Sterling weakened broadly in a subdued trading today, with no significant data releases to drive market activity. Investors are awaiting BoE Governor Andrew Bailey’s upcoming speech, where he might reaffirm a dovish tone. Earlier this month, in an interview with The Guardian, Bailey hinted at the possibility of becoming “a bit more activist” and cutting interest rates more aggressively if inflationary pressures continue to ease. The lower-than-expected UK CPI reading in September has lent weight to his stance. However, hawkish members within the BoE may push back on aggressive cuts if this week’s PMI data show persistent strength in the economy.

In the broader forex market, Dollar continues to lead as the strongest performer this week so far, buoyed by the surge in US Treasury yields. Swiss Franc follows behind, while Canadian Dollar is awaiting tomorrow’s BoC rate cut decision. Meanwhile, Japanese Yen remains the weakest currency, although selling pressure has not gained significant momentum. Sterling is the second weakest, ahead of Euro. Australian and New Zealand Dollars are trading in the middle.

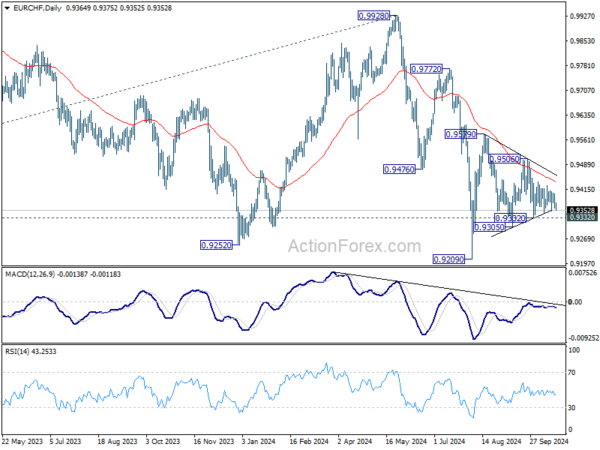

Technically, if Sterling’s decline deepens, attention will also turn to whether Euro follows suit. Specifically, EUR/CHF is a pair to watch. Break of 0.9332 support would extend the fall from 0.9506 towards 0.9305. Given the prior rejection by the 55 D EMA, EUR/CHF could also be on track for a retest of the 0.9209 low or even resumption of its long-term downtrend. Much of this could hinge on Thursday’s Eurozone PMI data.

In Europe, at the time of writing, FTSE is down -053%. DAX is down -0.28%. CAC is down -0.42%. UK 10-year yield is down -0.0143 at 4.130. Germany 10-year yield is up 0.017 at 2.307. Earlier in Asia, Nikkei fell -1.39%. Hong Kong HSI rose 0.10%. China Shanghai SSE rose 0.54%. Singapore Strait Times fell -0.75%. Japan 10-year JGB yield rose 0.0181 to 0.980.

New Zealand’s exports rise 5.2% yoy in Sep, imports fall -0.9% yoy

New Zealand’s trade balance in September 2024 showed a deficit of NZD -2.1B. Goods exports rose by NZD 246m, or 5.2% yoy, reaching NZD 5.0B. Meanwhile, goods imports fell by NZD -67m, or -0.9% yoy, to NZD 7.1B.

Export data showed mixed performance across key trading partners. Exports to China dropped significantly by NZD -109m (-8.8%), and Japan saw a decline of NZD -22m (-8.2%). Exports to Australia also fell NZD -7m or -0.9%. However, exports to the EUR surged by NZD 183m (67%), while exports to the US also increased by NZD 11m (1.9%).

On the import side, the decline was driven by a significant drop in imports from China, down by NZD -158m (-9.8%). Imports from the US surged, rising NZD 330m (51%), while imports from Australia and the EU saw marginal gains of 0.9% and 1.1% respectively. South Korea’s imports fell by NZD -45m (7.3%).

GBP/USD Mid-Day Outlook

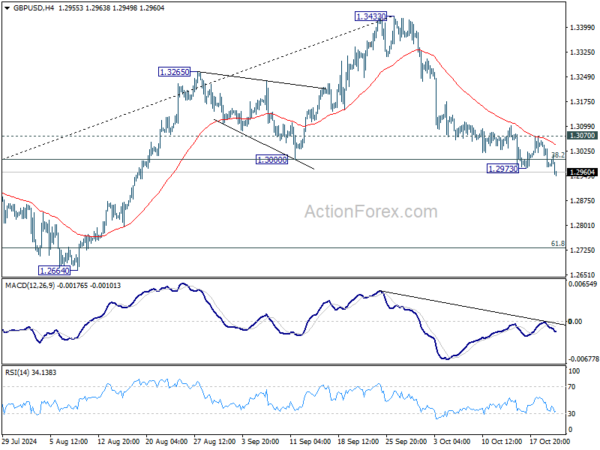

Daily Pivots: (S1) 1.2955; (P) 1.3007; (R1) 1.3036; More…

GBP/USD’s fall 1.3433 resumed by breaking 1.2973 temporary low and intraday bias is back on the downside. Sustained trading below 1.3000 cluster support (38.2% retracement of 1.2298 to 1.3433 at 1.2999) will argue that whole rise from 1.2298 has completed and bring deeper fall to 61.8% retracement at 1.2732. On the upside, break of 1.3070 minor resistance will turn bias back to the upside for stronger rebound.

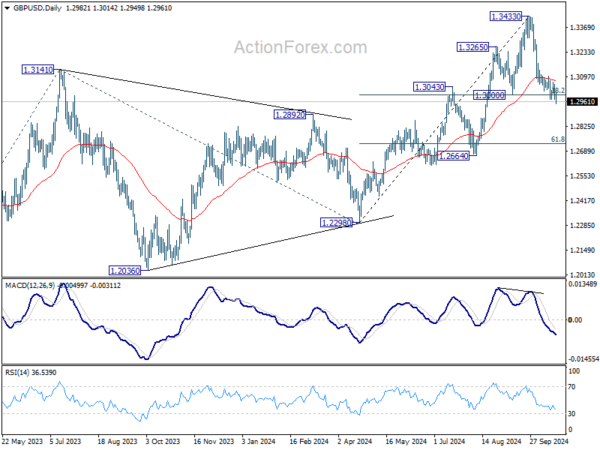

In the bigger picture, considering mildly bearish divergence condition in D MACD, decisive break of 1.3000 support will suggest that a medium term top is already formed at 1.3433. Price actions from there would be tentatively seen as correcting the up trend from 1.0351 (2022 low). In this case, deeper fall would be seen to 1.2298 structural support, strong support should be seen there to bring rebound.