlikely to be resolved immediately. Market participants may have to wait until the FOMC releases new economic projections in December to gain a clearer understanding of the central bank’s plans.

Meanwhile, British Pound holds steady after BoE’s widely anticipated 25bps rate cut to 4.75%. The accompanying statement indicates that BoE will proceed with a measured, gradual approach to policy easing moving forward. However, Governor Andrew Bailey noted during the press conference that the pace of rate cuts could accelerate if inflation continues to decline more rapidly than expected.

In the currency markets, Aussie is currently the strongest performer of the week, followed by Kiwi and Loonie, reflecting a typical risk-on environment where investors favor higher-yielding assets. On the other end of the spectrum, Swiss Franc is the weakest currency, with Euro and Yen also underperforming. Dollar and Pound are positioned in the middle of the pack.

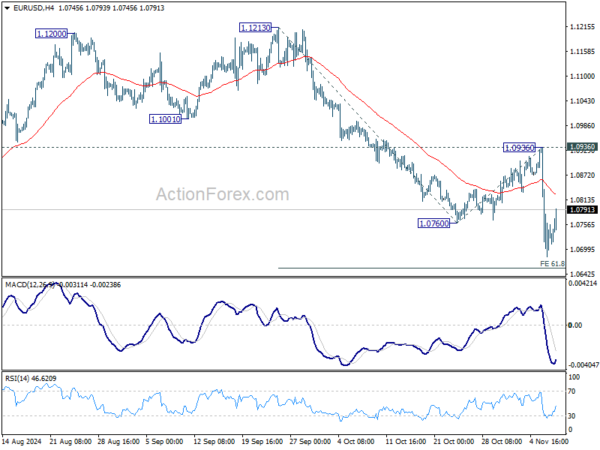

Technically, as Dollar’s pullback persists, key levels are coming into focus including 1.0936 resistance in EUR/USD, 1.3057 resistance in GBP/USD, 0.8614 support in USD/CHF and 151.27 support in USD/JPY. As long as these levels hold, Dollar’s near term rally would remain intact for resumption at a later stage.

In Europe, at the time of writing, FTSE is down -0.05%. DAX is up 1.44%. CAC is up 0.51%. UK 10-year yield is down -0.0185 at 4.545. Germany 10-year yield is up 0.040 at 2.448. Earlier in Asia, Nikkei fell -0.25%. Hong Kong HSI rose 2.02%. China Shanghai SSE rose 2.57%. Singapore Strait Times rose 1.96%. Japan 10-year JGB yield rose 0.0258 to 1.007.

US initial jobless claims rises to 221k vs exp 220k

US initial jobless claims rose 3k to 221k in the week ending November 2, slightly above expectation of 220k. Four-week moving average of continuing claims fell -10k to 227k.

Continuing claims rose 39k to 1892k in the week ending October 26, highest since November 13, 2021. Four-week moving average of continuing claims rose 8.5k to 1876k, highest since November 27, 2021.

BoE cuts 25bps, emphasizes gradual easing amid upgraded inflation projections

BoE reduced the Bank Rate by 25bps to 4.75%, in line with expectations. The Monetary Policy Committee made the decision by an 8-1 vote, with Catherine Mann dissenting, preferring to keep rates steady. In its statement, BoE highlighted that a “gradual approach” to reducing policy restraint remains “appropriate,” stressing that restrictive monetary policy will need to persist “for sufficiently long” until risks to sustainable 2% inflation are more fully mitigated.

BoE’s revised economic projections reflect a significant adjustment in inflation expectations. The forecast for CPI in Q4 2025 was raised from 2.2% to 2.7%, while the Q4 2026 estimate increased from 1.6% to 2.2%. Longer-term, inflation is expected to ease to 1.8% by Q4 2027, suggesting a slower return to the target rate.

GDP growth estimates were also adjusted, with the Q4 2025 growth forecast increased from 0.9% to 1.7%, though growth for Q4 2026 was revised down to 1.1%, followed by a modest recovery to 1.4% in Q4 2027.

BoE also provided an initial assessment of the government’s Autumn Budget 2024, forecasting that the fiscal measures could boost GDP by approximately 0.75% at their peak, compared to the August projections.

The budget’s influence on CPI inflation is anticipated to peak at just under 0.5%, due to both the narrowing excess supply margin and direct inflationary impacts from the budget measures.

Eurozone retail sales rises 0.5% mom, mixed sectoral performance

Eurozone retail sales rose by 0.5% mom in September, slightly above the expected 0.4% mom increase. Breaking down the numbers, the volume of retail trade showed a mixed sectoral performance. Sales for non-food products, excluding automotive fuel, saw a notable rise of 1.1% mom, while sales for food, drinks, and tobacco slipped by -0.4% mom. Automotive fuel sales in specialized stores edged up by 0.2% mom.

Across the broader EU, retail sales rose by 0.3% mom. Among member states with available data, Belgium, Denmark, and Croatia recorded the highest increases, each posting a robust 2.1% mom rise in retail trade volume. Germany followed with a 1.2% mom gain. In contrast, Slovenia experienced the sharpest drop at -2.6% mom, followed by Poland at -2.0% mom and Finland at -1.6% mom.

Japan’s real wages dip again in Sep, despite continued nominal wage growth

Japan’s real wages declined by -0.1% yoy in September, marking a second consecutive monthly drop as inflation erodes purchasing power. This dip follows a record 26-month downturn that ended in May, with wages briefly turning positive in June and July. However, the fading impact of summer bonuses led to another decline in August.

Nominal wages, reflecting total monthly earnings including base and overtime pay, rose by 2.8% yoy in September, marking the 33rd consecutive month of growth, but missed expectation of 3.0% yoy. When excluding bonuses and unscheduled payments, average wages grew by 2.6% yoy, the highest increase in nearly 32 years. Despite this, overtime pay and allowances declined by -0.4% yoy.

Separately, a Nikkei Research poll indicates optimism among companies for wage increases in the upcoming fiscal year. Approximately 42% of surveyed firms plan to raise wages by 3% to 5% for the fiscal year starting in April 2025, while 9% consider a larger increase of 5% to 7%. However, a significant portion (41%) of companies anticipate more conservative hikes in the range of 1% to 3%, suggesting that while wage pressures may continue, the scope and impact could vary widely across sectors.

RBA’s Bullock: Waiting for clear signals before assessing Trump’s win

At a Senate session today, RBA Governor Michele Bullock indicated that the central bank has not yet conducted detailed scenario analyses on how Donald Trump’s US presidential victory might impact Australia’s monetary policy.

Bullock emphasized that the effects could go different directions. She pointed out that while a Trump presidency might be “inflationary in some ways,” particularly if it leads to increased global demand or fiscal stimulus, it could also be “deflationary” if China, a key trading partner for Australia, is negatively affected.

Bullock stressed the importance of basing policy decisions on concrete developments rather than speculation. “We cannot be setting policy on the basis of things that could happen or might not happen,” she remarked. She added that the central bank intends to “wait and see what actually does happen” before making any adjustments.

As it stands, RBA has not revised its inflation outlook. Bullock reiterated that inflation is expected to return to the target band of 2-3% sustainably by 2026.

AUD/USD Mid-Day Report

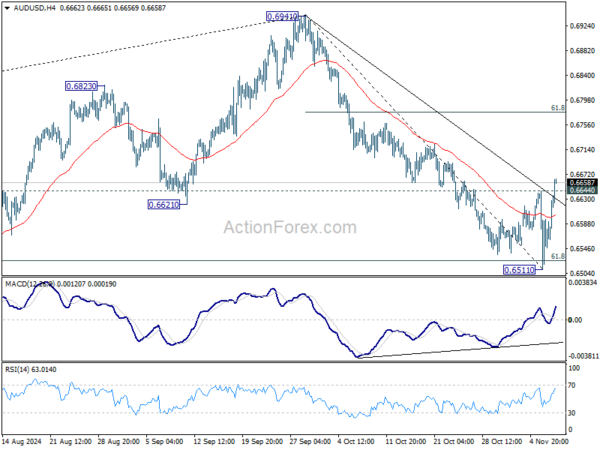

Daily Pivots: (S1) 0.6508; (P) 0.6577; (R1) 0.6640; More...

AUD/USD’s break of 0.6644 resistance indicates short term bottoming at 0.6511, on bullish convergence condition in 4H MACD, after drawing support from 61.8% retracement of 0.6269 to 0.6941 at 0.6526. Intraday bias is back on the upside for 55 D EMA (now at 0.6682). Sustained break there will bring stronger rebound back 61.8% retracement of 0.6941 to 0.6511 at 0.6777.

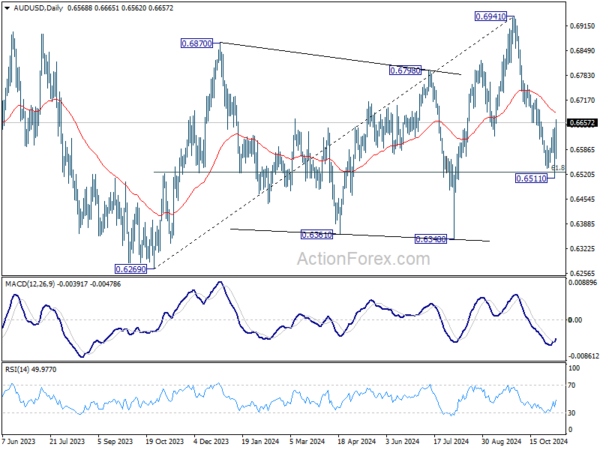

In the bigger picture, rise from 0.6269 (2023 low) should have completed with three waves up to 0.6941. Corrective pattern from 0.6169 (2022 low) is now extending with another falling leg. Deeper decline would be seen back to 0.6269 as sideway trading extends.