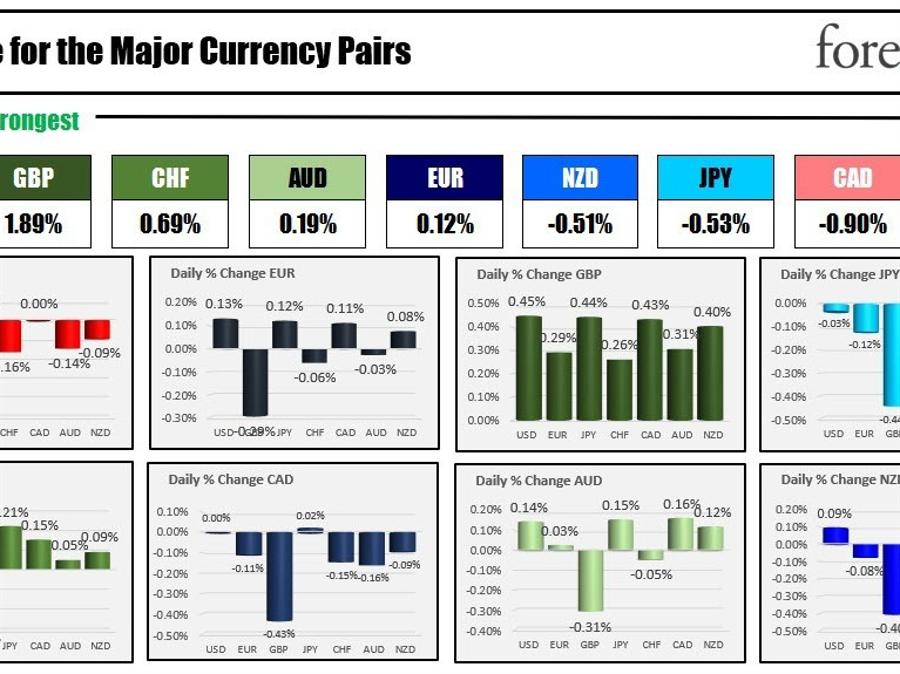

The GBP is the strongest of the major currencies while the USD is the weakest. The GBPUSD is trading up 0.37% which relatively speaking is not a whole lot of change for the “Biggest mover of the day”. All the major currencies are relatively scrunched today indicative a market that is taking a breather.

The EURUSD moved down for 3 consecutive days starting last Thursday, but closed a couple pips higher yesterday after a run to the downside was reversed in the volatility during and after Chair Powell’s Q&A yesterday where he a little something for everyone (see Justin’s comments HERE). Powell acknowledged the familiar storyline that goods inflation was down nicely, but service inflation was still lagging. That was reflected in the employment report where leisure and hospitality employment continued to lead the way to the upside with a gain of 128K (see weekend video HERE).

Yesterday US stocks had a wild ride during and after the Powell chat (which was quite light hearted and also informative to the inner workings of things like does Powell get the jobs data ahead of time and what power does he wield at meeting. which took away some of the fear).

In trading today, US stocks are a lower in pre-market trading. European bourses are stronger. Fed’s William’s speaks today. US yields are down a bit.

US mortgage applications rose 7.4% after last week’s -9% decline. Wholesale inventories are the only other economic release although the EIA will also release the weekly inventory data with crude stocks expected to increase 2.457M. The private data showed. a

Disney earnings after the close.

A look at other markets:

- Spot gold is trading up $4.40 or 0.24% $1876.50

- Spot silver up $0.21 or 0.93% at $22.35

- WTI crude oil trading at $77.66 after settling yesterday up sharply at $77.14 (up over $3 on the day)

- Bitcoin is trading at $23,116 and near the low for the day. That is off the high price at $23,439.

In the premarket for US stocks, the futures are implying a lower open:

- Dow Industrial Average -120 points after yesterday’s 265.67 point rise

- S&P index -18.5 points after yesterday’s 52.9 point rise

- NASDAQ index -43 points after yesterday’s 226.34 point rise

in the European equity markets, the major indices are higher helped by the higher close in the US yesterday:

- German DAX +0.70%

- France CAC +0.40%

- UK’s FTSE 100 +0.64%

- Spain’s Ibex +0.76%

In the US debt market, yields are lower with the five year yield down -3.6 basis points in the morning snapshot leading the way. Yesterday the three year note auction was not well received with a large tail. That may have been a result of the Q&A from Powell during the auction process. The U.S. Treasury will auction off 10 year notes today at 1 PM ET. Will international demand resurface?

A snapshot of the European benchmark 10 year yields shows most are higher German 10 year yields about five basis points. UK 10 year yields are near unchanged.