The USD is lower.

Yields are lower with the 2-year down -28 basis points. The 10 year yield is down -18 basis points.

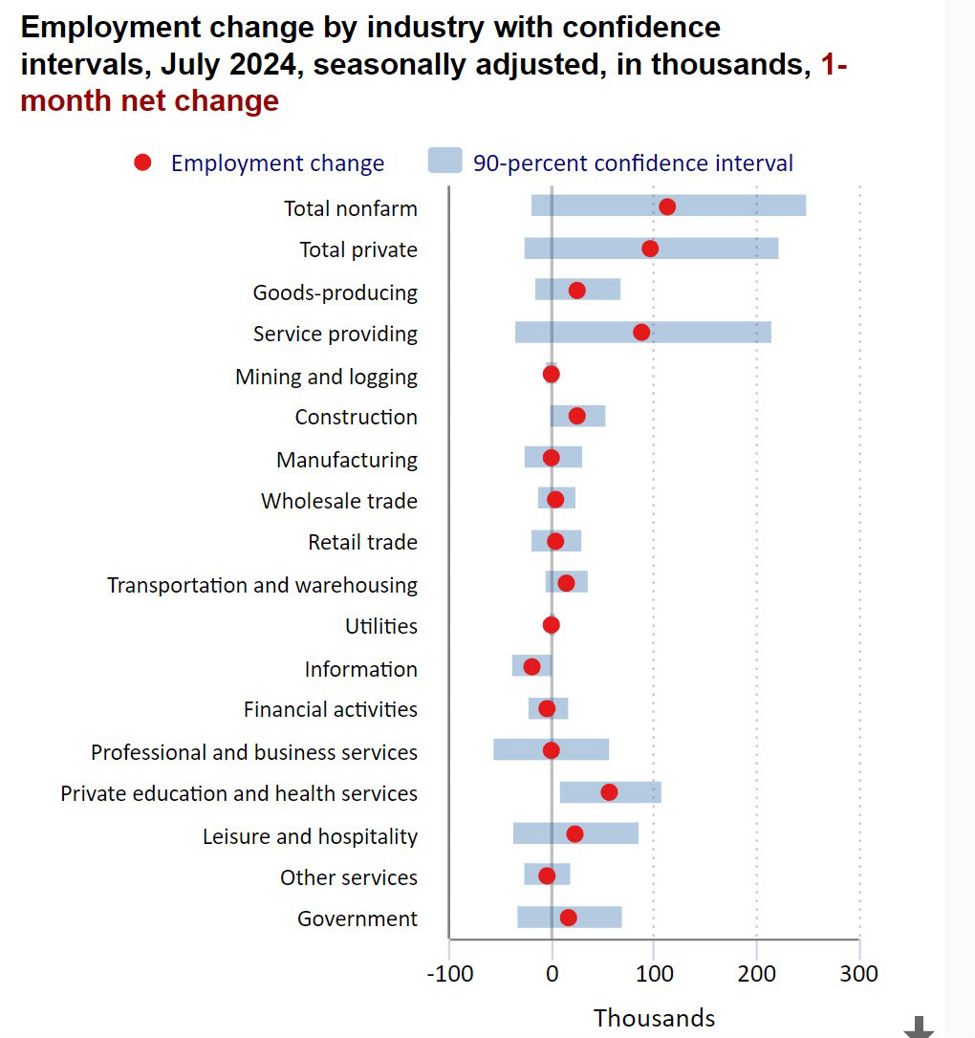

Stocks are moving lower from already depressed levels after the weaker US jobs report. S&P index is down -101 points. Dow Industrial Average was -575 points. NASDAQ index -476 point.

The market is now pricing in -108 basis points of cuts by year end. That is down over -20 basis points. There is a 73% chance of 50 bps cut in September now.

Job losses beget job losses. The Fed is now behind the curve. The bond market is doing the work for the Fed as it is late.

In the Forex:

- EURUSD: The EURUSD moved sharply higher off the report, and tested a key swing area near 1.0872. IN the process, the cluster of MAs were broken with the price above the 100 and 200-day MA, and the 100/200 hour MAs. Looking at the chart, you can see the key level and that is where it stopped.

- USDJPY: The USDJPY is trading to the lowest level since March. The next target area comes in between 145.89 and 146.514. Going back to November to March that area was a swing level where it provided either support or resistance before basing against the level one last time in March near 146.51 before racing to the upside.

This article was originally published by Forexlive.com. Read the original article here.