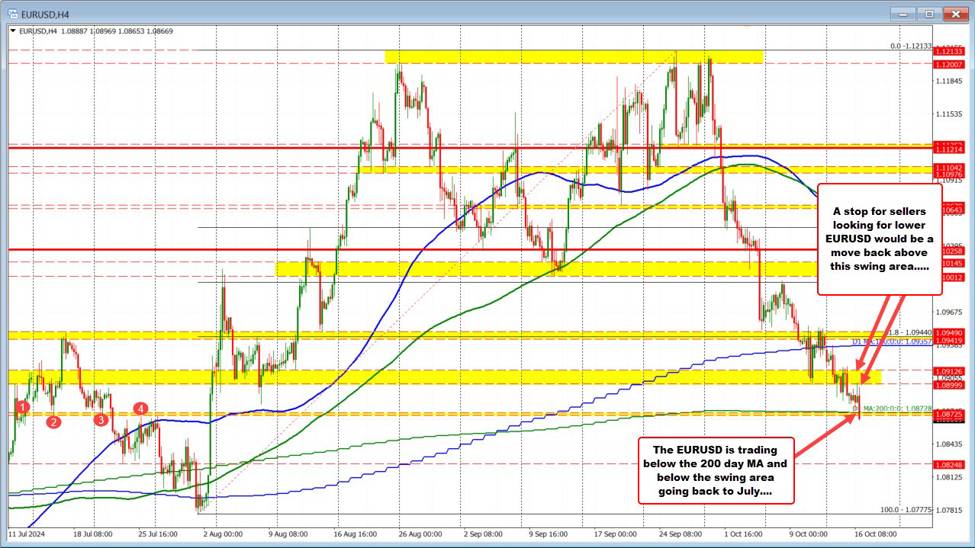

The ECB meets tomorrow with expectations of a 25 basis point cut. Going into that decision, the EURUSD is moving to its lowest level since August 2. In addition, technically the price just broke below its 200-day moving average at 1.08728. The current price trades at 1.08660.

Sellers are making a play below that 200-day moving average for the first time since August 2.

Of course, the risk exists through the ECB rate decision. Will there be a bounce-back rally after the fact? Or will sellers continue to put the pressure on and have traders looking toward the lows from the end of July/early August at 1.08248 and 1.07775 respectively?

A more conservative stop level now would be the swing area above between 1.0899 and 1.09125. The bounce-back corrective high after the initial low today did stall against the low of that area (and the natural resistance at 1.0900).

Fundamentally, Goldman is cautious (Adam posted earlier):

Key Points:

-

Limited ECB Guidance:

The ECB is expected to maintain its cautious approach and not move towards more explicit forward guidance at this week’s meeting, despite the anticipated 25 basis point rate cut. -

High Bar for Depreciation:

A one-at-a-time cutting cycle means that policymakers may require convincing data to support each subsequent cut, raising the threshold for EUR depreciation. This dynamic contributes to the euro’s relative resilience this year, even amid more downbeat economic data. -

Potential for Proactive Stance:

If the ECB were to adopt a more proactive stance and diverge from the Federal Reserve’s policy, it could create powerful conditions for EUR/USD to weaken. However, such a shift seems unlikely in the immediate future. -

Trade Recommendations:

While Goldman Sachs sees downside risks for the euro and continues to recommend trading it on the funding side, they caution that simply moving faster is insufficient to guarantee significant EUR/USD depreciation.

So if you are a buyer, I would wait for a rotation back above the 200 day moving average. Right now, with the break of the 200 day moving average there is no technical incentive to buy.