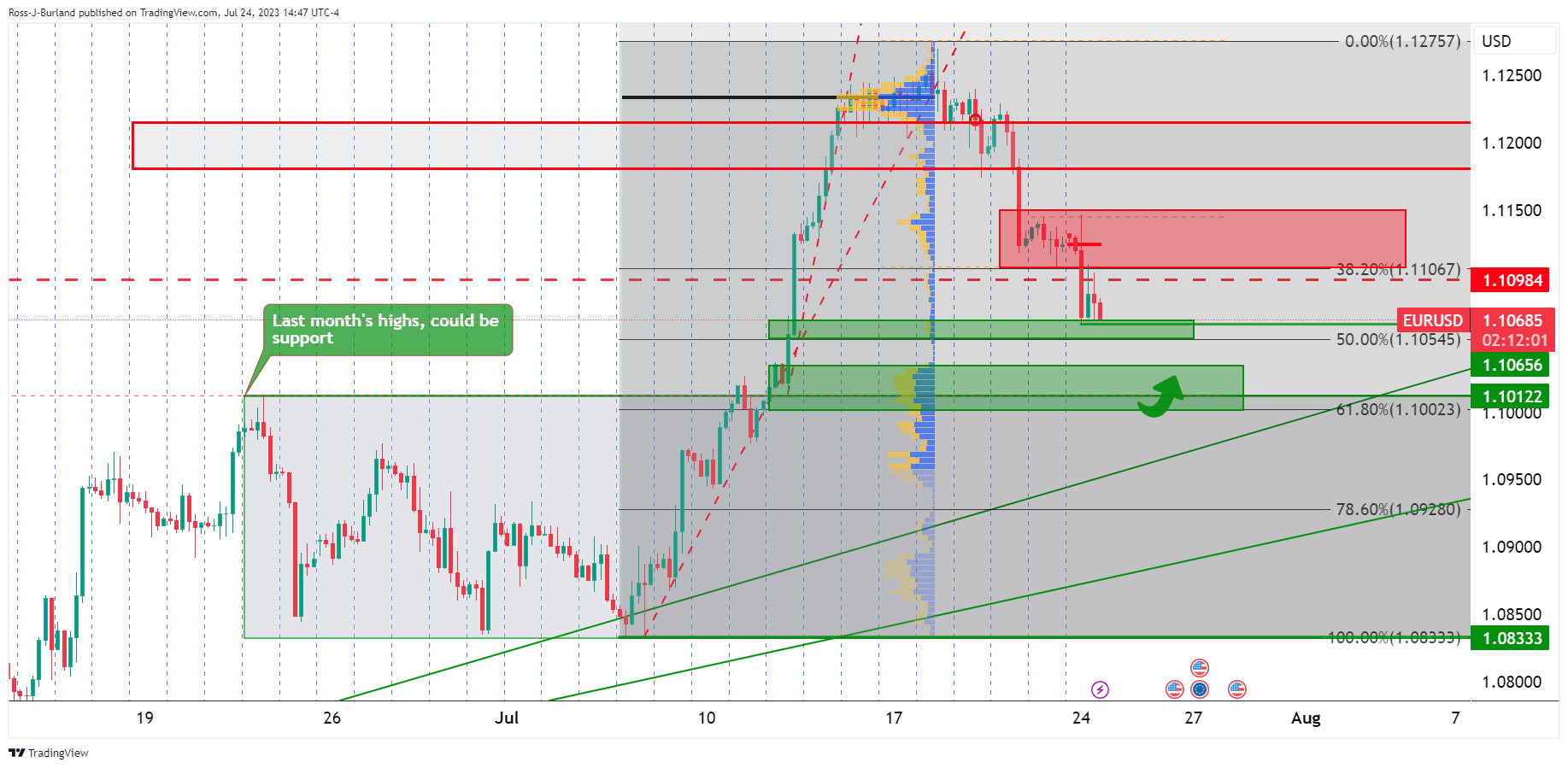

- EUR/USD bears are in the market and eye last month’s highs.

- A break of support will leave a 61.8% ratio vulnerable on the daily chart.

The Euro is under pressure due to economic data that continues to show the resilience of the US economy in contrast to those that are topping on the edge of a recession, such as the Eurozone. The initial balance for the week is being set ahead of the Federal Reserve on Wednesday and the following analysis leans with a bearish bias.

EUR/USD daily charts

EUR/USD is climbing the trendline support and is now headed back towards it where last month’s highs are located in a strong bearish correction. At least a 50% mean reversion is on the cards guarding the 61.8% ratio and conflieuece area.

EUR/USD H4 chart

EUR/USD is offered while below Friday’s closing price. The price is being supported in a higher volume area but if this were to give, then the prior month’s highs will be eyed near a 61.8% Fibonacci level near 1.1000.