Asian financial markets are displaying significant divergence today. Japan’s Nikkei index has plummeted over -4%, reacting sharply to the ruling Liberal Democratic Party’s election results from last Friday. Shigeru Ishiba, the newly elected LDP leader and Japan’s incoming Prime Minister, attempted to soften his previously hawkish stance on the BoJ monetary policy during a interview on Sunday. Despite these efforts, investors remain concerned about the impact of further monetary tightening on the appreciation of Japanese Yen, and the subsequent effects on the nation’s export-driven economy.

In stark contrast, stock markets in Hong Kong and mainland China are continuing their robust rally, bolstered by stimulus measures implemented last week. The market has largely ignored the disappointing PMI data released from China today. However, there is growing pressure for additional fiscal policies to supplement monetary efforts. Proposals include expanding the government’s balance sheet to stimulate consumer spending and enhance social welfare programs. China’s economy still faces challenges from subdued domestic demand and an increasingly adverse global trade environment.

Turning to the currency markets, Kiwi and Aussie are leading gains as the new week begins. Kiwi is particularly strong, underpinned by exceptionally positive business confidence data. Sterling is also performing well, ranking as the third strongest currency today so far. On the other end of the spectrum, Yen is the weakest performer, although this appears to be just consolidation following last week’s gains, with prospects for further strengthening ahead. Swiss Franc and the Dollar are also showing weakness, while Euro and Loonie are trading in the middle.

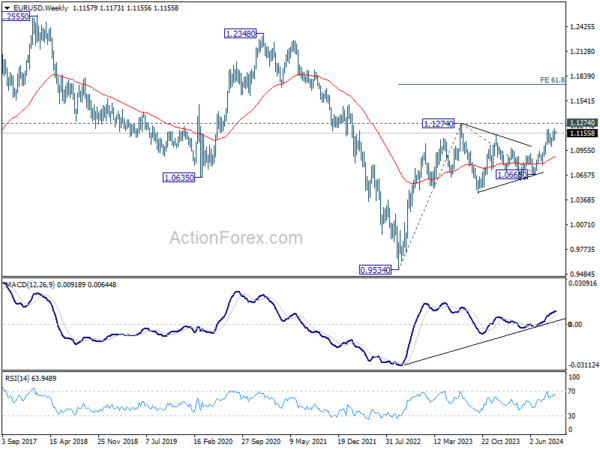

Looking ahead, EUR/USD will be the main focus this week, with Eurozone inflation data and US non-farm payrolls being critical in shaping the next policy decisions from ECB and Fed.

Technically, EUR/USD is so far struggling to build upside momentum to push through 1.1274 resistance (2023 high). However, strong break of this level will confirm resumption of the whole up trend from 0.9534 (2022 low). That would set the stage for further rally towards 61.8% projection of 0.9534 to 1.1274 from 1.0665 at 1.1740 in Q4 by the end of the year.

In Asia, at the time of writing, Nikkei is down -4.56%. Hong Kong HSI is up 3.01%. China Shanghai SSE is up 5.70%. Singapore Strait Times is up 0.20%. Japan 10-year JGB yield is up 0.0551 at 0.862.

Japan’s industrial output drops -3.3% mom in Aug, set for recovery in coming months

Japan’s industrial production took a sharp hit in August, contracting by -3.3% mom, a significant miss compared to market expectations of -0.5% mom decline.

The seasonally adjusted production index for factories and mines stood at 99.7, based on the 2020 benchmark of 100. Among the 15 industrial sectors surveyed, 12 experienced a decrease in output, with motor vehicles leading the decline at -10.6% mom. This drop was largely attributed to operational disruptions at more than a dozen Toyota Motor Corp. plants, caused by Typhoon Shanshan.

Despite this steep decline, Japan’s Ministry of Economy, Trade, and Industry maintained its assessment that industrial production remains “indecisive.” Manufacturers polled by the ministry are forecasting a rebound, with output expected to grow by 2.0% mom in September and further rise by 6.1% mom in October.

On a brighter note, Japanese retail sales increased by 2.8% year-on-year yoy in August, surpassing median forecast of 2.6% yoy . Compared to the previous month, retail sales posted 0.8% mom increase, following 0.2% mom rise in July, indicating steady consumer demand.

China’s PMI data points to continued manufacturing contraction and weakening services sector

China’s economic data for September painted a mixed picture, with manufacturing remaining in contraction and services sector losing steam.

Official NBS Manufacturing PMI edged up slightly from 49.1 in August to 49.7, above expectations of 49.5 but still below the 50-mark, signaling contraction for the fifth consecutive month. Export orders continued to weaken, with the new manufacturing export order subindex dropping from 48.7 to 47.5.

Meanwhile, NBS Non-Manufacturing PMI fell from 50.3 to 50.0, marking the end of 20 straight months of expansion. Within the non-manufacturing sectors, construction showed a marginal improvement, with its subindex rising to 50.7, but services dipped into contraction territory, falling from 50.2 to 49.9.

NBS PMI Composite rose modestly from 50.1 to 50.4. According to the NBS, extreme weather events like typhoons and the conclusion of the summer travel season significantly impacted transport, culture, and entertainment sectors.

Caixin Manufacturing PMI told a similar story, dropping from 50.4 to 49.3, the lowest reading since July 2023, while Caixin Services PMI also underperformed, falling from 51.6 to 50.3, a 12-month low. Caixin’s Composite PMI slipped from 51.2 to 50.3, reflecting broad weakness in both manufacturing and services.

Wang Zhe, senior economist at Caixin Insight Group, noted, “market conditions in the manufacturing sector worsened in September, marked by a limited expansion in supply and a significant contraction in demand.” Business confidence also fell to its “lowest level in recent years”.

NZ ANZ business confidence soars to 60.9, raising concerns of overreaction to RBNZ rate cuts

New Zealand’s ANZ Business Confidence Index saw a significant rise in September, jumping from 50.6 to 60.9, reflecting growing optimism in the business sector.

Key components of the survey also painted a positive picture. The own activity outlook rose from 37.1 to 45.3, while profit expectations surged from 8.0 to 22.2, suggesting a more upbeat economic environment.

Although cost expectations fell slightly from 68.3 to 66.8, wage expectations edged up from 75.1 to 76.4. Pricing intentions also increased from 41.0 to 42.8, while inflation expectations remained unchanged at 2.92%, marking the second consecutive month below 3%.

ANZ highlighted that this survey underscores ” the risk that the economy’s response to lower interest rates could be more vigorous than is generally expected.”

Inflation remains a concern. Firms are planning to raise prices by an average of 1.6% over the next three months, a notable increase from the June low of 1.2%. While wage growth has moderated from 4% in April to 3% now, and cost expectations have eased to 2.4%, inflationary pressures still require careful monitoring by RBNZ to ensure price stability.

US NFP and Eurozone CPI to Steer Fed and ECB’s Upcoming Decisions

The upcoming week features a series of critical economic data releases are poised to shape monetary policy decisions by some major central banks.

In the US, the primary question is whether Fed will proceed with a consecutive 50 bps rate cut on November 1. Currently, fed fund futures reflect a 53.3% probability of such a move, indicating that the market is evenly split on the outcome.

Fed have clearly indicated that as disinflation efforts are progressing satisfactorily, there is a growing need to focus more on the labor market, another half of the dual-mandate. Consequently, the forthcoming September non-farm payroll report, due this Friday, will be of paramount importance. Among the labor statistics, headline job growth and the unemployment rate are expected to be the most influential factors in Fed’s decision-making process. Wage growth, although still relevant, may receive slightly less emphasis given the current context.

In addition to employment data, ISM will release its manufacturing and services indexes, and they will be closely watched. Any unexpected deterioration in the services sector could dampen the current bullish sentiment in equity markets and rekindle fears of recession.

In the Eurozone, market sentiment has shifted sharply in favor of a 25bps rate cut by the ECB on October 17, with probability estimates soaring from 25% to 75% after dismal PMI readings. ECB officials have noted the lack of fresh economic data, but the anticipated release of both headline and core CPI for September may offer new insights that could sway the decision.

In Japan, the new LDP leader Shigeru Ishiba appeared to temper his support for an imminent BoJ rate hike. Over the weekend, he reiterated that monetary easing should continue, citing ongoing concerns over deflation. This could leave markets looking toward BoJ’s summary of opinions and the Tankan survey for further guidance. BoJ remains divided on the timing of future rate hikes, and this division may persist in the coming weeks.

This position of Ishiba suggests that the markets may need to recalibrate their expectations regarding BoJ policy moves. Focuses would be back on BoJ’s forthcoming summary of opinions and the Tankan survey for guidance.

Elsewhere, Swiss CPI could reinforce that SNB is on course for another rate cut in December.

Here are some highlights for the week:

- Monday: Japan industrial production, retail sales, housing starts; New Zealand ANZ business confidence; Germany import prices, CPI flash; UK Q2 GDP final, current account, M4 monthly supply, mortgage approvals; Swiss KOF economic barometer; US Chicago PMI.

- Tuesday: New Zealand building permits; Japan unemployment rate, Tankan survey, PMI manufacturing final, BoJ summary of opinions; Australia retail sales, building approvals; Swiss retail sales, PMI manufacturing; Eurozone PMI manufacturing final, CPI flash; UK PMI manufacturing final; Canada PMI manufacturing; US ISM manufacturing, construction spending.

- Wednesday: Japan monetary base, consumer confidence; Eurozone unemployment rate; US ADP employment.

- Thursday: Australia goods trade balance; Swiss CPI; Eurozone PMI services final, PPI; UK PMI services final; US jobless claims, ISM services, factory orders.

- Friday: Swiss unemployment rate; France industrial production; UK PMI construction; US non-farm payrolls; Canada Ivey PMI.

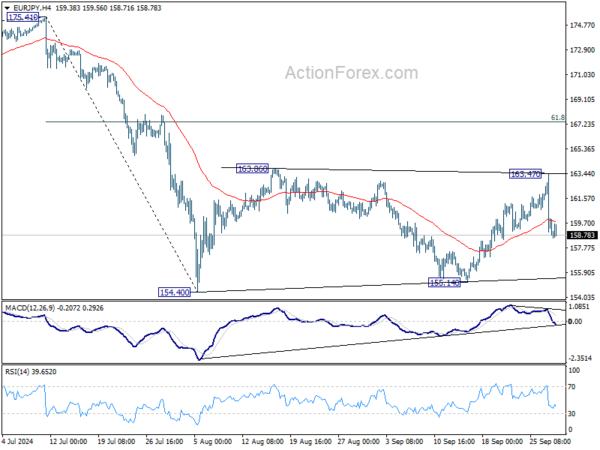

EUR/JPY Daily Outlook

Daily Pivots: (S1) 157.07; (P) 160.28; (R1) 161.99; More….

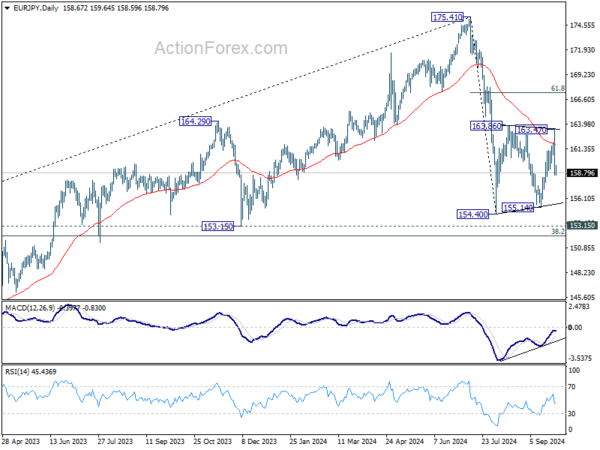

Intraday bias in EUR/JPY stays on the downside for the moment. Current development suggest that corrective pattern from 154.40 might have completed with three waves to 163.47 already. Deeper decline would be seen o retest 154.40/155.14 support zone. For now, risk will stay mildly on the downside as long as 163.47 resistance holds, in case of recovery.

In the bigger picture, price actions from 175.41 are seen as correction to rally from 114.42 (2020 low). The range of consolidation should have been set between 38.2% retracement of 114.42 to 175.41 at 152.11 and 175.41 high. However, decisive break of 152.11 would argue that deeper correction is underway.