Fundamental

Overview

The S&P 500 has been on a steady rise ever since the last week’s US Jobless

Claims as the data quelled the fears around the labour market following the

weak NFP report. The “growth scare” triggered by the ugly ISM Manufacturing PMI

and the weak NFP report looks to be behind us for now.

This week we got some more positive news on the inflation front as the US PPI surprised to the

downside and the US CPI yesterday showed some

more easing. That should be good news as the Fed will likely be even more

dovish from now on and the chances of three rate cuts by year-end solidify.

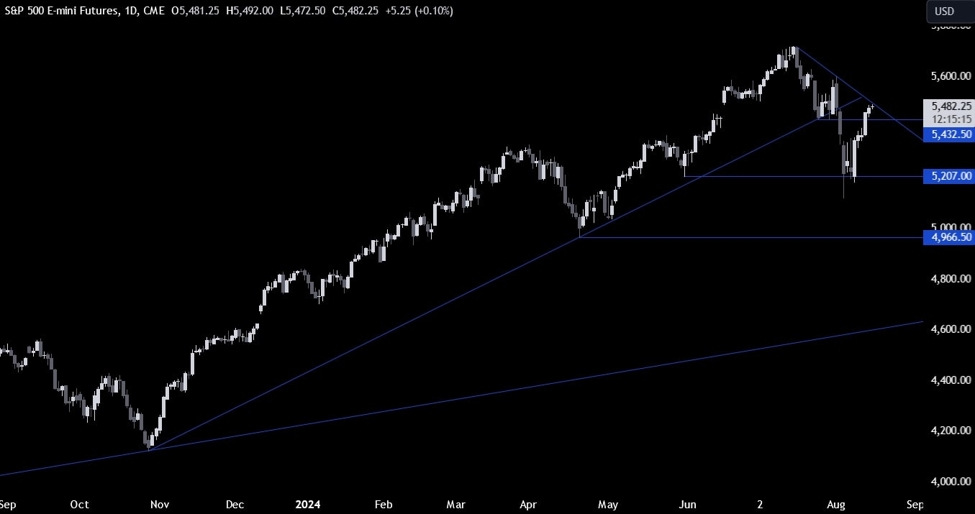

S&P 500

Technical Analysis – Daily Timeframe

S&P 500 Daily

On the daily chart, we can

see that the S&P 500 reached a key trendline

around the 5500 level. This is where we can expect the sellers to step in with

a defined risk above the trendline to position for a drop into new lows. The

buyers, on the other hand, will want to see the price breaking higher to

increase the bullish bets into a new all-time high.

S&P 500 Technical

Analysis – 4 hour Timeframe

S&P 500 4 hour

On the 4 hour chart, we can

see that we have a key support

around the 5432 level. If we get a pullback from the trendline, that’s where we

can expect the buyers to step in with a defined risk below the level to

position for a break above the trendline with a better risk to reward setup.

The sellers, on the other hand, will want to see the price breaking lower to

increase the bearish bets into new lows.

S&P 500 Technical

Analysis – 1 hour Timeframe

S&P 500 1 hour

On the 1 hour chart, we can

see that we have a minor upward trendline defining the current bullish momentum.

This is where the buyers keep on leaning onto to position for new highs. A

break below the trendline should see the sellers piling in and target the 5432

level where we will likely find the dip-buyers. The red lines define the average daily range for today.

Upcoming

Catalysts

Today we get the US Retail Sales and Jobless Claims figures. Tomorrow, we

conclude the week with the University of Michigan Consumer Sentiment survey.