- The Dow Jones clipped into yet another record bid on Tuesday.

- Investors are tilting into the risk-on side ahead of expected Fed rate cut.

- Markets are split on the depth of anticipated first Fed rate cut in over four years.

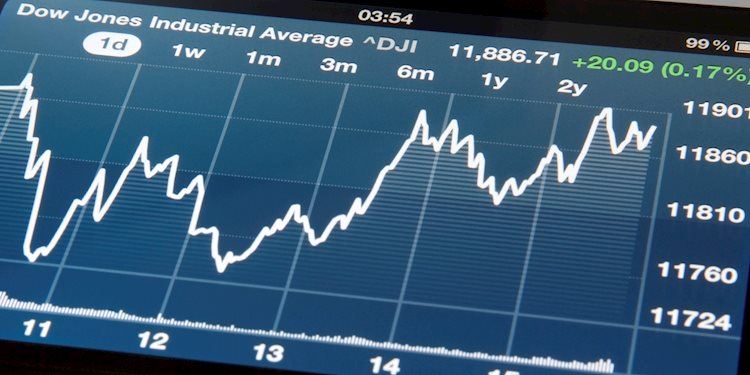

The Dow Jones Industrial Average (DJIA) rose into a fresh record high for the second day in a row on Tuesday as investors jostle for position ahead of the Federal Reserve’s (Fed) hotly-anticipated rate cut during the midweek market session. Despite a strong start to the day, the Dow Jones turned away from record peaks and dipped back into the previous day’s trading range.

US Retail Sales figures in August helped to keep market Fed expectations anchored, rising 0.1% compared to the median forecast of a -0.2% contraction. July’s Retail Sales figure was also revised higher to 1.1%, though core Retail Sales (excluding automotive purchases) only rose 0.1% compared to the 0.2% forecast.

The only meaningful event remaining on the data docket for stocks this week is the Fed’s upcoming rate call on Wednesday. Markets have been angling for a reduction in the Fed funds rate since the beginning of the year when investors were clamoring for a March cut. According to the CME’s FedWatch Tool, rate markets are still split on the depth of the Fed’s first expected rate trim since early 2020, with rate traders pricing in 60% odds of a 50 bps double cut to kick off the Fed’s next rate cutting cycle. The remaining 40% of rate cut expectations are stacked on a more reasonable 25 bps.

Dow Jones news

Despite an early pop into a fresh all-time intraday high on Tuesday, the Dow Jones remains broadly on-balance for the day. The DJIA is mixed, with half of the major index’s listed securities testing into the red.

Walmart Inc. (WMT) pared back recents gains, falling 2% on the day after hitting a fresh record high of $80.96 on Monday. The retail giant’s share price is now paring back, declining below $79 per share.

On the high end, Intel Corp (INTC) rallied another 3.3% to clear $21 per share after announcing plans to spin off the chipmaker’s foundry business into a subsidiary division, which would allow the computer hardware giant to raise additional outside funds. The news comes on the heels of an announcement this week that Intel would receive an additional $3 billion in federal grant funding despite plans to axe over 10% of the entire company’s workforce. Despite a near-term recovery, Intel’s valuation remains down around 60% for the year.

Dow Jones price forecast

Tuesday is proving to be a truly mixed day for the Dow Jones; despite setting a fresh record high bid above 41,750, the index is also testing into the low end and set to snap a four-day win streak. Investors are holding steady as the calendar runs down to the Fed’s upcoming rate call, but nerves are still on the frayed end, but a fast tumble to the 50-day Exponential Moving Average (EMA) at 40,493 can’t be ruled out.

A lack of meaningful technical resistance above price action makes it difficult for bulls to price out a logical target, but intraday bidders will be cautious with early pullback signs forming on the daily candlesticks.

Dow Jones daily chart

Economic Indicator

Retail Sales (MoM)

The Retail Sales data, released by the US Census Bureau on a monthly basis, measures the value in total receipts of retail and food stores in the United States. Monthly percent changes reflect the rate of changes in such sales. A stratified random sampling method is used to select approximately 4,800 retail and food services firms whose sales are then weighted and benchmarked to represent the complete universe of over three million retail and food services firms across the country. The data is adjusted for seasonal variations as well as holiday and trading-day differences, but not for price changes. Retail Sales data is widely followed as an indicator of consumer spending, which is a major driver of the US economy. Generally, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Last release: Tue Sep 17, 2024 12:30

Frequency: Monthly

Actual: 0.1%

Consensus: -0.2%

Previous: 1%

Source: US Census Bureau