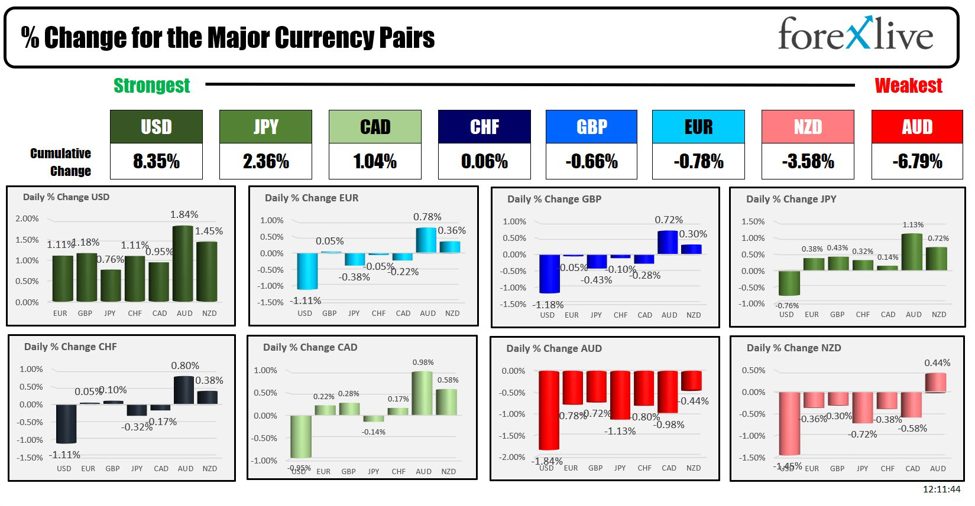

No surprise, but as the Europe/London traders head for the exits, the USD is the strongest and the AUD is the weakest. The AUDUSD is the biggest mover vs the greenback with a move of -1.84%.

Looking at the 4-hour chart of the AUDUSD, the price moved back below the near converged 100 and 200 bar moving averages, and also the 200-day moving average. Those lows come between 0.6542 and 0.6554. The next targets on the downside come in at a swing area between 0.6476 and 0.6486. Below that and traders would look toward the low price from 2024 at 0.64417.

AUDUSD falls and breaks below cluster of MAs

Looking at the equity markets, European indices are closing mixed:

- German DAX, +0.11%

- France CAC, -0.05%

- UK FTSE 100 hundred +0.33%

- Spain’s Ibex, -0.38%

- Italy’s FTSE MIB, +0.27%

A snapshot of the US markets are showing declines:

- Dow industrial average -470 points or -1.21% at 38415

- S&P index -55.55 points or -1.07% at 5153.75

- NASDAQ index -164 points or -1.01% at 16143

- Russell 2000-52.29 points or -2.51% at 2028.51

In the US debt market, yields are sharply higher with the shorter end leading the way. Remember at 1 PM, the U.S. Treasury will auction off 10 year notes. What kind of demand will we see from investors given the backup in rates? The US 10-year yield is trading at the highest level for the year and the highest level going back to November 2023.

- 2-year yield 4.947%, +20.1 basis points. That is the highest level since November 27.

- 5-year yield 4.573%, +19.7 basis points (highest since November 14)

- 10 year yield 4.517% +15.1 basis points (highest since November 27)

- 30-year yield 4.596% +9.8 basis points.

In other markets:

- crude oil is trading up $0.11 at $85.34

- Gold is trading down $15.22 or -0.65% at $2337.93

- Bitcoin is trading at $69,141 after reaching an intraday low of $67,482.