The

People’s

Bank of China set the onshore yuan reference rate a mammoth 400+

points lower (i.e. higher for USD/CNY) today, to the weakest for the

onshore yuan since February of 2008. Offshore yuan responded by

dropping to its lowest ever (i.e. highest on record for USD/CNH)

around 7.3650.

In

addition, the PBOC and the State Administration of Foreign Exchange

(SAFE) relaxed a cross-border funding rule, aimed at encouraging

capital inflow. The weakening yuan has been working to encourage

capital outflow, a key concern of Chinese authorities.

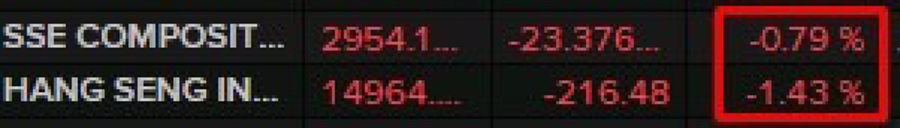

Shares

in mainland China and Hong Kong fell further in morning trade, though

not close to epic drop on Monday:

Across

major FX moves were subdued. We had comments again from Japan’s

finance minister Suzuki, with little impact. AUD, NZD and others gave

a little ground against the US dollar on the PBOC reference rate

setting.