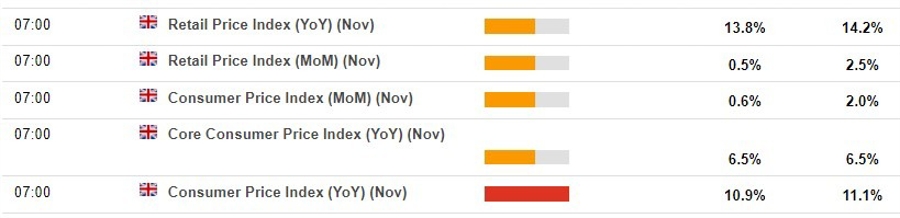

Coming up from the UK on Wednesday, 14 December 2022, November inflation data:

-

This

snapshot from the ForexLive economic data calendar, access

it here. -

The

times in the left-most column are GMT. -

The

numbers in the right-most column are the ‘prior’ (previous

month/quarter as the case may be) result. The number in the column

next to that, where there is a number, is the consensus median

expected.

Snippet previews via:

Société Générale

- Despite a continued rise in core and food inflation, negative base effects should allow a marginal reduction in headline inflation from 11.1% to 11.0% in November, although risks are tilted to the upside.

- For core, both stronger services and goods inflation should contribute to an acceleration from 6.5% to 6.7%.

Deutsche Bank

- We expect CPI to have slowed from 11.1% to 10.9%.

- If our forecasts are broadly on the mark, we have crossed the peak in inflation.

- And now, the next stage begins. We anticipate CPI will be over 8% YoY next year before landing around 6% in the fourth quarter.

This article was originally published by Forexlive.com. Read the original article here.