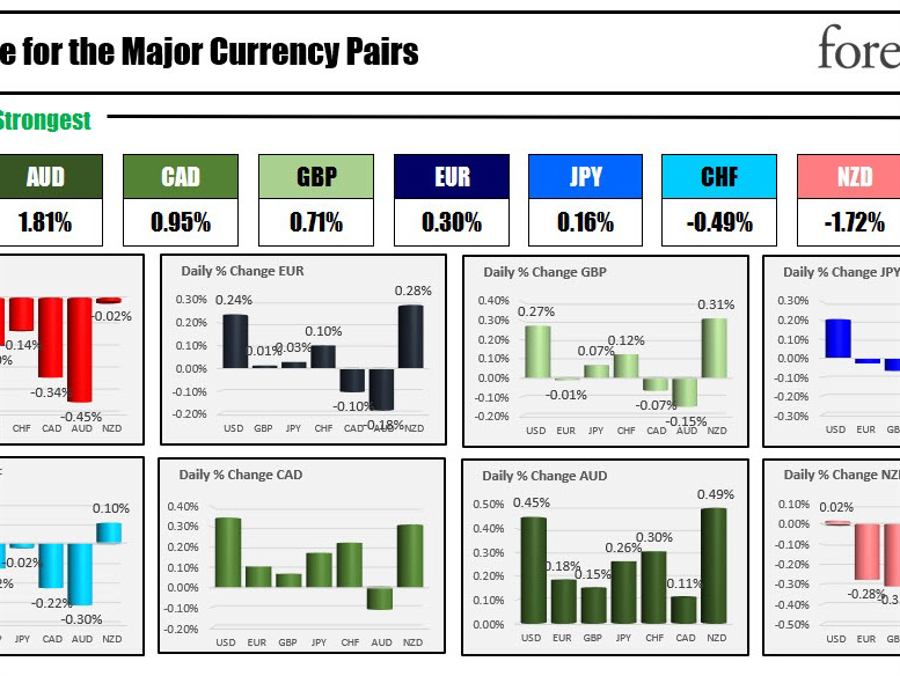

The AUD is the strongest and the NZD is the weakest as the NA session begins. The USD is modestly weaker today. Overall the moves in the currencies are off to a slow start for the runup to the the Christmas/New Year holiday. Hanukkah began yesterday at sunset. The biggest mover is the AUDNZD which has seen a 0.48% rise today. When that is the biggest mover, you can get the idea.

Elon Musk ousted himself at Twitter. Well he put it up to a vote and 57-58% said, “It is best you step aside”. So in the bizarre of what has been his Twitter experiment, he will indeed likely move toward someone else to save the $44B investment from banks and himself (mostly himself). He has to go save Tesla which is having it’s own hemorrhaging (down -57% on the year).

This week the key event in the US will be the Core PCE on Friday. Consumer confidence will be released on Wednesday. In Canada, they still have retail sales, and CPI to announce. The Bank of Japan will announce their latest intentions in the new day tomorrow.

A look around the markets is showing:

- spot gold is trading near unchanged at $1792.45

- spot silver is down five cents or -0.22% at $23.16

- WTI crude oil is trading up $0.35 at $74.79

- bitcoin is trading below the $17,000 level at $16,752. On Friday it traded as a low as $16,572. The same level as today’s current price. The high over the weekend reached $16,850

in the premarket for US stocks, the futures or applying a modestly higher opening after Friday’s declines:

- Dow Industrial Average +45.54 points after Friday’s -281.76 point decline

- S&P index +8.6 points after Friday’s -43.39 point decline

- NASDAQ index +39 points after Friday’s -105.11 point decline

in the European equity markets, the major indices also trading to the upside today:

- German DAX, +0.52%

- Francis CAC +0.57%

- UK’s FTSE 100 +0.52%

- Spain’s Ibex +0.59%

- Italy’s FTSE MIB +0.45%

in the US debt market, yields are higher today days after the Fed raised their guess for the terminal rate to 5.1%. The 10 year is up from 3.42% low last week to 3.559% currently.

The benchmark European 10 year yields are also trading higher. The ECB was also more hawkish last week: