Last week, the “WOW” came from the US jobs report.

Recall the US added 517K new jobs, much higher than the 185K estimate.

Today, “WOW II” came via the Canada jobs report which added 150K. That gain came after a sharp rise of 69K last month which was revised lower from 104K previously reported, but still quite strong. The two month gain of 219K is quite impressive.

To put the gain in perspective, the Canada population is 38.5M. The US population is 332M (roughly) or between 9 and 10 times larger. The US job add was 517K vs 150K for Canada. You can do the math. 69K is solid. 150K at this point of the post pandemic time period is very strong. Pre-pandemic, the high water marks for job growth going back to early 2000s was about 108K.

The unemployment rate at 5% was only bettered by 4.9% in May and June of last year when it reached 4.9% (going back to 2006).

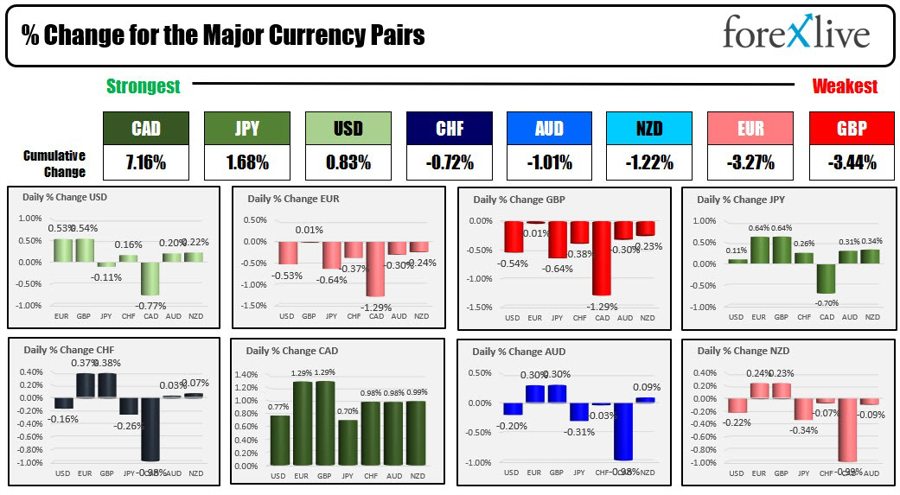

The data propelled the CAD to the top of the standings for the strongest to the weakest. The GBP and the EUR are the weakest.

The USD was marginally higher today with gains vs the EUR, GBP, AUD, NZD and CHF. The dollar fell vs the CAD and marginally vs the JPY.

The USD was much lower vs the JPY at the start of the trading day as traders reacted to the reports that Masayoshi Amamiya – a dove – turned down the potential nomination.

The nominee – to be officially nominated next week – will be academic Kazuo Ueda. Ueda and economist educated at MIT, was a former board member and expected to still be supportive of ultraloose BOJ policy. He is just less known vs Amamiya.

So how did the dollar perform this week, one week after the “WOW I” US jobs report? Recall, the US was the strongest currency at the end of the week last week.

Versus the major currencies, the USD was mixed this week with gains vs the EUR, JPY, AUD and NZD and declines vs the CHF and CAD. The green back was unchanged vs the GBP this week :

- Up 1.08 vs the EUR

- Up 0.19% vs the JPY

- Unchanged vs the GBP

- Down -0.22% vs the CHF

- Down -0.41% vs the CAD

- Up 0.04% vs the AUD

- Up 0.25% vs the NZD

US stocks this week were lower with the Nasdaq falling for the first time in 5 weeks:

- Dow fell -0.17%

- S&P fell -1.11%

- Nasdaq fell -2.41%

- Russell 2000 fell -3.36%.

The S&P index closed the week back below the December highs near 4100 at 4090 tilting the bias a little more to the downside.

In the US debt market this week, yields continued their moves to the upside:

- 2 year yield up 24 basis points to 4.525%

- 5 year yield up 27 basis points to 3.93%

- 10 year yield up 22.5 basis points to 3.745%

- 30 year yield up 22 basis points to 3.83%.

In other markets:

- Crude oil moved up close to $7 or 8.75% helped by China reopening, US economy not going into a recession and Russia announcing 5% production cuts in retaliation for western sanctions.

- Gold is ending the week virtually unchanged on the day.

- Bitcoin last Friday closed at $23434. The current price is at $21577 as risk off sentiment pushed the price back down. The high on the rebound off the recent low reached up to $24258 on February 2.

This weekend is the Super Bowl in my home town of Phoenix. My mind says Eagles, but got a hunch it will be the Chiefs.

In addition, the Phoenix Open golf tournament (The Greatest Show on Grass) with SOLD OUT crowds of 300,000 on Friday and Saturday (the Sunday crowd is traditionally lower as hangovers and the Super Bowl ease the numbers a bit) will take place just 5 miles from our house and pack restaurants and bars each evening. The tournament is home to the famous 16th Stadium Hole where “QUIET PLEASE” is not part of the equation.

This is what they build every year, and then take down after the tournament.

Recession? What recession?

Have a SUPER weekend!