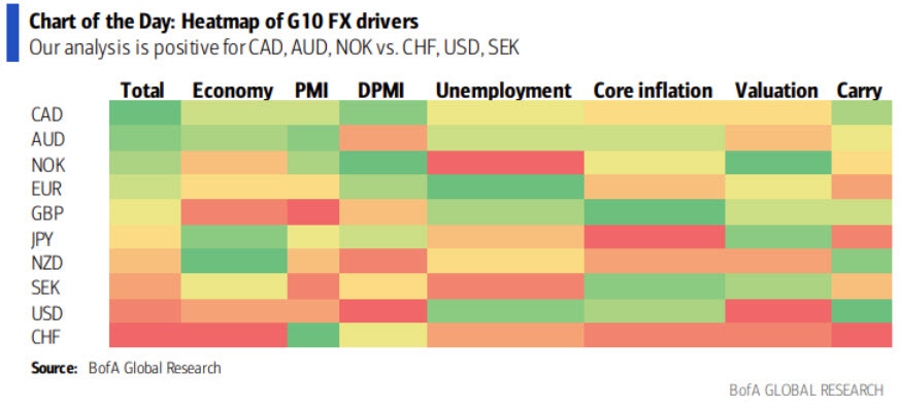

Bank of America Global Research constructed a G10 heatmap of likely G10 FX drivers this year.

“FX markets are already close to the end of 2023 consensus forecasts,

but this is a year with plenty of known unknowns. We are concerned

about the outlook of risk assets in the short-term, whether sticky

inflation during a recession will keep central banks hawkish,”BofA

notes.

“We constructed a G10 heatmap, looking at likely G10 FX

drivers this year. Although we expect USD strength in the short-term, on

the back of risk-off without a central bank policy put, our analysis is

positive for CAD, AUD and NOK vs. CHF, USD and SEK, which is consistent with our end-year forecasts,” BofA adds

For bank trade ideas, check out eFX Plus. For a limited time, get a 7 day free trial, basic for $79 per month and premium at $109 per month. Get it here.