The major US stock indices are opening lower as traders react to the higher-than-expected PPI and expectations for more Fed hikes. The Fed’s Mester is starting the Fed speak today with a more hawkish tone.

The declines in the stocks are being led by the NASDAQ index which is currently down -1.3%. The S&P index is down over 1%.

A snapshot on the market currently shows:

- Dow Industrial Average -282.91 points or -0.83% at 33845.15

- S&P index -46.14 points or -1.11% at 4101.47

- NASDAQ index -160.89 points or -1.33% at 11909.70

- Russell 2000 down -23.52 points or -1.20% at 1937.44

Looking at the US debt market yields are higher:

- two year yield 4.657% +3.0 basis points

- five year yield 4.072% +3.4 basis points

- 10 year note 3.851% +4.4 basis points

- 30 year bond 3.867% +4.5 basis points

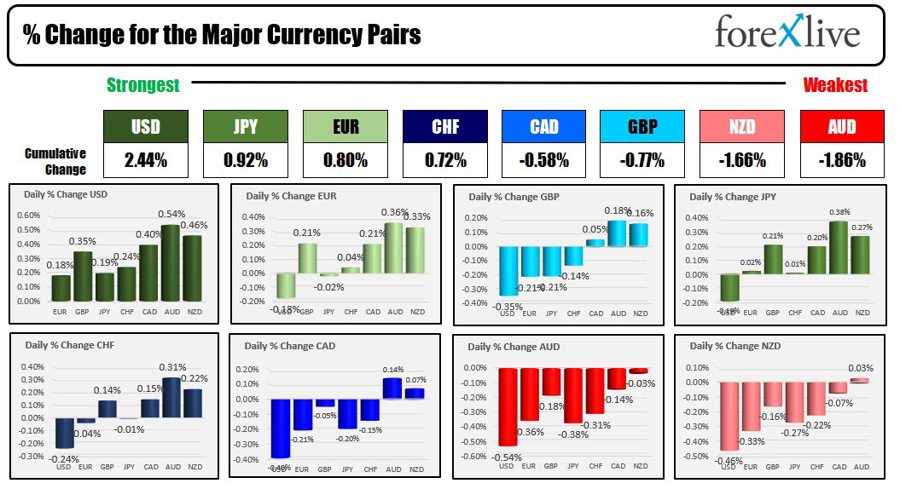

In the forex, the US dollar is the strongest of the major currencies. The AUD is the weakest.

In Australia, the employment data was weaker than expectations. The initial move was to the downside but then snapped back higher before rotating back to the downside held by the stronger dollar in the early US session. The AUDUSD is trading to a new session low and looks to test the low price from last week at 0.6855. The low price just reached 0.68634. At the high today, the pair successfully tested the 100 and 200 hour moving averages and found willing sellers (see blue and green lines in the chart below).