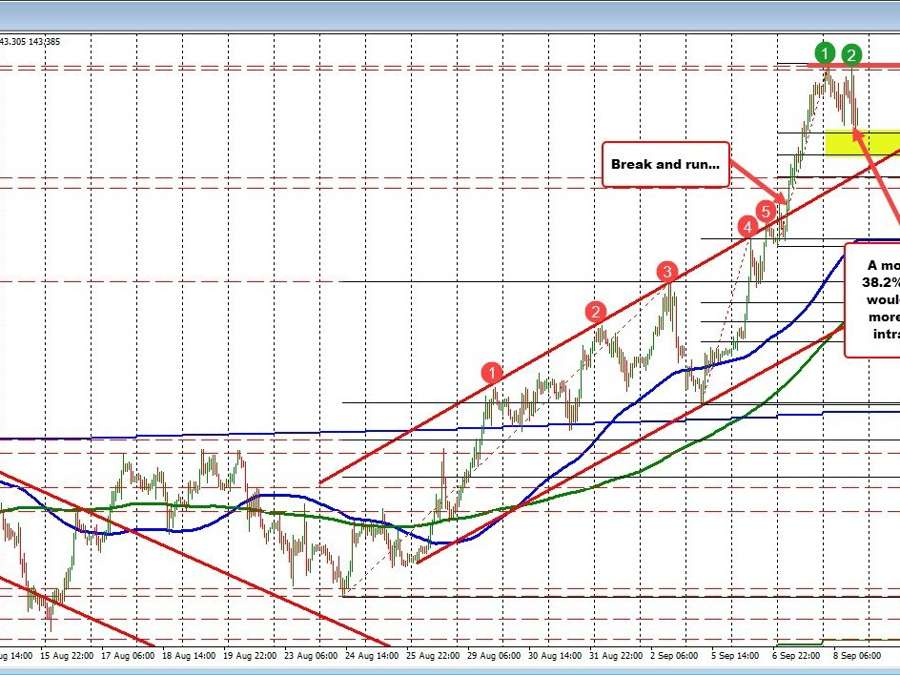

The EURJPY made a new high in the Asian session today and later at the start of the US session. The highs stalled at 144.32.

The rotations to the downside saw buyers near the 38.2% retracement at 143.169. The initial low came in at 143.37. The more recent low reached to 143.169 precisely on the 38.2% retracement of the move up from yesterday’s low (the last trend leg higher).

If sellers are to take control, getting below the 38.2% retracement is the minimum corrective level to get to and through (and stay below that level).

Helping the bearish storyline comes from taking a broader look at the daily chart below. Looking at the daily chart, the high price today stalled near the high prices from June. Those highs reached 144.24 to 144.27 (see red numbered circles on the chart below). The high price today once reached 142.32 just above that ceiling.

Not being able to get and stay above that ceiling area gave the sellers incentive to correct the price back to the downside. The next target on the daily chart to the downside comes against the July highs near the 142.32 area (see green numbered circles in the chart below).