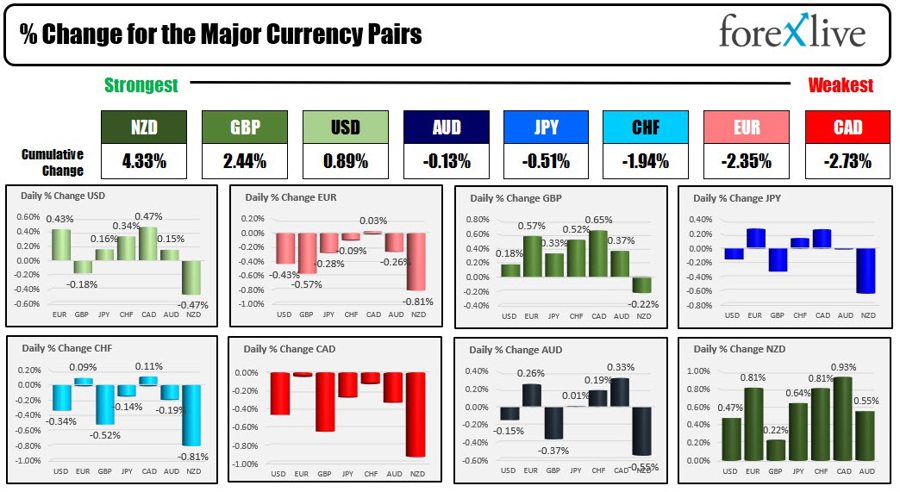

The NZD was the strongest and the CAD was the weakest of the major currencies to end the trading week. The USD was mostly higher with declines only vs the GBP and the NZD. The greenback moved the most vs the CAD at 0.47%. The dollar rose 0.43% vs the EUR.

Of note late in the day was that the commitment of traders showed speculators position in the USD moved to net short for the first time since July 2021 and that the EUR also net longs in the EUR rose to the largest since June 2021.

This week, the dollar was mixed:

- EUR +0.31%

- GBP -0.42%

- AUD, +0.44%

- NZD -0.55%

- JPY +1.10%

- CHF +1.43%

- CAD +1.00%

In the US debt market, the

- 2 year yield rose 7.7 basis points to 4.530%

- 5 year yield rose 7.2 basis points to 4.008%

- 10 year yield rose 5.6 basis points to 3.828%

- 30 year yield rose 3.8 basis points to 3.926%

With the Fed officials maintaining their hawkish bias this week, with Fed’s Bullard putting the terminal Fed rate between 5% and 7%, the 2-10 year spread moved to the most negative on record at -70 basis points indicative of the expectations for higher shorter rates but not for long.

In other markets today

- Spot gold fell 9.38 or -0.52% at $1750.68. For the trading week, the price of gold fell -1.15%

- Spot silver is unchanged at $20.94. For the week, it fell -3.42%

- WTI crude oil is trading at $80.14 after settling at $80.08. The price of crude oil closed below its 100 week moving average tilting the bias to the downside on that chart. The price fell -9.88% on the week.

- Bitcoin is trading at $16,633. That is little changed on the day. For the week, the price recovered 2.0% after last weeks -22% plunge.

Existing home sales were lower than last month at 4.43M annualized pace vs 4.71M last month, but was higher than expectations at 4.38M. The decline was the 9th straight month decline. October sales fell 28.4% from a year earlier, the biggest annual decline since February 2008.