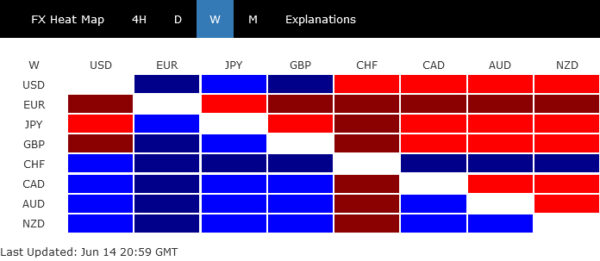

Global financial markets were abuzz with several high-profile events last week, including critical meetings of Fed and BoJ, alongside release of US inflation data. However, it was the escalating political turmoil in France that captured the most attention, significantly impacting Euro and overshadowing other major economic news. The common currency emerged as the week’s weakest performer. Meanwhile, pronounced selloffs rippled through both French and German stock markets as political uncertainty loomed large.

The unfolding political drama in France, sparked by President Emmanuel Macron’s decision to call snap parliamentary elections, has thrown the European Union into a state of heightened anxiety. Investors are now bracing for the possibility that volatility could extend until the election results are in, which could either exacerbate the current downturn or provide some relief if the outcomes are market-friendly.

Simultaneously, Japanese Yen also experienced late turbulence, mainly due to disappointment with BoJ’s ambiguous stance on tapering its bond purchases. While a late-week decline in US and European bond yields provided a temporary lift, it remains to be seen whether this support is robust enough to catalyze a turnaround for Yen.

British Pound wasn’t spared from the market upheaval, ending up as the third weakest performer. Dragged down by Euro’s decline and its own domestic political uncertainties, with a general election looming in early July, Sterling found itself under considerable pressure.

In contrast, Swiss Franc shone as the week’s standout performer, capitalizing on its safe-haven appeal amid the escalating instability in the European Union. This status helped it attract significant flows, distancing itself from the turmoil affecting its European counterparts. Following closely behind were the New Zealand and Australian Dollars, which strengthened mainly due to their relative detachment from the problems plaguing Europe.

Canadian Dollar remained relatively stable, positioned in the middle of the currency spectrum, while Dollar saw a rollercoaster week. Initially depressed by softer CPI data suggesting continued slowdown in inflation, the greenback later gained on safe-haven flows triggered by escalating concerns in Europe.

European Political Uncertainty Shakes Markets, Euro and CAC 40 Take Major Hits

Europe was thrust into the spotlight of the global financial markets following unexpected political developments, with the sudden decision by French President Emmanuel Macron to call snap parliamentary elections following European Parliament elections. These events have injected significant uncertainty into the markets, with Euro experiencing sharp declines and French stocks taking a substantial hit.

Euro ended the week as the poorest performer among major currencies, depreciating by -1.66% against Swiss Franc and over -1.5% against Australian and New Zealand Dollars. This downturn reflects growing investor apprehension about political stability and economic future of the European Union.

France’s benchmark stock index, CAC 40, posted its worst weekly performance since March 2022, plummeting by -6.23%. Moreover, the spread between French and German bond yields widened dramatically to a seven-year high, signaling a sharp increase in perceived risk for French government debt relative to its German counterpart. The last time such a yield divergence occurred was in 2017, just before Macron’s first presidential victory over Marine Le Pen.

The initial opinion polls following Macron’s call for elections have only added to the pessimism, showing his centrist party lagging significantly behind not only the far-right National Rally led by Marine Le Pen but also a unified left-wing bloc. A potential heavy loss for centrist candidates could critically endanger Macron’s agenda for pro-growth reforms.

Further dampening investor confidence, projections based on the results of the European Parliament elections suggest a grim scenario for Macron’s party in the upcoming legislative elections scheduled for June 30 and July 7. According to these forecasts, only about 40 of Macron’s MPs are expected to qualify for the second round in the contest for France’s 577-seat National Assembly. This potential outcome raises the specter of a fragmented and polarized parliament where extremist agendas could dominate.

Economists have voiced concerns that if Le Pen influences the new parliament and begins implementing her costly fiscal and protectionist “France first” agenda, France could face a financial crisis similar to that seen in the UK under Liz Truss. Additionally, the coalition of four left-wing parties has made extravagant, unfunded spending pledges worth tens of billions of Euros, further compounding the risk of fiscal irresponsibility.

Technically, while deeper fall cannot be ruled out yet, CAC is now close to an important support zone and recovery should be due shortly. The zone include trend line support at 7440, 61.8% retracement of 6773.81 to 85290.19 at 7341.22, and 38.2% retracement of 5268.41 to 8259.19 at 7254.23. However, risk will remain heavily on the downside ahead as long as 55 D EMA (now at 7984.35) holds, even in case of stronger rebound.

DAX also lost nearly -3% as dragged down by the sharp turn in sentiment in Europe. Rise from 14630.21 should have completed a five-wave sequence to 18892.92, on bearish divergence condition in D MACD. Further decline is expected as long as 55 D EMA (now at 18292.01) holds, to 17626.90 support. But for now, strong support is expected from 38.2% retracement of 14630.21 to 18892.91 at 17264.55 to bring rebound, and keep the long term up trend intact.

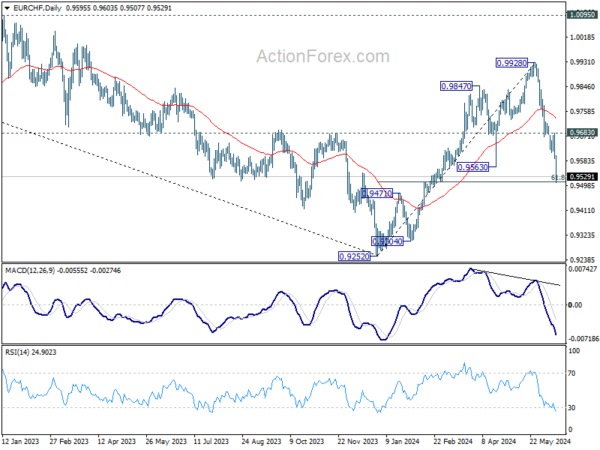

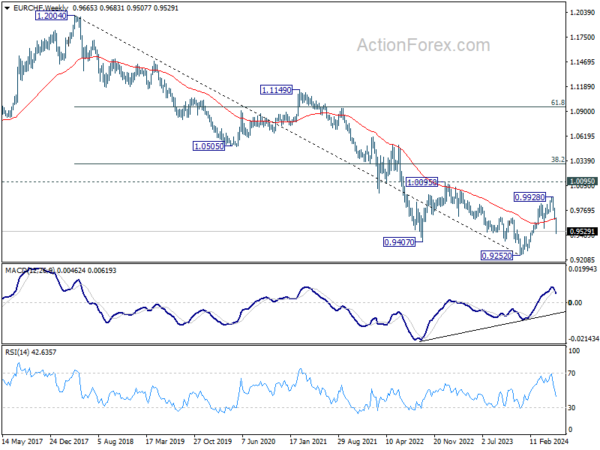

EUR/CHF’s steep decline and strong break of 55 W EMA (now at 0.9672) indicates that whole rally from 0.9252 has completed already. For now, near term outlook will remain bearish as long as 0.9683 resistance holds. Sustained trading below 61.8% retracement of 0.9252 to 0.9928 at 0.9510, will raise the chance of long term down trend resumption, and target 0.9252 low next.

S&P 500 and NASDAQ Reach New Highs, Dollar Index Rebounds

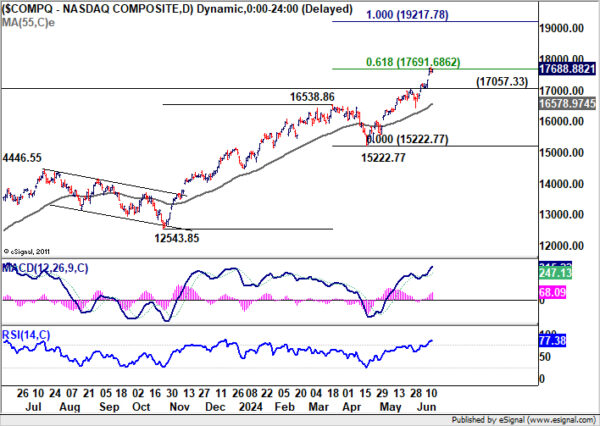

In the US, investors cheered lower than expected May CPI data that showed disinflation remained on track. Nevertheless, reactions to FOMC’s new economic projections were muted. Overall, S&P 500 and NASDAQ capitalized on the positive momentum from the CPI report, both reaching new record highs. In contrast, DOW did not partake in this upward trend and remained noticeably behind its counterparts.

Fed’s decision to maintain interest rates at the current range of 5.25-5.50% aligned with broad market expectations. However, the details within Fed’s updated economic projections introduced a slightly hawkish tilt that moderated some of the initial enthusiasm from the disinflation news.

On the hawkish front, Fed’s median projections have been revised to indicate only one rate cut for this year, significantly down from the three anticipated cuts noted in March. This was further reflected in the updated dot plot, which showed a majority of 11 members now favoring one or no rate cuts, compared to eight members who still advocate for two cuts. This sets a high threshold for shifting back to two rate cuts this year.

Additionally, the upward revision of the long-term “neutral” rate from 2.6% to 2.8%—an increase of over a quarter of a percentage point since the last two sets of projections—signals Fed’s growing concern that inflation may be tougher to tame in the coming years. This change implies that the baseline rate for managing economic growth without sparking inflation may need to be higher than previously estimated.

Conversely, the dovish elements in Fed’s projections included a significant shift in the committee’s stance on future rate hikes. Notably, no FOMC members currently project further rate increases, compared to previous projections where two members anticipated additional hikes might be needed. This consensus to avoid tightening further could be seen as a reassurance to investors

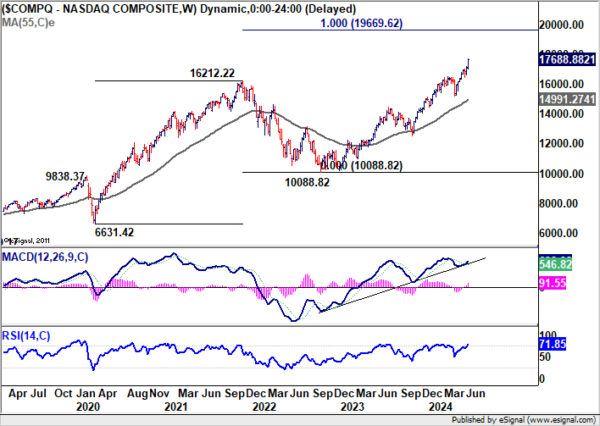

Technically, near term outlook in NASDAQ will remain bullish as long as 17057.33 support holds. Sustained break of 61.8% projection of 12543.85 to 16538.86 from 15222.77 at 19217.78. The long term up trend is also looking healthy, with next target at 100% projection of 6631.42 to 16212.22 from 10088.82 at 19669.62.

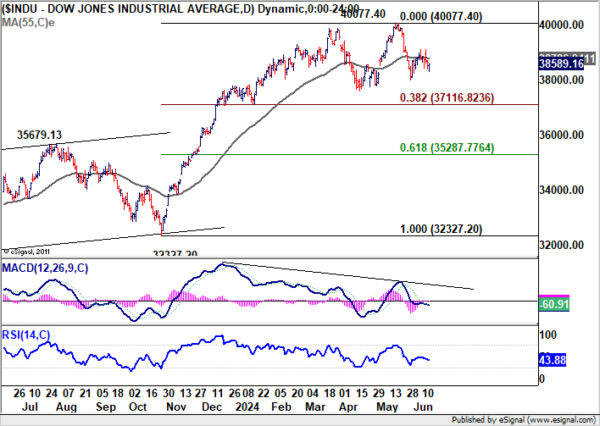

DOW, on the other hand, continued to struggle in sideway trading. While deeper pullback cannot be ruled out, downside should be contained by 38.2% retracement of 32327.20 to 40077.40 at 37116.82 to bring rebound. As long 55 E EME (now at 36900.74) holds, the long term up trend is still in favor to resume at a later stage, to 100% projection of 18213.65 to 36952.65 from 28660.94 at 47399.94.

10-year yield’s fall from 4.747 resumed last week to close at 4.213, largely due to safe haven flows. Current development is inline with the view that fall from 4.737 is the third leg of the corrective pattern from 4.997. Immediate focus is on 55 W EMA (now at 4.174). Sustained break there will strengthen this bearish case and target 3.785 support and below. Nevertheless, strong rebound from current levels, followed by break of 4.479 resistance, will argue that rise from 3.785 might not be over yet.

Dollar Index rebounded strongly thanks to the selloff in both Euro, and to a lesser extend Yen. The development argues that fall from 106.51 has completed as a correction to 103.99, after drawing support from 55 W EMA (now at 104.17). More importantly, rise from 100.61 is not over. Further rally is now in favor as long as 103.99 holds, to retest 106.51 resistance first. Firm break there will resume the rise from 100.61, as the third leg of the pattern from 99.57, to 107.34 resistance and possibly above.

Yen Struggles Amid BoJ’s Uncertainty, CHF/JPY Hits New Highs

Japanese Yen ended as the second-worst performer in the forex markets, despite a late rebound that sparked some optimism that the selloff might be short-lived. BoJ’s decision to maintain its policy interest rate unchanged did not come as a surprise. However, the central bank’s vague stance on the future of its bond purchase program has injected a significant level of uncertainty into the markets.

BoJ only stated its intention to scale back debt purchases but postponed any detailed announcements until its next policy meeting. This cautious approach is understandable from a strategic perspective, as the board prefers to wait for the upcoming economic projections in July before committing to a specific tapering strategy.

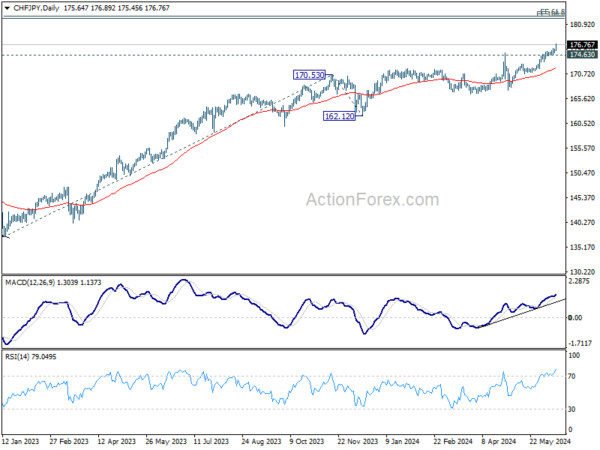

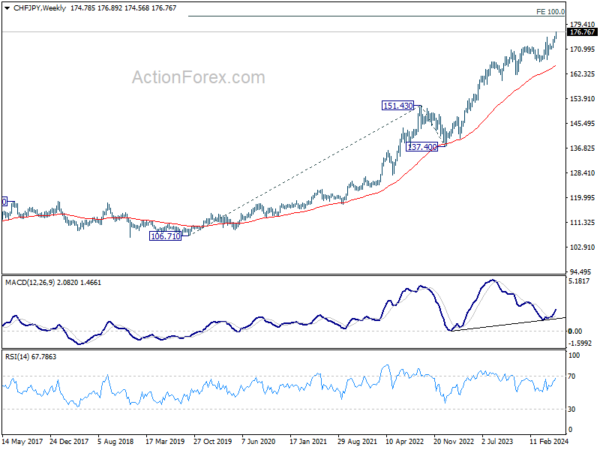

CHF/JPY surged to new record high as the cross builds up momentum again, as seen in both D and W MACD. Near term outlook will stay bullish as long as 174.63 support holds. Next target is 61.8% projection of 137.40 to 170.53 from 162.12 at 182.59. This is slightly above long term level of 100% projection of 106.71 to 141.43 from 137.40 at 182.12.

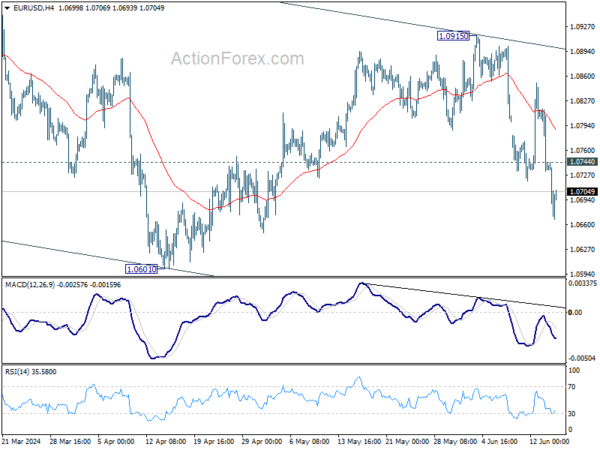

EUR/USD Weekly Outlook

Euro’s strong decline last week suggests that rebound from 1.0601 has already completed as a correction to 1.0915. Initial bias stays on the downside this week for retesting 1.0601 low first. Firm break there will target channel support at 1.0510 next. On the upside, above 1.0744 minor resistance will turn intraday bias neutral again first.

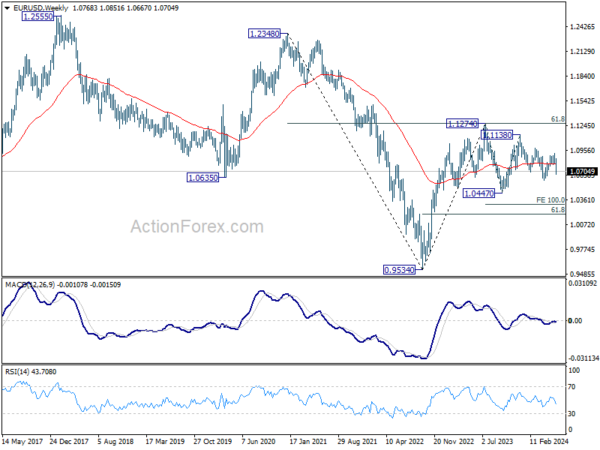

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that’s still in progress. Break of 1.0601 will target 1.0447 support and possibly further to 100% projection of 1.1274 to 1.0447 from 1.1138 at 1.0311. For now, this will remain the favored case as long as 1.0915 resistance holds, in case of rebound.

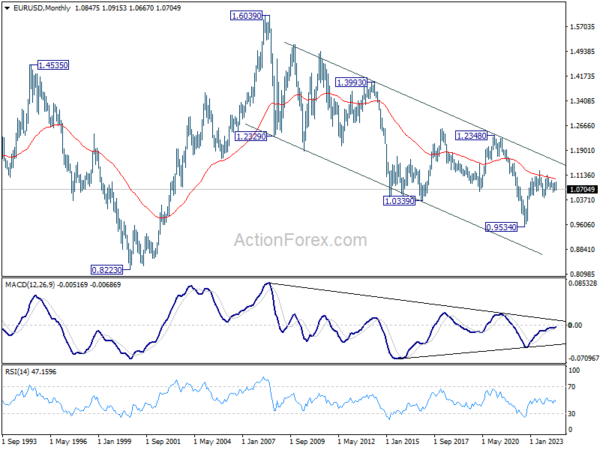

In the long term picture, a long term bottom is in place at 0.9534 (2022 low). But considering that upside is still capped below 55 M EMA (now at 1.1030), there is no sign of trend reversal yet. Down trend from 1.6039 (2008 high) could resume at a later stage if current selloff picks up momentum.