Markets:

- WTI crude oil up $0.21 to $85.30

- US 10-year yields down 1 bps to 3.45%

- Gold up $10 to $1673

- S&P 500 down 28 points to 3873, or 0.7% — down 4.8% on the week

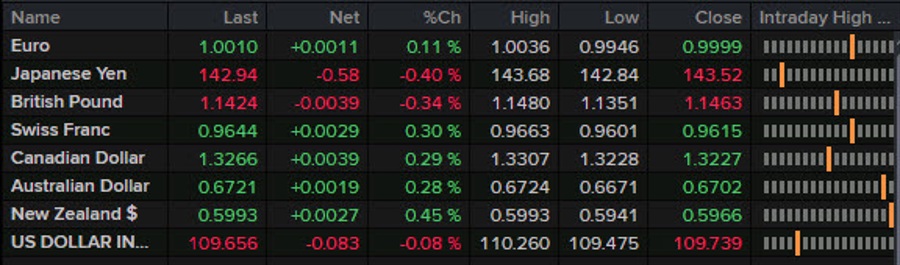

- NZD leads, GBP lags

It could have been worse.

The FedEx warning late yesterday boosted the dollar and weighed heavily on equity futures. In the end, the decline in the S&P 500 was only about half of the worst levels. The commodity currencies in particular showed some late life and that ensured AUD/USD closed above some critical levels after touching a two-year low in early European trade.

The euro caught a bid into the London fix. It later gave about half of that move back but ultimately finished 10 pips higher with some late-day bids on improving equities.

The simmering catalyst was a dip in inflation expectations in the UMich survey. Both 1 year and 5-10 year inflation moved lower month-to-month and led to a small bid in bonds. It also led to a drift lower in 100 bps Fed hike odds from 25% to 17%.

Cable ended the day as the worst peformer but it made up some ground in US trade as it rose to 1.1423 from a low of 1.1351. The catalyst was a soft retail sales report. Late in the day we also learned the businesses will be getting their power bills cut in half. The question is: Was the market expecting more help on energy?

USD/JPY remains a focus with the threat of intervention looming. The pair formed something of a double top at 143.75 today and drifted lower to finish near the lows at 142.94. That’s still a gain on the week but the 145.00 level is looking like a tough one to crack and that’s five straight weeks of gains.

Have a wonderful weekend. Next week is Fed week.