The EURUSD moved up and down yesterday to start the trading week, and today that price action is continuing.

The pair spiked higher after the Bank of Japan surprise decision, and in the process moved above its 100 hour moving average after stalling near that moving average yesterday in the North American session (the European session did extend above the moving average level however and failed).

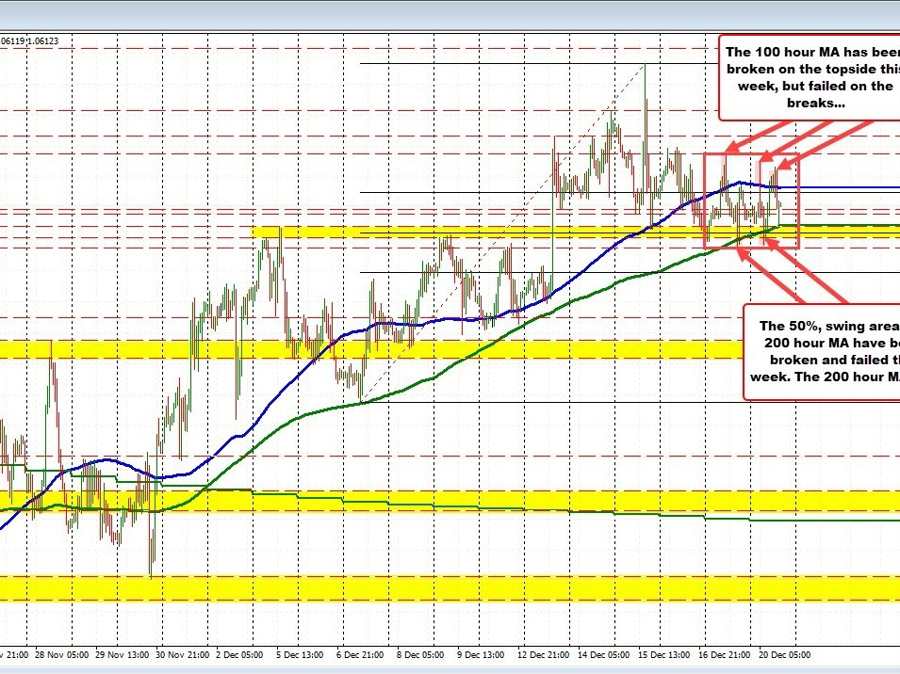

The extension above the higher 100 hour moving average today failed and the price tumbled back down, falling below the 200 hour moving average (green line in the chart above) and other technical levels including the 50% of the December trading range, and the old swing highs from early in December between 1.0584 and 1.05943 .

Remaining true to the ups and downs, that break failed on the downside too. Yesterday, there was a similar dip below that cluster of levels that failed.

More recently today, the London highs today moved above the 100 hour MA and failed again. The subsequent dip in the current hourly bar did stall at the 200 hour MA, however (and above the 50% and swing area down to 1.05843 too).

The point is, there is a lot of ups and downs with the MAs being chopped around in the process.

The buyers and sellers are battling it out, trying to figure the next shove.

With the 200 hour MA stalling the fall on the most recent move lower, that increases the levels importance in the short term. Move below SHOULD see more selling as the dip buyers against the level fail. A break below the 1.05843 would help confirm.that bias shift BUT the 200 hour MA would then be the risk level. The price would have to stay below.

Until then, however, the holding of the 200 hour MA, gives the buyers the slight edge intraday. Get and stay above the 100 hour MA above is required, however. Admittedly, that has not been too successful this week as the markets range trade, but is nevertheless, the barometer for a more positive technical view.