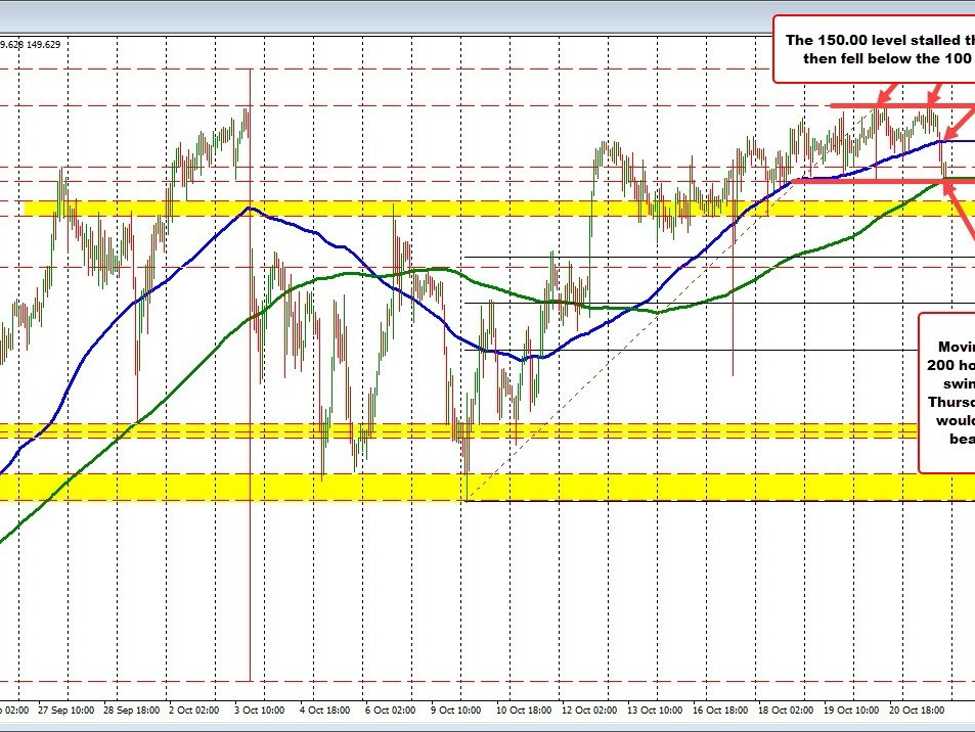

The USDJPY moved below its 100-hour moving average earlier today at 149.82. The break below that MA (blue line) has taken the price to the 200 hour moving average at 149.649 (green line), and the low prices from Thursday and Friday at 149.64. Both those levels would need to be broken to increase the bearish bias and have traders looking toward a swing area between 149.47 and 149.54.

Move below that area, and the next target would be the 38.2% retracement of the move up from the October low (reached on October 10) at 149.289. That retracement level is a minimum retracement target to get below if the sellers are to start to take back more control.

On the top side, once again the 150.00 level held resistance in trading today with the high price coming in near 149.99. On Friday that level was also the upside limit. Traders still fear the Bank of Japan action on a break above the 150.00 level.

Lower yields are helping the downside. The US 10-year yield reached a high of 5.02% today before reversing the lower. It is currently at 4.839%, -8.4 basis points. The 30-year yield is down 10 basis points at 4.987% (and back below 5.000%).