Australian Dollar saw a modest rebound in the Asian session today, buoyed by much stronger-than-expected employment data. The Australian labor market continues to display resilience, with full-time jobs rising sharply, pushing the total over 10 million for the first time, while unemployment rate held steady at 4.1%. This robust labor market data has dashed any hopes for a near-term RBA rate cut. While some had hoped that rate reductions could come sooner, today’s data suggests that the first policy shift will still likely be deferred until February next year, depending upon Q3 CPI figures due on October 30.

Despite this positive surprise, momentum for Aussie remains relatively weak. The underwhelming press conference from China’s Ministry of Housing, PBoC, and National Financial Regulatory Administration left markets disappointed. While China pledged to expand its “whitelist” of real estate projects and increase bank lending to unfinished developments by CNY 4T, analysts largely viewed these moves as “fine-tuning” of existing policies rather than the substantial stimulus package that markets had hoped for. This led to only a modest rebound in Chinese and Hong Kong stock markets.

In the broader currency markets, Canadian Dollar leads the way this week, though largely as a correction of recent losses. Dollar continues its upward march, while Yen remains resilient. Yen could avoid further sharp declines for now, unless traders push it through 150 psychological level against the greenback. At the other end of the spectrum, Swiss Franc is the weakest currency this week, followed by Aussie and New Zealand Dollar. Sterling is faring relatively better after yesterday’s selloff, while Euro is hovering in the middle as traders await today’s anticipated ECB rate cut.

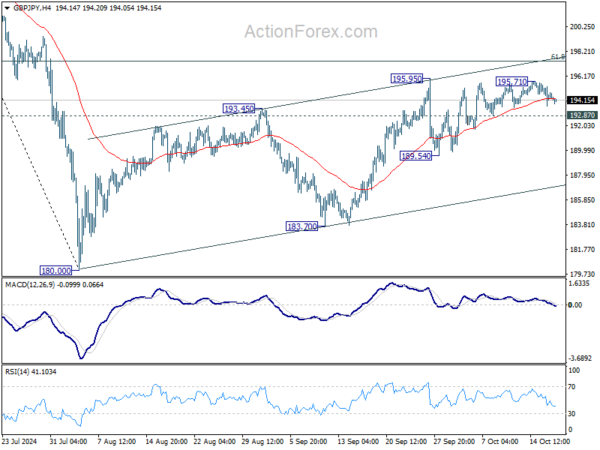

Technically, as GBP/JPY dips further today, focus is now on 192.87 minor support. Break there will firstly open up deeply decline to 189.54 support first. Decisive break there will rise the chance that whole corrective rise from 180.00 has completed, and turn near term outlook bearish for 180.00/183.70 support zone.

In Asia, at the time of writing, Nikkei is down -0.47%. Hong Kong HSI is up 0.83%. China Shanghai SSE is up 0.26%. Singapore Strait Times is up 0.93%. 10-year JGB yield is up 0.0091 at 0.964 . Overnight, DOW rose 0.79%. S&P 500 rose 0.47%. NASDAQ rose 0.28%. 10-year yield fell -0.022 to 4.016.

ECB gears up for first back-to-back rate cut in 13 yrs

ECB is widely expected to cut the deposit rate by 25bps to 3.25% today, marking the first back-to-back rate reduction in 13 years. This step reflects ECB’s growing urgency to accelerate monetary easing as inflation cools faster than anticipated and persistent manufacturing struggles spill over into services and employment.

Although December had initially been considered the optimal time for the next cut, recent economic data has heightened concerns among ECB officials. Nevertheless, the December meeting remains significant, with updated economic projections that will shape the policy direction in 2025.

While the market is almost fully pricing in three further cuts through March 2025, ECB President Christine Lagarde is unlikely to offer explicit guidance today. However, the underlying message will likely suggest that another cut in December is likely unless the economic outlook improves.

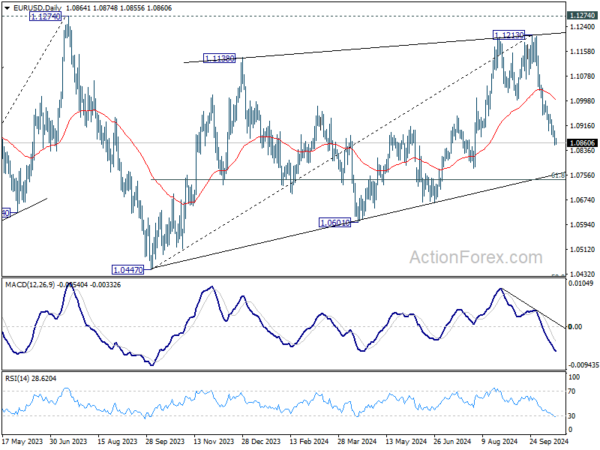

Technically, EUR/USD’s fall from 1.1213 short term top is in progress. Near term outlook will stay bearish as long as 55 D EMA (now at 1.0999) holds. This decline is seen as the third leg of the corrective pattern from 1.1274 (2023 high). Next target is 61.8% retracement of 1.0447 to 1.1213 at 1.0740. Any further dovish tone from the ECB today could accelerate this downward movement.

Australia’s employment grows 64.1k in Sep, unemployment rate unchanged at 4.1%

Australia’s employment figures for September showed stronger-than-expected growth, with 64.1k jobs added, significantly exceeding forecast of 25.2k. Full-time employment led the gains, rising by 51.6k, while part-time jobs increased by 12.5k.

Unemployment rate remained steady at 4.1%, slightly better than the expected 4.2%. Participation also increased by 0.1% to 67.2%, indicating higher workforce engagement. Monthly hours worked saw a modest rise of 0.3% mom.

Over the past year, employment has grown by 3.1%, outpacing the civilian population growth of 2.5%. This pushed the employment-to-population ratio to a historical high of 64.4%, reflecting robust labor market conditions.

Australia’s NAB business confidence drops to -6 in Q3, inflation pressures ease slightly as margins squeezed

Australia’s NAB quarterly Business Confidence declined from -2 to -6 in Q3. Business conditions also dropped from 5 to 2, with trade conditions falling from 9 to 5, profitability slipping from 2 to 0, and employment conditions down from 5 to 3, signaling softer economic momentum.

Leading indicators weakened, with expected business conditions for the next 3 months falling from 11 to 10, and for the next 12 months from 15 to 12. Forward orders remained negative at -4, and capacity utilization eased from 83.6% to 83.0%. Capital expenditure plans also declined from 24 to 19, indicating reduced investment expectations.

Cost pressures remained persistent. Labor costs grew 1.2%, up from 1.1%, and purchase costs increased to 1.0%, up from 0.9%. Final product price growth, however, slowed from 0.6% to 0.4%, and retail price growth remained steady at 0.7%, suggesting inflationary pressures are easing but at the expense of business margins.

NAB Head of Australian Economics Gareth Spence noted, “Labor cost growth remains elevated, and wage costs are the top issue affecting business confidence. While purchase cost growth persists, the marked drop in final product price growth suggests progress on inflation, though margins are under pressure.”

Japan’s exports fall -1.7% yoy in Sep, first decline in 10 months

Japan’s exports in September dropped by -1.7% yoy to JPY 9.038T, marking the first annual decline in 10 months. This slump was driven by weaker demand from key trading partners. Exports to China, Japan’s largest market, fell by -7.3% yoy, while those to the US dropped by -2.4% yoy.

On the other hand, imports rose modestly by 2.1% yoy to JPY 9.333T, leading to a trade deficit of JPY -294B, the third consecutive monthly shortfall.

In seasonally adjusted terms, there was a small improvement. Exports grew by 2.0% mom to JPY 8.956T, while imports fell by -1.2% mom to JPY 9.144T. This led to a seasonally adjusted trade deficit of JPY -187B.

Looking ahead

ECB rate decision is the main event in European session. At the same time, Swiss trade balance, Eurozone trade balance and CPI final will also be released.

Later in the day, a batch of US data will be released including jobless claims, retail sales, Philly Fed survey, industrial production, business inventories and NAHB housing index.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6646; (P) 0.6678; (R1) 0.6699; More...

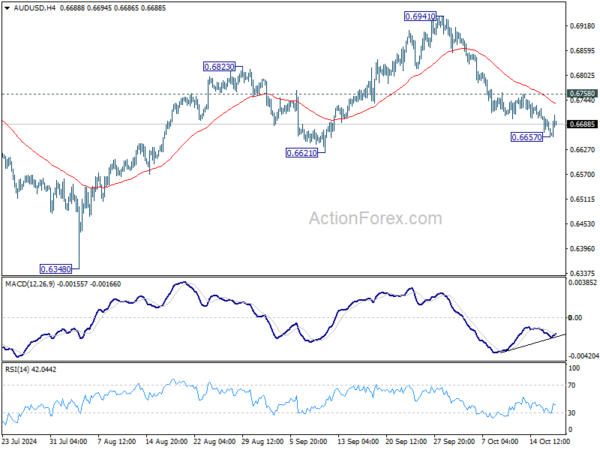

Intraday bias in AUD/USD is turned neutral with current recovery, but further decline is expected as long as 0.6758 resistance holds. Below 0.6657 will resume the fall from 0.6941 short term top to 0.6621 structural support. Decisive break there will pave the way back to 0.6348 support next. Nevertheless, considering bullish convergence condition in 4H MACD, firm break of 0.6758 will turn bias back to the upside for retesting 0.6941 instead.

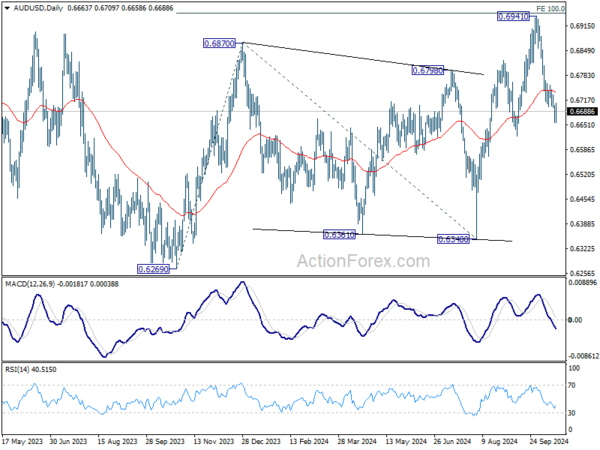

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern, with rise from 0.6269 as the third leg. Firm break of 100% projection of 0.6269 to 0.6870 from 0.6340 at 0.6941 will target 138.2% projection at 0.7179. However, break of 0.6621 support will argue that rise from 0.6269 has completed and bring deeper fall back to 0.6269/6348 support zone.