The major US indices are trading higher after tame core and headline PCE data out of the US this morning. The good news is inflation is melting away. There is some worry, however.

Nike reported their earnings after the close yesterday and their guidance was not all that rosy. Shares of Nike are trading down -10.52%.

The question in 2024 is how bad is a slowdown and whether it will it lead to the cycle of “job losses beget job losses”. So far, job losses have been limited. Good news is productivity should increase (or that is a hope). Consumers are also flush with solid balance sheets from the stock gains and home prices which remain elevated helped by low supply.

A snapshot of the market shows:

- Dow Industrial Average is up 79.48 points or 0.21% at 37487.59

- S&P index is up 20.13 points or 0.42% at 4767

- Nasdaq index up 58.1 points or 0.39% at 15021.59

The small-cap Russell 2000 is up 21.92 points or 1.09% at 2038.98.

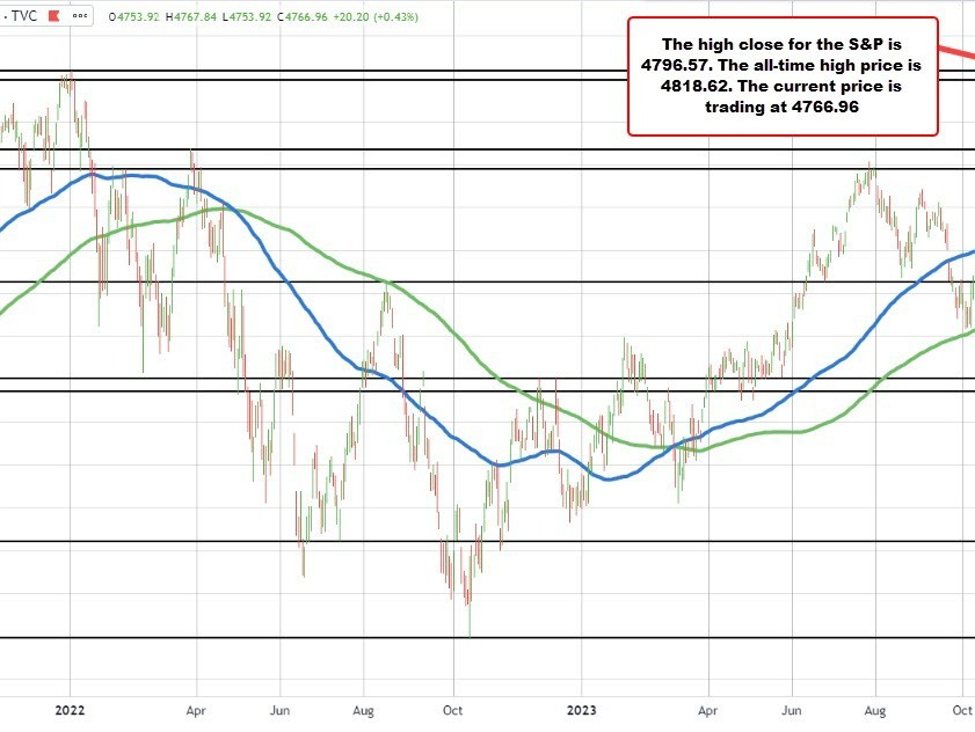

The S&P index is getting closer to its high closing level of 4796.57 (January 2022). Its high price today has reached 4768.77.

S&P index approaches is all-time high close level

Yields in the US are lower but not running away:

- 2-year yield 4.321%, -2.8 basis points

- 5-year yield 3.860%, -2.2 basis points

- 10 year yield 3.876% -2.0 basis points

- 30-year yield 4.018% -1.6 basis points