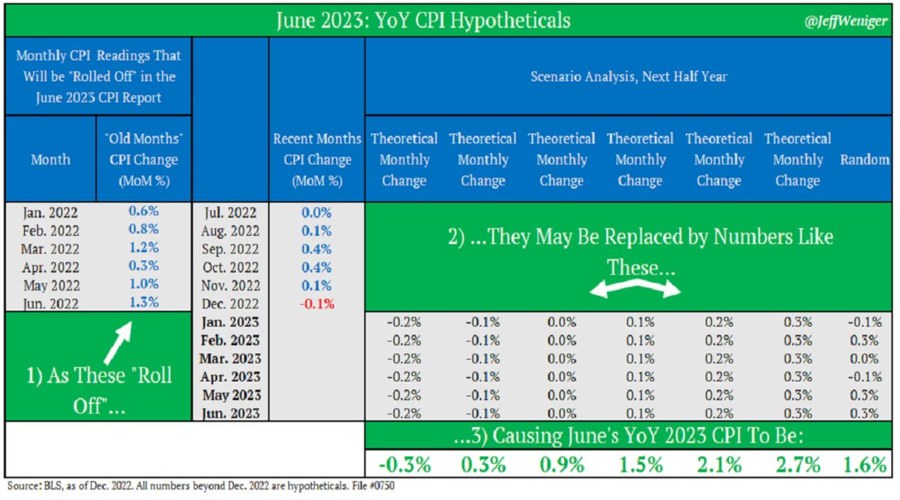

Jeff Weniger from WisdomTree put together a nice graphic emphasizing that US inflation is about to begin lapping some seriously high year-over-year comparative numbers. With that, the old numbers will ‘fall out’ of the year-over-year reading and that will cause inflation readings to fall.

How far will they fall?

If CPI were to run at 0.3% m/m for the next six months, we would be looking at 2.7% y/y in June and if it’s 0.2% the Fed would reach its target.

What will make it tougher than it might seem is that commodity (especially gasoline) prices have stopped falling and that’s been a big help. Meanwhile, much of the core services numbers are either lagged in the presentation (like rents) or sticky.

At the same time, there may still be more help from goods deflation to come. Tesla cut its prices to take them right back to pre-pandemic levels today, so that’s essentially zero inflation for three years. Many economists think other automakers will need to do the same, or at least ramp up incentives that lower the true cost of the car.