Unexpected developments from Asia significantly influenced global financial markets last week. China’s surprise stimulus measures invigorated investor sentiment, leading to substantial gains in Chinese and Hong Kong equities, as well as strengthening Chinese Yuan. This positive shift boosted commodity-linked currencies, with New Zealand Dollar and Australian Dollar emerging as the top performers for the week.

Adding to the drama in Asia, the unforeseen outcome of the Liberal Democratic Party leadership election in Japan resulted in sharp appreciation of Japanese Yen, making it the third-best performing currency. Markets quickly began speculating on whether his government would support more rate hikes from BoJ, further fueling Yen strength.

In contrast, Europe’s economic struggles were highlighted by disappointing PMI data, which reignited expectations of an ECB rate cut in October. As a result, Euro tumbled, marking it as the worst-performing major currency for the week. Across the Atlantic, Dollar also lost ground, weighed down by inflation data that cemented expectations for additional policy easing by Fed. Additionally, the record-breaking performance of DOW weighed on the greenback. Meanwhile, British Pound, Swiss Franc, and Canadian Dollar showed mixed performances.

Chinese stocks surge on bold stimulus oves, FOMO drives market momentum

China surprisingly took center stage in the global financial markets last week, unleashing a series of long-awaited monetary stimulus measures that ignited investor optimism. The 24-member Politburo reinforced this momentum by pledging to boost fiscal spending and, for the first time, committing to halt the decline in property prices. Additionally, the leadership unveiled a renewed focus on stimulating consumption to address public concerns. These decisive actions propelled stock markets in China and Hong Kong to their best weekly performance since 2008. Notably, the Hong Kong HSI surged on Friday with a record turnover of HKD 445B, a clear indicator of heightened investor enthusiasm .

This moment is viewed as a critical juncture for China’s economy and equity markets. Politically, it signifies President Xi Jinping’s turn from the shift from ideologies to recognition of the need for a stable growth baseline to maintain social harmony, enhance global influence, and achieve national revitalization goals. The timing is particularly advantageous, coinciding with global monetary easing efforts, including those by Fed, which is expected to bolster consumer spending—a positive development for China’s export-driven economy. The overwhelming market momentum suggests that fear of missing out is currently overshadowing any skepticism regarding the effectiveness of China’s policy measures.

China’s Shanghai SSE Composite ended the week gaining 12.81%, and closed above the psychologically important 3000 handle. Technically, the key hurdle ahead is 3174.26 cluster resistance, with 50% retracement of 3731.68 (2021 high) to 2635.09 (2024 low) at 3183.39.

Strong resistance could be seen from 3714/83 to limit upside, at least on first attempt. If happens, the pullback from this level could be steep given the speed of the rally from 2689.70. But downside should be contained well above 55 D EMA (now at 3865.18).

Decisive break of 3714/83 should confirm that the SSE is already reversing the whole down from from 3731.68, and target 61.8% retracement at 3312.78 next, with prospect of revisiting 3731.68 in medium term.

The Hong Kong HSI powered through 19706.12 resistance to resume the rally from 14794.16. Near term outlook will stay bullish as long as 19072.72 support holds. Next target is 100% projection of 14794.16 to 19706.12 from 16964.28 at 21876.24.

The major question now is whether HSI could eventually break through key resistance zone between 22700.85 (2023 high) and 50% retracement of 33484.08 (2018 high) to 14597.31 (2022 low) at 24040.70 to add to the case of long term reversal.

USD/CNH accelerated lower and broke through 100% projection of 7.3679 to 7.0870 from 7.3111 at7.0302 and the psychologically important 7 handle. Near term outlook will stay bearish as long as 7.0870 support turned resistance holds, for 161.8% projection at 6.8566.

It’s still early to assess the chance, but there is prospect for USD/CNH to fall further to 6.6971 cluster support (61.8% retracement of 6.3057 (2022 low) to 7.3746 (2022 high) at 6.7140) before bottoming.

Ishiba’s Surprise LDP Leadership Victory Rattles Japanese Markets

The unexpected result of Japan’s LDP leadership contest last week also caught the markets off guard. Markets had been apparently positioned for reflationist Sanae Takaichi to win, but Ishiba’s triumph has dramatically shifted expectations. Yen surged in response to the news, reflecting investor sentiment toward Ishiba’s critical view of BoJ’s past monetary stimulus. Ishiba has openly supported the central bank’s current rate hikes, reigniting speculation that BoJ may raise interest rates again in December.

The immediate market reaction was pronounced. Japanese Yen surged against major currencies, reflecting investor expectations of tighter monetary policy ahead. However, concerns have emerged that Ishiba’s hawkish stance could pose challenges for equity markets. There is apprehension that aggressive rate hikes might create headwinds for stocks and lead to increased Yen volatility.

Nikkei futures tumbled more than 2,000 points following the news, and the cash index is expected to open sharply lower on Monday.

It’s still early to call for reversal of Nikkei’s whole rebound from 31156.11. But some consolidations is likely in the near term, with risk of dipping through 55 D EMA (now at 37786.39). Yet, downside should be contained by 35253.43 support to bring rebound. In case of another rise, upside potential should be limited by 61.8% projection of 31156.11 to 39080.64 from 35253.43 at 40150.78.

So in short, Nikkei is expected to trade within the 35k to 40k range until there is greater clarity on Japan’s political situation. Investors are closely watching to see if Ishiba will call a snap general election to secure his mandate and reveal more details about his economic and foreign policy agendas.

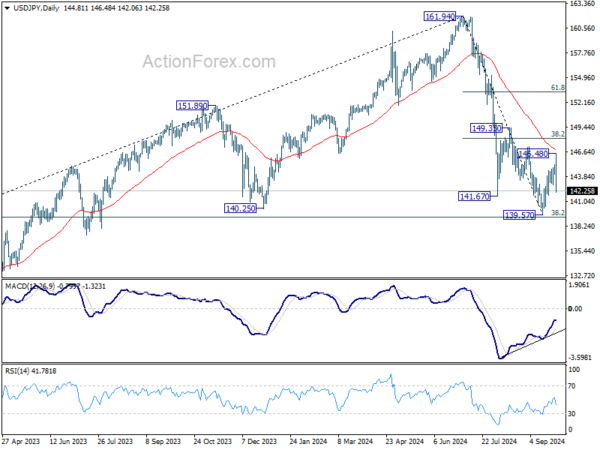

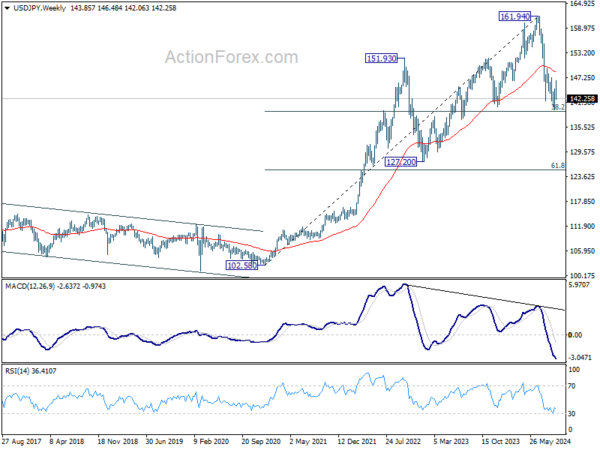

USD/JPY’s steep decline on Friday suggests that rebound from 139.57 has completed at 146.48, ahead of falling 55 D EMA. While the development is keeping outlook bearish and favors deeper fall, strong support is still expected at around 38.2% retracement of 102.58 to 161.94 at 139.26 to bring another rebound. However, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25 in the medium term.

Record-Breaking DOW Rally May Start to Lose Steam

DOW surged to a new all-time high on Friday, fueled by optimism over continued disinflation as the PCE inflation data showed further progress. Major US indexes extended their gains for the third consecutive week, with DOW and S&P 500 each rising about 0.6% for the week, while NASDAQ posted a solid 1% gain.

The positive inflation data strengthened the view that Fed could afford to shift its focus toward the labor market. This rate-cutting bias is seen as a significant tailwind for stock markets. With inflation seemingly under control, consumers sensitive to higher interest rates might finally see some relief too.

Technically, however, DOW might start to lose momentum at around 61.8% projection of 32327.20 to 39889.05 from 38000.96 at 42674.18. Break of 41859.73 support will indicate short term topping, and bring pullback to 55 D EMA (now at 40819.85), before continuing the long term up trend. Nevertheless sustained break of 42674.18 will pave the way to 100% projection at 45562.81 next.

Dollar Index gyrated lower last week, with week momentum as seen in D MACD. While further decline is in favor as long as 101.91 resistance holds, strong support might emerge at 99.57 (2023 low) to contain downside at first attempt. Break of 101.91 resistance will bring stronger rebound.

AUD/USD Weekly Report

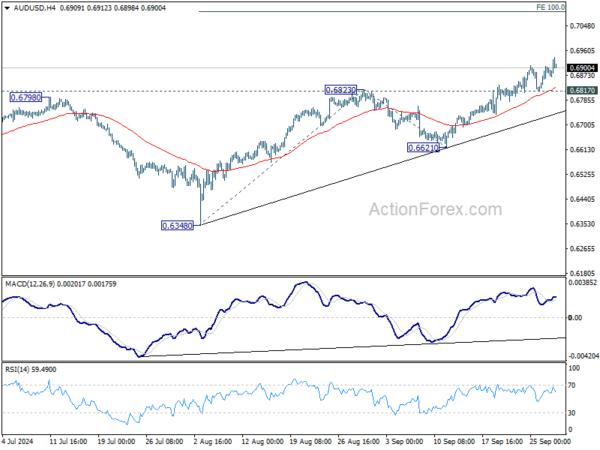

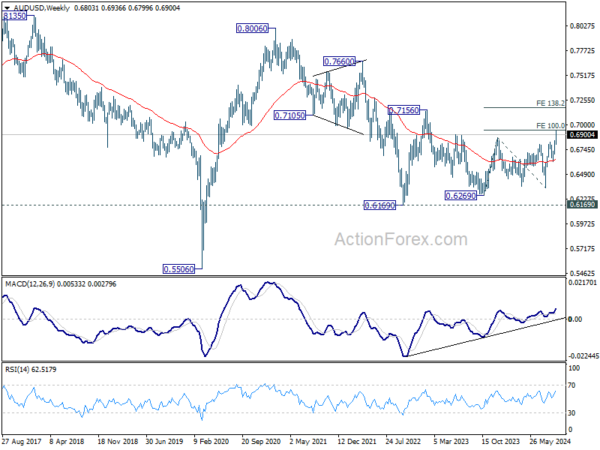

AUD/USD’s rally contained last week and hit as high as 0.6936. Initial bias is on the upside this week. Firm break of 0.6941 will pave the way to 100% projection of 0.6348 to 0.6823 from 0.6621 at 0.7096. On the downside, below 0.6817 support will turn intraday bias neutral first.

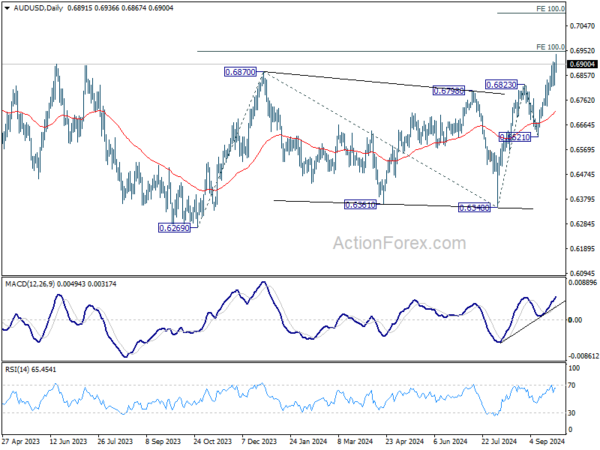

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern, with rise from 0.6269 as the third leg. Firm break of 0.6870 resistance will target 100% projection of 0.6269 to 0.6870 from 0.6340 at 0.6941, and then 138.2% projection at 0.7179. This will now remain the favored case as long as 0.6621 support holds.

In the long term picture, the down trend from 1.1079 (2011 high) should have completed at 0.5506 (2020 low) already. It’s unsure yet whether price actions from 0.5506 are developing into a corrective pattern, or trend reversal. But in either case, fall from 0.8006 is seen as the second leg of the pattern. Firm of 0.7156 resistance will argue that the third leg has already started towards 0.8006.