The US jobs report was – as Fed’s Daly put it – a “wow” number. The Non Farm Payroll increased by a whopping 517K. The prior two months were revised higher by 71K. The combined total of 587K far outpaced the expectations of 185K. Wow is right.

The unemployment rate moved down to 3.4% (expected a rise to 3.6%), the lowest since 1969. The average hourly earnings increased by 0.3% and the YoY by 4.4% which were as expected. The work week increased to 34.7 hours from 34.3 hours expected. That is a big jump and indicative of solid employment.

The number was more the initial claims and the JOLTs data vs the anecdotal stories of layoffs.

It had some analysts saying, “it is so good, ignore it”, which I guess is another way of saying, “My model is right. The BLS is wrong”. However, the reality is, the jobs data continues to show month after month strength.

Looking at the industries:

Good producing jobs added 46K

- manufacturing +19

- construction +28K

IN the service jobs, they added 397K

- professional and business services 82K

- private education and health services +105K

- trade transportation and utilities +63K

- transportation and warehousing +23K

- Leisure and hospitality rose 128K

- information -5K

- financial activity minus 6K

Government even added a chunk with a gain of 78K

Later the ISM nonmanufacturing index came in much stronger than expected at 55.2 versus 50.4

- new orders index rose to 60.4 from 45.2 last month

- employment back to the 15 level from 49.4 last month

- prices dip to 67.8 from 68.1

- backlog of orders rose to 52.9 from 51.5

- new export orders search to 59.0 from 47.7

Recession? What recession?

The US stocks initially took the news as more bearish as the Fed might need to hike more and keep the rates higher for a time period longer than the market’s expectations. However, when momentum slowed on the decline, the major indices moved back to the upside and erased all the declines for the day. That was also in the face of less than stellar earnings from Amazon, Alphabet and Apple after the close on Thursday. Intraday,

- The Dow was down as much as -240.09 points, and reverset to up 125.63 points

- The S&P was down as much as -56.39 points, and reversed to up 2.61 points

- The Nasdaq was down as much as -253.96 points, and reversed to up 30.49 points

However, the climb was a tough one and buyers turned back to sellers. Word that Fed’s Daly would be speaking on FoxBusiness, may have been a catalyst to take some off the table. Recall, Daly was a bit more hawkish on the inflation prospects when she spoke on January 9th just before the blackout period. She was particularly insistent that the goods inflation was coming down, but service inflation ex housing was still elevated.

The stock buyers had the courage of 1000 matadors in the morning hours, but cowered a bit with the prospects of a Fed official coming out and saying “we are still data dependent”, inflation is still elevated, and “it was far to early” to call a peak (which is what she reminded the market).

Next week, when more Fed officials speak, it will be hard to say things are slowing down. In reality, the employment situation seems like it is doing the opposite – despite the job cuts announced, and that will continue to be a scare to the Fed who only has one job – to see inflation comes down.

In the debt market. yields moved higher and stayed elevated for the day:

- two year yield 4.288% +19.9 basis points

- five year yield 3.653% +17.1 basis points

- 10 year yield 3.520% +12.3 basis points

- 30 year yield 3.615% +6.1 basis points

Gold tumbled in reaction to the higher dollar. It is closing down near -$46 or -2.44% at $1865.63 after moving to within $41 of $2000 yesterday (the high reached $1959.74). Silver tumbled 4.67% or down -$1.09.

Crude oil focused on the higher dollar and it too fell even though stronger growth might lead to more demand down the road. Crude oil closed the week down -7.89%

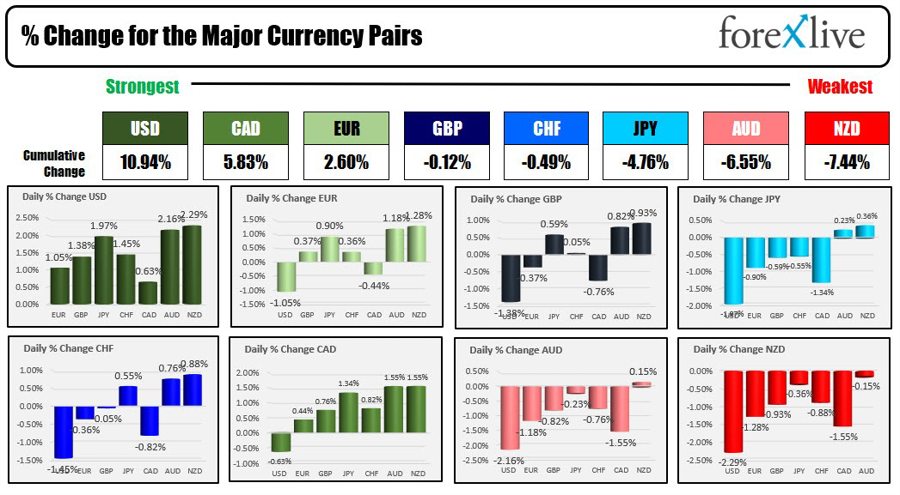

The USD was the strongest of the majors rising by over 2% vs the NZD (+2.29%), AUD (2.16%) and was up 1.97% vs the JPY. The only currency the USD rose by less than 1% today was the CAD with a gain of only 0.69%.

For the trading week, the USD rose vs all the major currencies:

- EUR, +0.67%

- JPY, +1.09%

- GBP, +2.7%

- CHF, +0.55%

- CAD, +0.70%

- AUD, +2.61%

- NZD, +2.54%

It certainly was a Wow day (and a Wow week as well with 3 major central banks in play, and an earnings week highlighted by the likes of Meta, Apple, Alphabet, Amazon, Boeing, Merck, Honeywell, Starbucks).

Next week, the calendar of events will be a little less packed. Nevertheless, the anticipation of what Fed officials might say is intriguing and potentially market moving. ON Tuesday at 12 PM, Fed’s Powell will speak at the Economic Club of Washington. On Wednesday, NY Fed’s Williams will also speak (and I am sure others Fed officials will be asked to comment on policy post the jobs report).

The Bank of Australia is expected to hike rates by 25 basis points on Tuesday in Australia (Monday night at 10:30 PM ET).. Recall Australia CPI for Q4 came in at 1.9% vs 1.6% estimate when announced on January 24. Canada will release their employment report on Friday a month after reporting an oversized gain of 104K last month. The expectations are for 15K on Friday. The BOC raised rates by 25 bps on January 25th and said they were “conditionally pausing” as they assess the economic data going forward. That will be a key data point for their rate hike sabbatical.

Taking a look at the calendar of earnings, the major releases are now over. Next week there are a few names but the impacts should be minimal:

Monday:

- Activision Blizzard

Tuesday:

Wednesday

- Disney

- CVS

- Emerson

- MGM

Thursday

- Toyota

- Pepsi

- AstraZeneca

- Phillip Morris

- Unilever

- PayPal

- Motorola