The major US stock indices rallied for the 2nd consecutive day as traders hope that inflation will continue to move lower, allowing the Fed to take the foot off the brake sooner. The Nasdaq and the S&P reached the highest level in 6 weeks (going back to December 13/14 2022.

Moreover, the Nasdaq rose by over 2% for the 2nd consecutive day and moved further away from its 100 day MA below at 10995.76, and closer to its 200 day MA above at 11552.74. The index closed at 11364.42.

The Nasdaq price has not closed above its 200 day MA since January 14, 2022. Key level IF the momentum can continue.

For the S&P it is already above its 200 day MA at 4019.82. It’s KEY level on the topside is the 4100 level which was the high price December 1 and again on December 13 (both days stalled at the 4100 level).

The final stock numbers are showing:

- Dow Industrial Average rose 254.07 points or 0.76% at 33629.57

- S&P index rose 47.22 points or 1.19% have 4019.82

- NASDAQ index rose 223.99 points or 2.01% at 11364.42

- Russell 2000 rose 23.43 points or 1.25% at 1890.76

Although stocks moved higher, the US yields moved higher as well (there was no help from lower rates today):

- 2 year yield 4.231%, +4.9 bps

- 5 year 3.622%, +5.6 bps

- 10 year 3.521%, +3.8 bps

- 30 year 3.688%, +3.3 bps

The 2-10 year spread continues to be signaling a recession as it stands at -71 basis points.

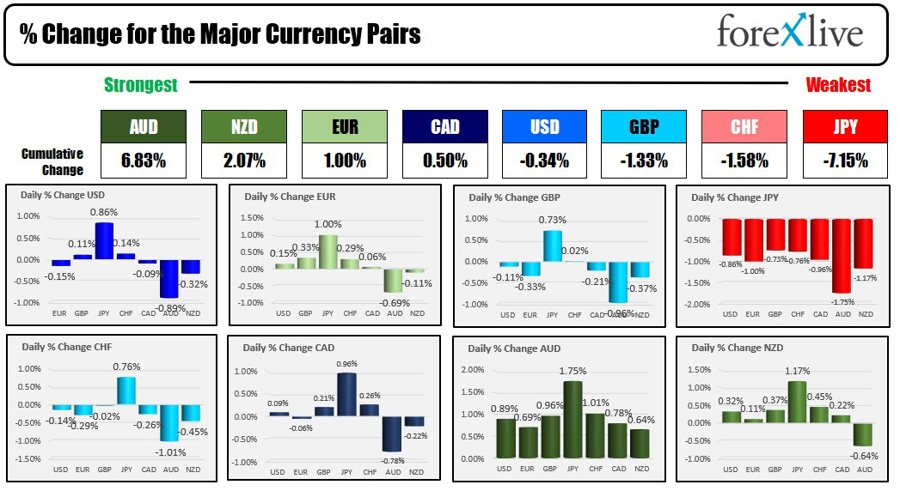

IN the forex market, the AUD is the strongest of the majors today. The JPY was the weakest.

Australia will release CPI data on Wednesday morning in Australia with the expectations for 1.6% QoQ. Although lower from 1.8% in the 3Q, 1.9% in the 2Q and 2.0% in 1Q 2022, at 1.6% it would still be the 4th highest quarterly reading going back to 3Q 2000. The YoY is expected to come in at 7.6% up from 7.3%.

With the BOJ reiterating that rates were on hold and easing would continue to be expansionary, the JPY can go lower at any time. Today the USDJPY moved initially below its 200 hour MA in the early Asian Pacific session at 128.88, but found support buyers ahead of the lower 100 hour MA at 128.91. The subsequent rally took the price back above the 200 hour MA and all the way to an intraday high of 130.63 before consolidating near the high into the close(closing at 130.62)

- Gold increased by $4.65 or 0.24%

- Silver fell by $0.48 or -2.03%

- Crude oil settled the day at $81.62. That’s down two cents on the day