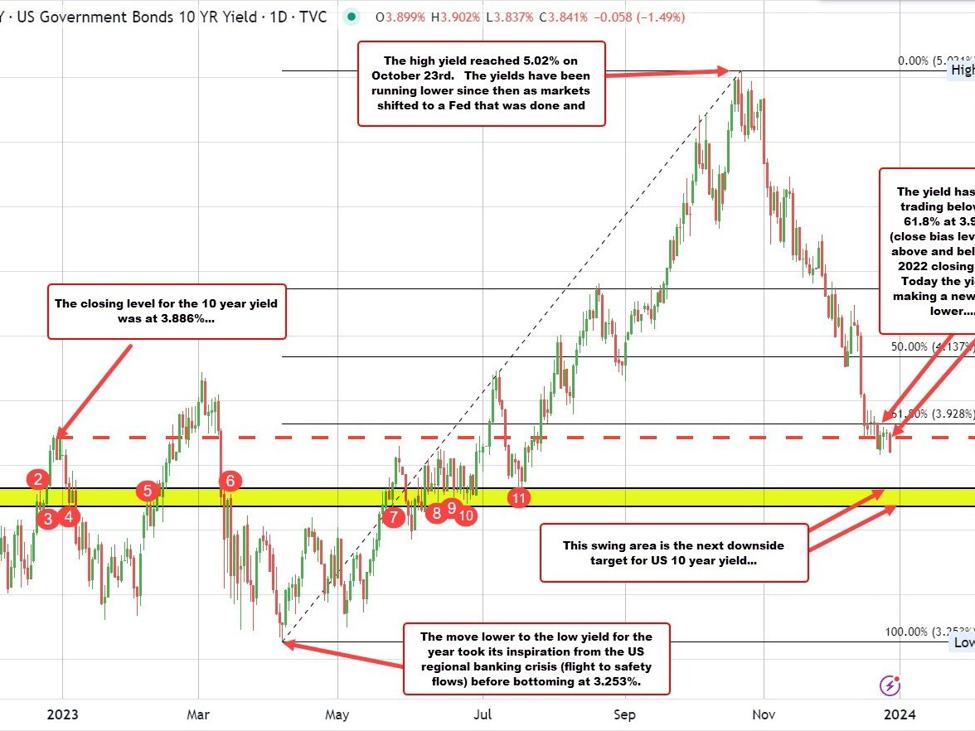

US 10 year yield below the closing level from 2022

The US 10-year yield is trading at 3.844% currently. That is down 4.0 basis points on the day. The decline today is moving the yield below the closing level from the end of 2022 at 3.886%. The last five trading days have been trading above and below that level. Today is making a run lower.

The direction of yields for 2023 initially saw a low reached in early April as a regional banking crisis played out leading to flows into the relative safety of the US debt. The low yield bottomed at 3.253% before starting its ascent back to the upside as the crisis was averted and focus returned to inflation and the strong US economy.

On July 6, the yield moved back into positive territory peeking at 4.094% on July 7. A corrective move lower to the yield down to 3.729% on July 19 before starting the next major surge that ultimately culminated with the yield highs reaching 5.021% on October 23.

Since then, the yield has steadily moved lower. The low yield today reached 3.837% which is just short of the low yield reached last week at 3.831%.

Looking at the daily chart, the price has closed below the 61.8% retracement of the 2023 range at 3.928% over the last five trading sessions (downward bias). That level is now a close bias-defining level. Staying below keeps the bias more to the downside.

The next major target area comes near a swing area between 3.671% and 3.729% (see yellow area and red numbered circles).

What would hurt the downward bias in 2024:

- There is a lot of optimism priced into US yields. If growth/inflation is stronger than expectations, the US yields may shift higher across the yield curve. The Fed Funds target is still at 5.25% to 5.50%. The Fed sees rates moving to 4.6% at the end of 2024. The market’s are pricing in more. If that story line changes because on higher inflation/stronger jobs/growth, the Fed may be more stingy with cuts (or delay altogether) and that could see the whole curve shift higher

-

Ironically, the Fed starting to ease earlier (or more aggressively) than expected could slow the decline in the 10-year and push the focus by traders more into the shorter end of the yield curve. The 2-year yield is down from a high of 5.259% to 4.281% today, but the 2-10-year spread is currently at -44 basis points (the high point for 2024 well on. A flow of funds that pushes that yield spread back into positive territory, could act as a floor for the 10-year sector.