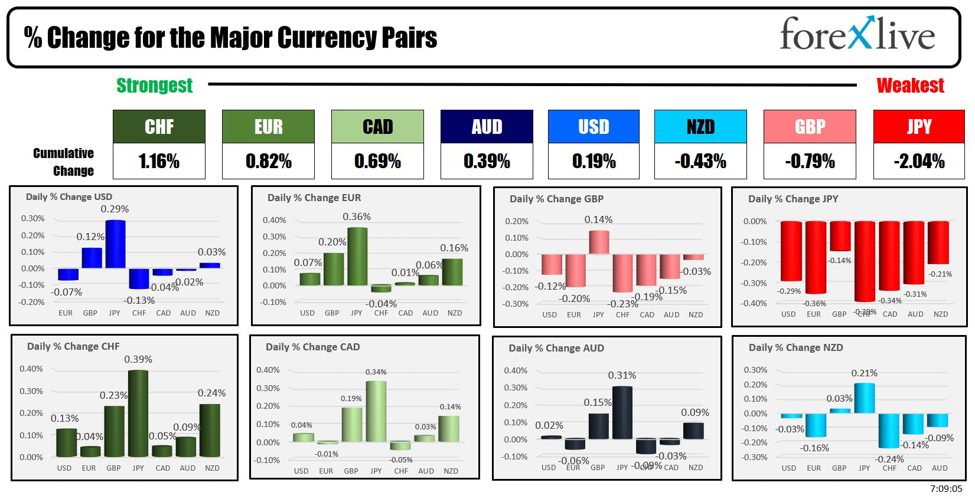

As the North American session begins, the CHF is the strongest and the JPY is the weakest. The day is characterized by very modest ranges and changes for the EURUSD, USDCHF, USDCAD, AUDUSD and NZDUSD. Each of those pair have total low to high ranges of 19 pips or less (AUDUSD only has a 14 pip trading range today). Meanwhile, the USDJPY is moving, and that also has the JPY crosses on the run. Today, the move is corrective to the upside.

The catalyst for the JPY moves? Finance Ministry and BOJ comments.

Japan’s Finance Minister Suzuki highlighted some positive trends in the country’s economy, including significant pay increases and record capital expenditures. However, he stressed that Japan has not yet reached a point where the risk of reverting to deflation is entirely off the table, indicating that it’s premature to declare victory over deflation. Suzuki refrained from commenting on market movements, such as those in forex and stock prices, signaling a cautious stance towards immediate monetary policy tightening by the Bank of Japan. Additionally, he declined to speculate on the interest rate outlook following the potential end of negative interest rates, further complicating the discussion around Japan’s monetary policy direction and emphasizing a careful, watchful approach to economic indicators and risks.

Those comments kickstarted the USDJPYs move to the upside.

Later BOJ Governor Ueda spoke emphasized a strategic approach to exiting the Bank of Japan’s expansive monetary policy, stating that a shift away from negative interest rates, yield curve control, and other significant easing measures will be considered once the achievement of a 2% inflation rate appears stable and sustainable. Ueda highlighted that the sequence of phasing out these monetary tools would depend on the prevailing economic, price, and financial conditions. He also mentioned the BOJ’s ability to manage short-term rates effectively by paying interest on reserves held at the bank. Furthermore, Ueda pointed out that should inflation rise sharply, necessitating monetary tightening, it could be addressed by increasing interest rates without the need to reduce the BOJ’s bond holdings, presenting a flexible stance towards future monetary policy adjustments based on inflation dynamics.

The comments were a modest shift away from the tightening buildup, and poured some cooler water on the markets declines in the JPY pairs (higher JPY) that were started last week. The move lower last week saw the USDJPY pair move lower by about 410 pips from the high to the low. That move took the USDJPY to – and through – the 38.2% of the move up from the December low at 146.809. The price low reached 146.47. Admittedly, the price action has been up and down above and below the 38.2% (red line chart below) mainly between some swing areas (see chart below) before the break to the upside today. The 38.2% remains a key barometer for the pair going forward.

USDJPY moves higher

The focus will now be on the US CPI data released at 8:30 AM ET. For the numbers excluding food and autos, CPI is expected at:

- +0.3% m/m vs +0.4% prior

- +3.7% y/y vs +3.9% prior

- Estimates range from 3.6% to 3.9%

As for the headline, the consensus is:

- +0.4% m/m vs +0.3% prior

- 3.1% y/y vs +3.1% prior

- Estimates range from 2.9% to 3.2%

For a full preview, see Adam’s post HERE.

A snapshot of the markets as the North American session begins currently shows:

- Crude oil is trading unchanged on the day near $77.94. At this time yesterday, the price was at $77.68

- Gold is trading down -$10.20 or -0.46% at $2171.81. At this time yesterday, the price was at $2178.30

- Silver is trading down eight cents or -0.34% at $24.37. At this time yesterday, the price was at $24.34

- Bitcoin currently trades at $72,146. At this time yesterday, the price was trading at $71,701

In the premarket, the major indices are trading mixed. The broader indices (S&P and Nasdaq) are higher with NASDAQ leading the way. Yesterday the broader indices fell.

- Dow Industrial Average futures are implying a loss of -10.60 points. Yesterday. However the index gained 46.97 points or 0.12% at 38769.67

- S&P futures are implying a gain of 12.31 points. Yesterday the index fell -5.75 points or -0.11% at 5117.93

- Nasdaq futures are implying a gain of 75.52 points. Yesterday the index fell -65.84 points or -0.41% at 16019.27.

In the European equity markets, the major indices are trading higher.

- German DAX, +0.38%

- France CAC , +0.06%

- UK FTSE 100, +1.14%

- Spain’s Ibex, +0.43%

- Italy’s FTSE MIB, 0.57% (delayed by 10 minutes).

Shares in the Asian Pacific markets were mixed:

- Japan’s Nikkei 225, -0.06%.

- China’s Shanghai Composite Index, -0.41%

- Hong Kong’s Hang Seng index, +3.05%. The index opened above its 100-day moving average and built on that shift in the technicals

- Australia S&P/ASX, +0.11%.

Looking at the US debt market, yields are marginally higher:

- 2-year yield 4.450%, +1.7 basis points.. At this time yesterday, the yield was at 4.498%

- 5-year yield 4.088%, unchanged. At this time yesterday, the yield was at 4.053%

- 10-year yield 4.086%, -1.7 basis points. At this time yesterday, the yield was at 4.071%

- 30-year yield 4.244%, -3.2 basis points. At this time yesterday, the yield was at 4.242%

- The 2-10 year spread is at -46.6 basis points. At this time yesterday, the spread was at -42.5 basis points

- The 2-30 year spread is at -30.8 basis points. At this time yesterday, the spread was at -25.7 basis points

European benchmark 10-year yields are lower:

European benchmark 10 year yields