- Dow Jones backslides as investors balk at softening US data.

- Markets have shifted to bets of a November Fed rate cut.

- Monday kicks off NFP week with a sharp pullback in equities.

The Dow Jones Industrial Average (DJIA) is down around 200 points on Monday with investors taking a step back after US ISM Manufacturing Purchasing Managers Index (PMI) figures unexpectedly declined in May. Softening US data knocked risk appetite lower as markets rethink their outlook on the US economy.

Despite an uptick in May’s S&P Global Manufacturing PMI, which rose to 51.3 compared to the expected flat hold at 50.9, investors are balking after the ISM Manufacturing PMI for the same period eased lower. May’s ISM Manufacturing PMI eased back to 48.7 from the previous month’s 49.2, falling away from the market forecast increase to 49.6.

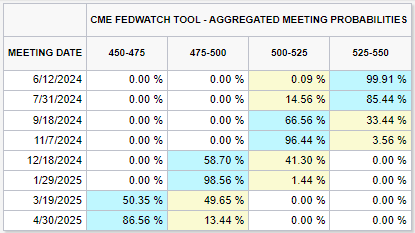

According to the CME’s FedWatch Tool, rate markets have fully priced in a first rate cut from the Federal Reserve (Fed) in November, with interest rate traders seeing over 96% odds of an initial 25-basis-point decline in the Fed Funds Rate by the Federal Open Market Committee’s (FOMC) November rate decision.

Dow Jones news

The Dow Jones initially plunged 400 points in early Monday trading, recovering slightly to -300 points on the day as investors try to recover their footing. Around two-thirds of the DJIA’s constituent equities are in the red on Monday, with losses lead by Chevron Corp. (CVX) which fell -3.35% to $156.71 per share. CVX is closely followed by Dow Inc. (DOW), which fell -3% to %55.91 per share on Monday.

Boeing Co. (BA) rebounded 2.34% on Monday, climbing to $181.91 per share. Merch & Co Inc. (MRK) followed closely behind, gaining 1.85% and rising to $127.85 per share.

Dow Jones technical outlook

Monday’s pullback chewed throw a significant portion of last Friday’s much-needed rebound, keeping the Dow Jones pinned below 39,000.00. The major equity index is still down over 4% from record highs set just above 40,000.00.

The Dow Jones is on pace to close down once more on Monday, and the index’s pullback has seen the DJIA close in the red for all but three of the last ten consecutive trading sessions. The Dow Jones still remains firmly in bull territory, but bids are edging closer to the 200-day Exponential Moving Average (EMA) at 37,247.44.

Dow Jones five minute chart

Dow Jones daily chart

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months’ reviews and the Unemployment Rate are as relevant as the headline figure. The market’s reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.